As the tech evolution unfolds and customer expectations rise, financial institutions face escalating challenges, navigating shifting budgets and increasing interest rates while also grappling with the need to increase deposits and elevate customer satisfaction.

While Generative AI may still be new for institutions, its potential in the financial sector is already evident, with financial institutions actively embracing these technologies. Gartner projects that by 2026, over 80% of enterprises will have used generative AI APIs or deployed generative AI-enabled apps.

AI adoption is now imperative for survival and success. According to the Engageware 2024 Report on “AI-Driven Customer Engagement: Navigating the Role of AI in Financial Services”, 83% Financial Services leaders agree that investing in AI at their institution is table stakes for customer engagement for 2024.

Financial Insights:

Navigate Customer Engagement with AI

Access Report What is artificial intelligence (AI) in finance?

Artificial intelligence (AI) in finance enables financial institutions to gain insights for data analytics performance measurement, predictive analysis, real-time calculations, customer service, and more. AI technology empowers financial service organizations to gain deeper insights into market trends and customer behavior. By seamlessly replicating human intelligence and interactions on a large scale, AI facilitates personalized engagement strategies, thereby driving superior outcomes and positively reshaping financial services.

AI Use Cases in Financial Industry

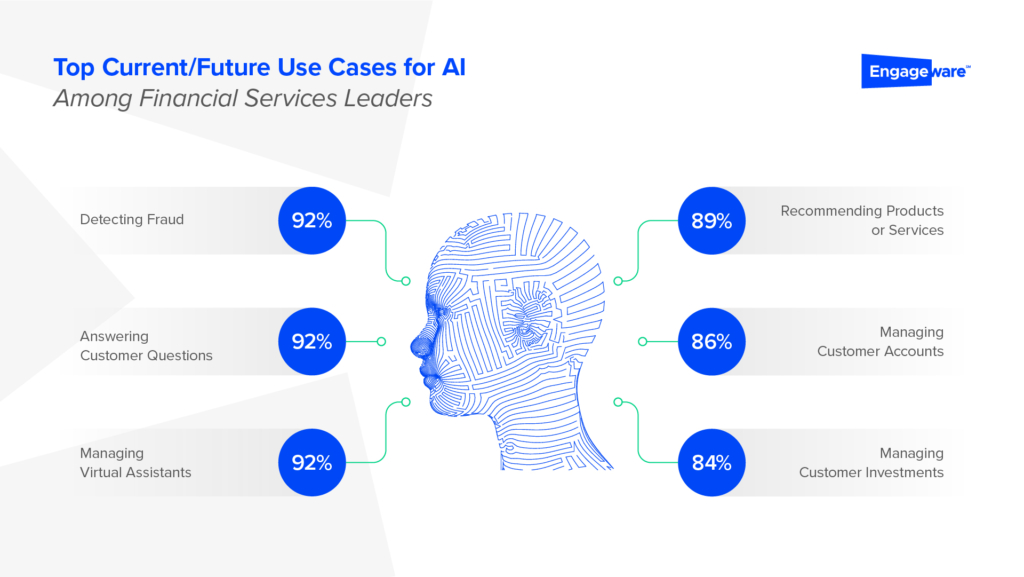

Building upon the significant impact of AI, a question arises: Where do financial institutions stand? In the financial scope, the conversation around AI adoption is marked by both caution and excitement. Most financial leaders report their institutions are already using or plan to use AI by the end of 2024 to perform several specific customer-facing and internal functions in their institutions, including detecting fraud, answering questions, and recommending products or services. As highlighted in Engageware Report:

Moreover, according to the CSI study on Banking Priorities, fraud detection emerges as a paramount concern for 2024. Complementary to this, financial professionals recognize the pressing need for solutions in this area, with 93% viewing AI-driven fraud detection as a top use case, as emphasized in the Engageware Report.

Additionally, as AI continues to gain prominence as a top technology trend, financial professionals anticipate significant growth opportunities. McKinsey reports AI technology could deliver value equal to an additional $200-340 billion annually if the use cases were fully implemented.

To navigate the adoption of AI in financial services requires strategic partnerships. Engageware, with 25 years of experience, ensures data security and compliance. By partnering with Engageware, financial entities can ensure their data is safeguarded, and AI-generated content is powered solely by the institution’s policies and not sourced from the overall internet. With a track record of over $760 million questions answered via virtual assistants for 700+ companies worldwide, Engageware stands at the forefront of AI innovation.

How can Financial Institutions harness the power of AI?

Empowering Employees and Driving operational Efficiency with AI

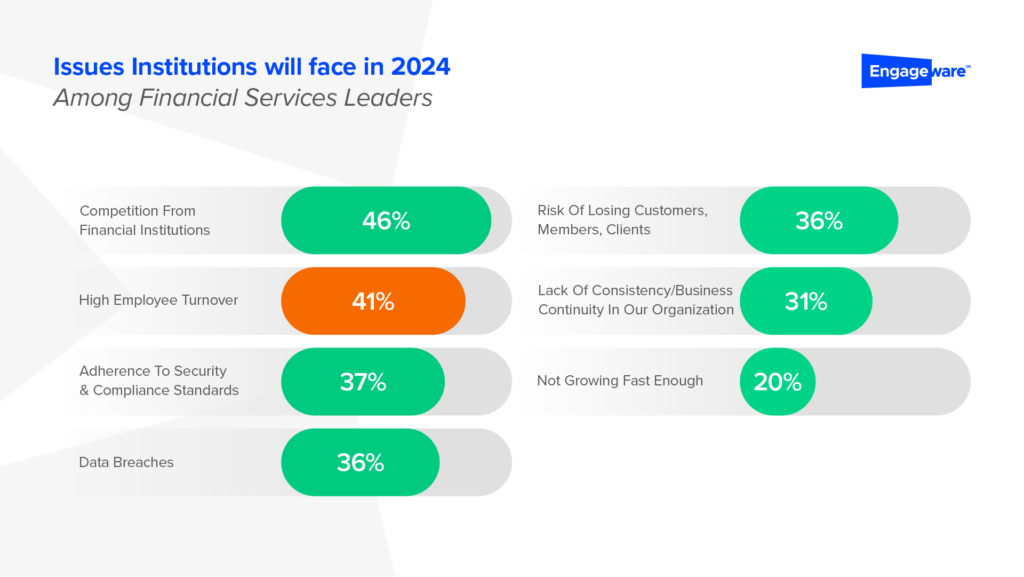

Addressing the pressing need to retain talent in the financial sector amid high turnover expectations in 2024, driving financial institutions to seek effective strategies for employee engagement amidst operational challenges.

Currently, customer service employees grapple with the complexity of an average of seven Customer Engagement Systems, presenting a significant strategic and operational hurdle. This overload results in 75% of employees feeling overwhelmed, leading to burnout and diminished operational efficiency.

In response, AI rises as a powerful ally for employee empowerment. Recent surveys indicate that more than 41% of banks are actively exploring or testing generative AI technology to support internal workflows, particularly in contact centers and customer-facing agents.

AI’s transformative impact lies in consolidating data and functionalities from diverse systems into a cohesive platform. This platform simplifies the work environment for employees, streamlining the delivery of consistent and accurate information across the service frontline and back office.

Learn how Engageware’s Employee Knowledge Management has helped hundreds of financial institutions to enhance customer service and streamline operations through process automation, boosting employee satisfaction by reducing workloads, and ultimately contribute to the operational success with its knowledge Management approach.

Examples of AI for Customer Service in Banking

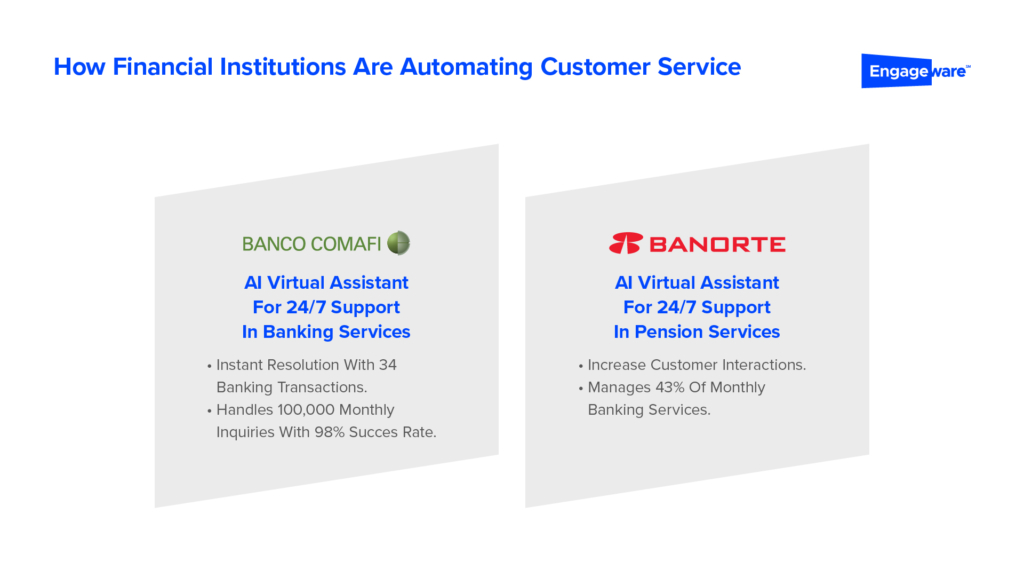

Banco Comafi – Instant Resolution via Virtual Assistant + WhatsApp

Banco Comafi faced challenges in adapting to evolving technology and changing customer expectations. Partnering with Engageware, the bank launched Sofia, the bank’s AI-driven Virtual Assistant, capable of handling multiple tasks on website and WhatsApp, assists 100,000 customer queries monthly.

The bank achieved a remarkable 387% surge in customer interactions with a 98% success rate in queries resolution. Customers can access instant resolution to their needs by managing 34 automated banking transactions on WhatsApp.

Banorte – 100% Automated Credit Application

Banorte’s pensions payment subdivision, aimed to excel in customer service and introduce new services to retirees. By adopting Engageware’s AI-driven Virtual Assistant, the bank achieved a remarkable 300% surge in monthly customer consultations. Integrated with WhatsApp, the Virtual Assistant now efficiently manages 43% of monthly banking services. An additional milestone is the Virtual Assistant’s capability to offer and manage 100% automated credit applications through WhatsApp channel, highlighting a strategic approach to expanding product offerings.

How to Get Started

Experience the transformative force of AI in good customer service. Learn more about Engageware’s AI solutions that have a real impact on your team’s efficiency and customer satisfaction. Schedule a demo today and see how AI can transform your organization’s service strategy. Let’s shape a customer-focused journey together!