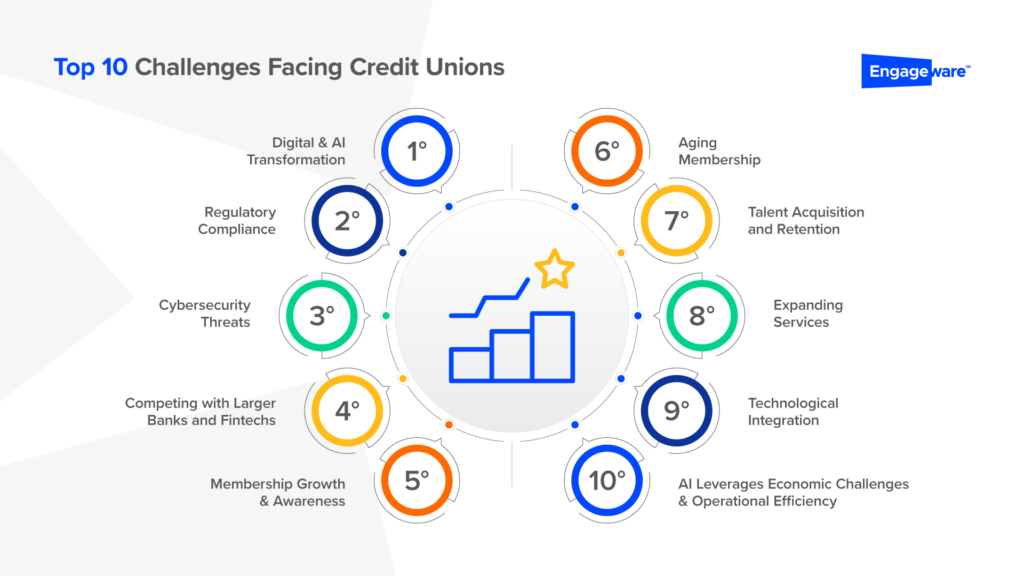

Table Of Contents

- Digital & AI Transformation

- Regulatory Compliance

- Cybersecurity

- Competing with Larger Banks & FinTechs

- Membership Growth & Awareness

- Aging Membership

- Talent Acquisition and Retention

- Expanding Services

- Technological Integration

- AI leverages Economic & Operational Efficiency

- Actions for Credit Union Success

Credit unions offer a local, personal touch that inspires trust and fosters community — something many consumers are hungry for in an age of megabanks and mergers. But in a rapidly changing financial sector, are credit unions at risk of falling behind?

Despite their appeal, customers are not ready to sacrifice the conveniences offered by larger banks. On the contrary, most customers want the best of both worlds. Credit unions are positioned to win new members, but if they want to keep them, they must face their own unique challenges in this fast-evolving digital landscape.

Here are the top 10 challenges of credit unions in 2024 in order to keep up and stay both relevant and competitive.

1. Digital & AI Transformation

Digital banking is table stakes in banking. Period. Credit union members expect similar seamless online banking experiences to what they would get with a big bank — including mobile apps, 24/7 service, digital transaction processing, and AI.

Engageware’s 2024 Report on “AI-Driven Customer Engagement” reinforces the fact that, according to 83% of financial services leaders, AI investment is crucial for customer engagement in 2024. Adapting to these demands can be a culture shock for a small credit union, requiring key investments in technology and training. With recent advancements made in the widespread availability of AI, credit unions must contend with incorporating generative and conversational AI to automate customer service, increase sales and conversions, streamline omnichannel member experience, and reduce call center workload.

2. Regulatory Compliance

The financial sector is one of the most heavily regulated industries, and that’s as true for a credit union as a big bank. Staying compliant with ever-changing local, federal, and even international regulations requires resources, good data, and ongoing training.

Generative AI, when integrated through the right partnership like Engageware, can offer a powerful solution, tailored to operate strictly within banking regulations. It leverages a credit union’s own verified data sources and ensures consistency, security, and compliance, thereby reducing the risk of issues.

3. Cybersecurity Threats

Credit unions are no more immune to crime than the big banks — and with a smaller IT bench they may present a tastier target.

The National Credit Union Administration (NCUA) has issued a warning about a 25% increase in cybersecurity incidents, highlighting the specific threats credit unions will face in 2024, including ransomware, phishing, email scams, and poorly secured IoT devices. As digital banking continues to expand, the risk of these cyberattacks also grows. It is essential for credit unions to stay ahead with robust cybersecurity measures to protect members’ sensitive data and maintain their trust.

4. Competing with Larger Banks and FinTechs

Larger banks have much deeper pockets than credit unions, and are able to invest significant resources in marketing, technology, and new product offerings. Similarly, Neobanks and Fintech often have low overheads and are highly agile and innovative. Credit unions, especially smaller ones, might find it more challenging to compete. Credit unions must find the path to digitalization to stay competitive and retain membership.

5. Membership Growth & Awareness

While credit unions offer many advantages over traditional banks, many potential members remain unaware of these benefits. In fact, many people are unaware they are even eligible to join a credit union at all. Credit unions must focus on targeted marketing and education efforts if they want to win new members.

6. Aging Membership

A significant portion of credit union members belong to older generations. In fact, according to American Banker, the industry has struggled to move the average age of its members below 47 for decades. Additionally, industry insights highlight that younger customers show less loyalty to their primary financial institutions and are more open to switching during economic declines.

“Overall, I like my FI, but there are some things they could be doing better technology-wise as well as with customer service. Their app was very outdated…Their call center has very limited hours and the online chat feature is limited to the same ones.”

– 22-Year-Old Female Customer, Engageware’s 2024 Report

Engaging younger members and tailoring services to their preferences—and higher standards for digital transformation—will be essential for long-term sustainability. There’s an urgent need for credit unions to adopt new technologies that cater to the digital-first preferences of younger members, ensuring both relevance and resilience in a competitive financial landscape.

7. Talent Acquisition and Retention

Credit unions are just as exposed to the talent squeeze as anyone else. To stay staffed, they need to attract tech-savvy talent and ensure they provide an environment where employees feel valued and can grow.

Banking leaders identify employee-related challenges as significant obstacles to customer engagement, with 80% viewing employee turnover as a major issue for 2024.

Furthermore, difficulties in accessing the right information can lead to job burnout and further exacerbate high turnover rates among staff. By leveraging a unified knowledge base, credit unions can enhance employee satisfaction, improve staff training, and boost overall customer service.

8. Expanding Services

Credit union members expect a wide range of services from their financial institutions and may seek to consolidate different financial needs under one institution. From specialized loans to insurance to investment advice, credit unions should consider diversifying and expanding their offerings to meet these expectations.

9. Technological Integration

Using technological solutions, like conversational AI and knowledge bases, can vastly improve member experiences. However, integrating these solutions with existing infrastructures can be a significant hurdle, particularly since credit unions can rarely afford to build vs. buy. To effectively manage this, credit unions should focus on vendor consolidation, selecting partners capable of supporting a broad array of third-party integrations and preferably in a low-code environment to simplify the implementation process.

According to Deloitte, key digital tools for financial institutions to consider in 2024 include:

- Personal Financial Management Technologies: partnering with vendors that can deliver speed in financial services. Account opening processes exceeding five minutes lead to abandonment.

- Marketing Automation and AI Predictive Models: These tools help in efficiently analyzing data and automating repetitive tasks, freeing up resources for higher-value activities.

- Transaction Security: Security measures for real-time payments, and peer-to-peer transactions are vital, ensuring transaction safety across platforms.

10. Leveraging AI to address Economic Challenges & Operational Efficiency

Despite economic fluctuations and global uncertainties, credit unions must continue to adapt and innovate. Leveraging AI technology is crucial for enhancing member experiences and maintaining competitive advantage. 88% of financial services leaders anticipate that AI virtual assistants will manage all customer interactions within two years, underscoring the shift towards automated, yet personalized member services. (Engageware’s 2024 Report)

AI not only streamlines operations, but also supports staff by automating routine tasks, allowing them to focus on complex member needs. Embracing AI helps credit unions stay resilient and member-focused, ensuring their role as viable alternatives to larger banks in a digitally evolving landscape.

Strategic Actions for Credit Union Success

To address these challenges and ensure member engagement and experience, credit unions must:

- Continuously listen to and understand member needs and preferences — and lean into the bespoke services that sparked their creation.

- Beat FinTech competitors at their own game by leveraging software partners — like Engageware — to better scale member experience and member service.

- Invest in training and development for staff, ensuring that the human touch remains the competitive advantage it has always been — even when doing more with less.

- Remain agile, constantly evaluating and adjusting their strategies in response to the evolving digital and financial landscape.

Modern platforms powered by conversational and generative AI can aid in many of these areas, offering seamless experiences, automating customer service, and reducing operational workload—all while drawing from a unified knowledge base that serves both members and employees.

Engageware is the game-changer in customer engagement technology. We offer mid-sized banks and credit unions the ability to provide top-notch customer experiences at scale. Our platform, powered by conversational AI, not only ensures seamless member experiences but also automates customer service functions, significantly reducing operational workload. With Engageware, credit unions can tap into a unified knowledge base that enhances both member and team experiences, ensuring cohesive and efficient operations across the board.

Interested? Schedule a demo today!