The stakes are high for customer service teams in banking. Tech-savvy banking customers — from big national bank clients all the way to members of the smallest credit unions — have set new expectations for financial institutions. Things like 24/7 engagement, a consistent omnichannel experience, and personalized interactions have become table stakes.

Traditional customer service models are buckling under these new demands. With resources diminishing and employee churn rates spiking — overwhelmed customer service leaders are looking for ways to make the efforts of human agents more scalable and effective. That means not only helping customer service teams to scale, but also creating a better customer experience.

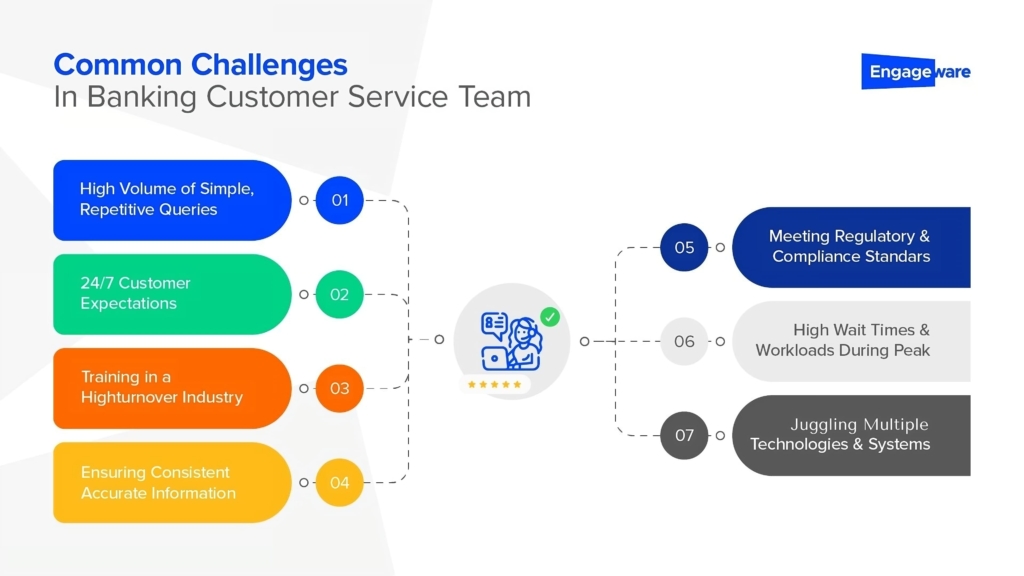

Common challenges faced by Banking Customer Service Teams:

A high volume of simple, repetitive queries

Your agents are swamped with the same questions over and over again. “What’s my balance?” “How do I reset my password?” This monotonous loop isn’t just mind-numbing for your team; it also takes valuable time away from tackling more complex issues.

24/7 customer expectations

It’s 3 AM, and someone needs urgent help with their account. In our always-online world, customers expect help at all hours, not just 9 to 5. But keeping a human team staffed, ready and alert around the clock is rarely practicable.

Training a team in a high-turnover industry

High turnover is a harsh reality in customer service across every industry. Just when you think your team’s up to speed, someone leaves, and it’s back to square one with training. Plus, tech is ever evolving in finance, with many different solutions in play. It’s a never-ending cycle of learn, unlearn, and relearn for your agents and it seems like they’re never caught up.

Ensuring consistent, accurate information

If every time you ask the same question, you receive a slightly different, and confusing, answer it can be incredibly frustrating. That’s what happens when different agents give their own spin to customer queries — or pull from inconsistent and out-of-date sources. This is a problem that can erode trust faster than you can say “low NPS.”

Meeting regulatory and compliance standards

Risk is a four-letter word in banking — in every possible way. Banks and credit unions want to ensure that every team member is always on the right side of regulations and compliance during every interaction — but as essential as that is, it can also be tricky. Teams are only human.

High wait times and workloads during peak

Long wait times, mounting stress, and fraying customer patience during peak hours are a perfect storm where service quality and customer happiness can easily get washed away.

Juggling multiple technologies and systems

Agents sometimes need to toggle between multiple systems to access information for a single query, playing a high-stakes game of tag with multiple systems just to answer one question. It’s a juggling act that slows things down and makes solving customer issues feel like solving a Rubik’s Cube – complex and time-consuming.

Enter generative AI. By now, most people are familiar with this groundbreaking technology — though you may not have considered how profoundly it is redefining the landscape of customer service in banking and finance.

At Engageware, we have seen it firsthand. Generative AI for customer service can extend the capability of your customer service team — drawing from your own institutional knowledge to manage a high volume of repetitive queries, stay compliant, offer round-the-clock service, and train new team members on the fly.

What Are Generative AI Solutions and their Impact in Banking?

Revolutionizing Customer Service in Banking with Generative AI Solutions

We should start with a few definitions. What exactly do we mean by generative AI for customer service— and more importantly, is it safe and secure for banking?

Generative AI solutions, in a nutshell, refer to sophisticated algorithms that can create content, solve problems, and even mimic human interactions. Think of it as having a digital brain that not only understands data but also generates new, relevant information.

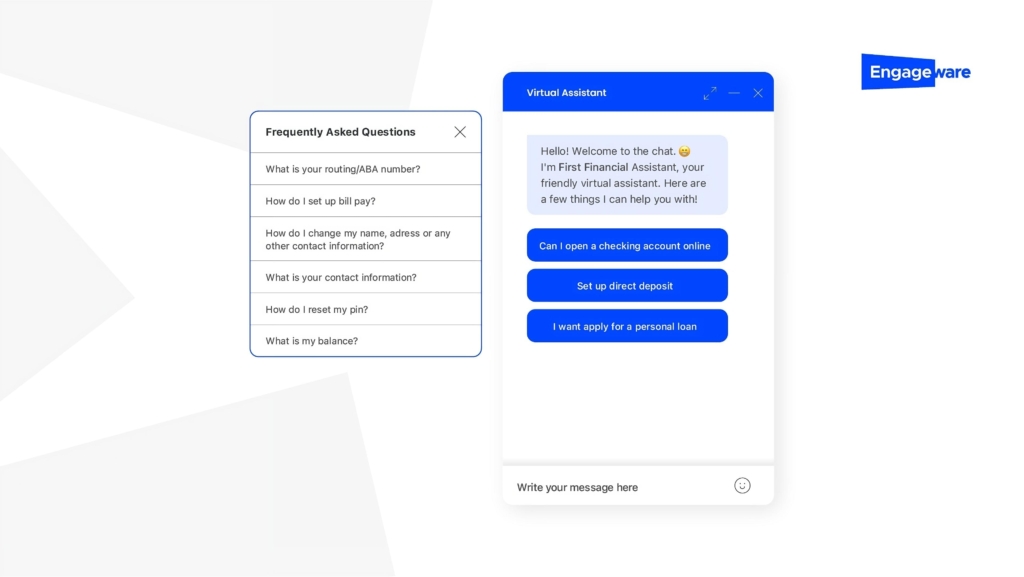

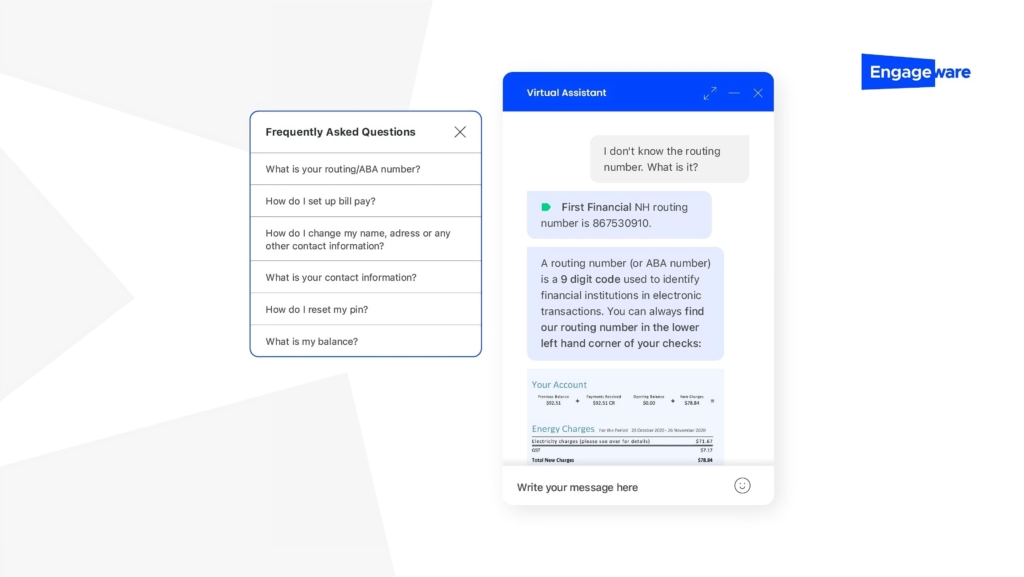

For bank and credit unions’ customer service, this AI powerhouse steps in as a versatile Virtual Assistant, adept at handling a range of tasks from answering FAQs to providing personalized advice. Its ability to learn and adapt makes it exceptionally suited for the dynamic environment of banking, ensuring customers receive swift, accurate, and contextually relevant support. This AI innovative technology is reshaping the landscape of customer service in finance, offering a smarter, more efficient way to meet the ever-evolving needs of customers.

And yes, it’s safe in banking applications — when you’re working with software that makes use of your own data to inform the AI assistant — maintaining a closed system that trains on and keeps that data safe.

Let’s dive into 10 ways Generative AI for Customer Service can revolutionize customer service in your bank or credit union and meet escalating demands on customer service in the digital age.

10 Strategies for Leveraging Generative AI to Enhance Customer Experience

1. Automated first-interaction resolution for simple issues

Think of generative AI for customer service as your team’s co-pilot. It’s like having a smart assistant who can quickly handle everyday customer questions like balance inquiries — freeing up your human agents to focus on more complex or high-value interactions, such as a loan inquiry. Generative AI can understand and provide answers to customers’ most common queries instantly, reducing manual intervention and resolution times.

2. More personalized customer interactions

It’s not just about answering questions. AI and machine learning get to know your customers, easily processing slang and misspellings, and remembering past chats and preferences. This means every interaction feels more like a one-on-one conversation. Use generative AI to tailor responses based on customer profiles and past interactions for a more personalized omnichannel customer service experience.

3. Gen AI never sleeps

Customers can reach out any time, day or night. AI doesn’t sleep, so it’s always ready to help, making sure no one’s left hanging. A consistent omnichannel experience with generative AI ensures that customers get all the help they need, 24/7, whenever and wherever they require it.

4. Reduces training time

Training new hires? AI for customer service is like the ultimate co-pilot — offering instant suggestions, answers and guidance from a centralized source of truth, all in real-time. This means less time spent on training and more time doing the real work. In this way, generative AI helps simplify training processes and get new team members up to speed faster.

5. Enhanced data analysis and insights

Generative AI is like a detective, sifting through customer feedback and call data to find what’s working and what’s not. These analytics are crucial to understanding the impact of your AI, and consistently improving it. Using AI to understand customer feedback and pain points also helps you to improve performance and offers actionable insights that improve service. This includes using autogenerated knowledge from your own source of truth, reporting that shows how AI is interacting with customers, and training insights that let you calibrate the optimal customer experience.

6. Efficiently handling peak traffic

When things get hectic, AI has your back. Unlike human agents, generative AI can juggle multiple requests at once and take the pressure off the backlog — making those peak hours feel like a breeze.

7. Seamless integration with existing platforms

Generative AI gets to know and helps you to bring your existing systems into conversation. It’s all about ensuring that all info is consistent and easily accessible. The adaptability of AI in integrating with various banking systems and platforms. In this way, your generative AI becomes a single source of truth for omnichannel customer service — ensuring consistent, accurate responses for human agents and customers, regardless of the channel.

8. Ensuring regulatory compliance and building trust

Banks have rules, and AI respects that. It’s designed to always stay within banking guidelines, building trust and keeping things up and up. Generative AI can be designed to always operate within the bounds of banking regulations, leverages your own scrubbed source of truth, and helps to keep you consistent, secure and out of trouble with auditors and regulators.

9. Scaling the workload without scaling the team

As your business expands, generative AI grows with you. This means you can handle more without always adding more people to the team. Generative AI helps your customer service function scale to meet increasing demand — doing more without massive resource investments.

10. Helping human agents shine

AI takes care of the routine stuff, so your human team can focus on the trickier, more nuanced and rewarding tasks. It’s all about letting your humans use their unique skills where it matters most. By handling the busywork, generative AI lets customer service agents add more value to every interaction.

Exceptional Customer Service in Banking with Generative AI. Discover Engageware

Generative AI isn’t just a trendy tech buzzword; it’s a game-changer in the realm of omnichannel customer service. Its ability to streamline operations, personalize interactions, and scale with demand makes it an invaluable asset, especially in the fast-paced world of finance.

That’s where Engageware comes in. We’re not just using generative AI; we’re pioneering its application in customer service. By harnessing its power — and the power of your own content and data— we’re enabling financial institutions like you to transform their customer interactions, making them more efficient, personalized, and compliant.

Our recent acquisition of Aivo has vastly expanded these capabilities — putting Engageware at the forefront of AI innovation and offering a wider array of tools and solutions that make a real difference in the experience of your teams and customers.

Delve into our Generative AI solutions and discover how Engageware can revolutionize your customer service and empower your institution to not just meet but exceed customer expectations. Schedule a tour of the Engageware solution and witness the transformative power of generative AI in action. Let’s redefine customer service together.