Highlights

- Customer Self-Service is a proactive approach, enabling customers to access information and perform tasks independently.

- Employee Empowerment, as a management philosophy, fosters independent decision-making, empowering customer service teams. Strategies include building a customer-centric culture, providing tools, creating systems, and offering training and support.

- Employee Engagement with AI ensures employees benefit from AI-infused knowledge bases, enhancing efficiency and accuracy through personalized solutions.

- Results of Effective Knowledge Management encompass increased first contact resolution, reduced handling times, and are particularly valuable for new employees. Key elements involve easy-to-use answers, a consolidated knowledge base, and insights for effective knowledge management.

Navigating Staff Challenges

Despite the economic ups and downs of 2023, one thing is staying steady — the challenge to attract and retain skilled staff continues to impact financial institutions and every sign suggests that finding skilled employees isn’t likely to get better, anytime soon.

In the latest industry insights presented in ENGAGE Report 2024: Outlook for Customer Engagement in Banking, the narrative of these challenges deepens. A striking 80% of banking leaders now recognize employee turnover as a major hurdle, painting a vivid picture of the industry’s struggle to secure a stable workforce. Furthermore, 94% of these leaders emphasize the pivotal role of technology investment in retaining and satisfying employees, indicating a shift toward embracing innovative solutions.

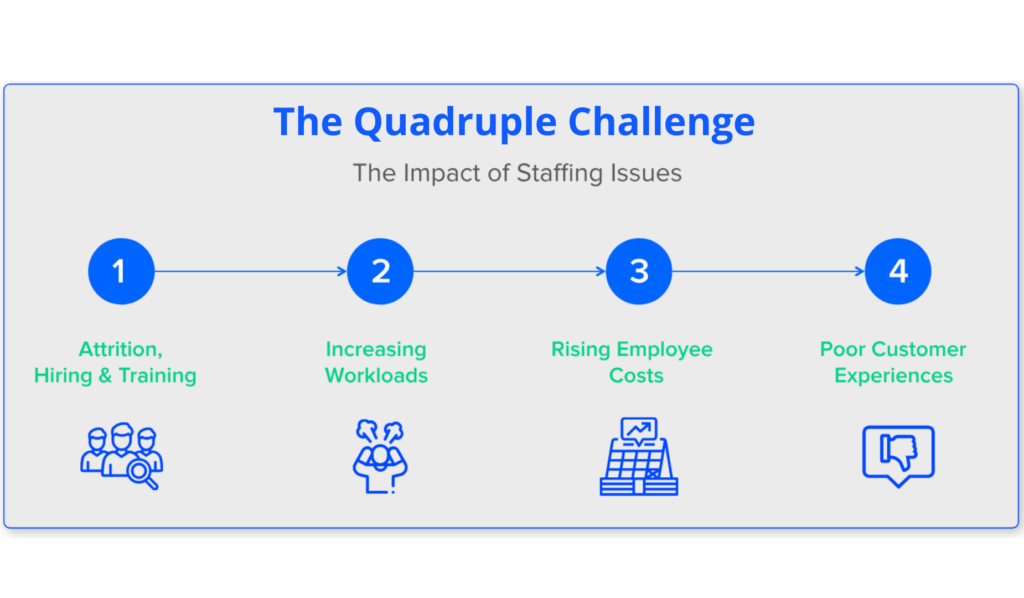

Combine this shortage with the churn of the past three years and you get a major productivity strain that has left banks and credit unions desperate to balance doing more with a less experienced staff — while still hitting their goals. While managing rising costs, increased workloads, and poor customer experiences and you’ve got a quadruple challenge.

Leveraging AI for Customer Engagement and Self-Service Banking Support

In navigating a tight labor market, reduced workforce and higher customer expectations, financial institutions must work smarter to do more with less. The challenge, where to start? Banks and credit unions face the task of growing deposits, increase accounts, enhance customer experiences, and drive more efficiency.

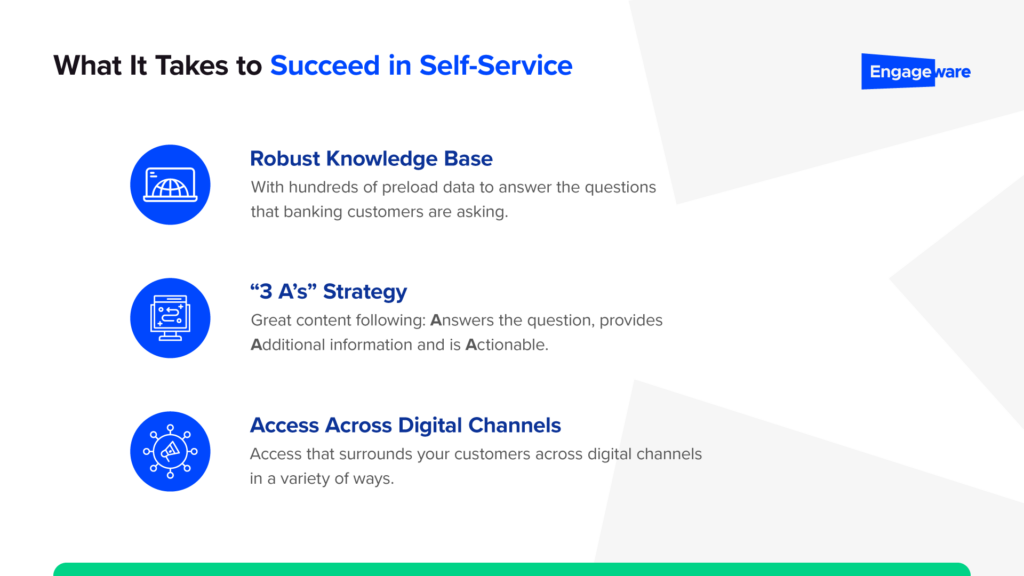

Recent industry insights, reveal that 75% of customers find self-service support convenient—highlighting the importance of empowering members with tools for independent issue resolution.

Leveraging AI to drive customer service in banking is no longer a futuristic vision but an immediate solution. Consider it as having another valuable team member, ready to assist and enhance efficiency.

While AI is currently a buzzword in the industry, the real strategic move lies in working with trusted partners. This can be a pivotal move in this scenario. Recognizing that implementing AI goes beyond adopting trends; it involves collaborating with experts that integrate seamlessly your existing solutions.

As a part of the doing more with less perspective, banking chatbots and virtual assistants can provide 24/7 support, answer high volume yet routine customer queries, and utilize predictive analytics for offering personalized services — AI brings forth a spectrum of possibilities that banks and credit unions can explore to alleviate the pressure brought on by staff shortages and enhance customer engagement.

Self Service Software: Elevating Customer Experience

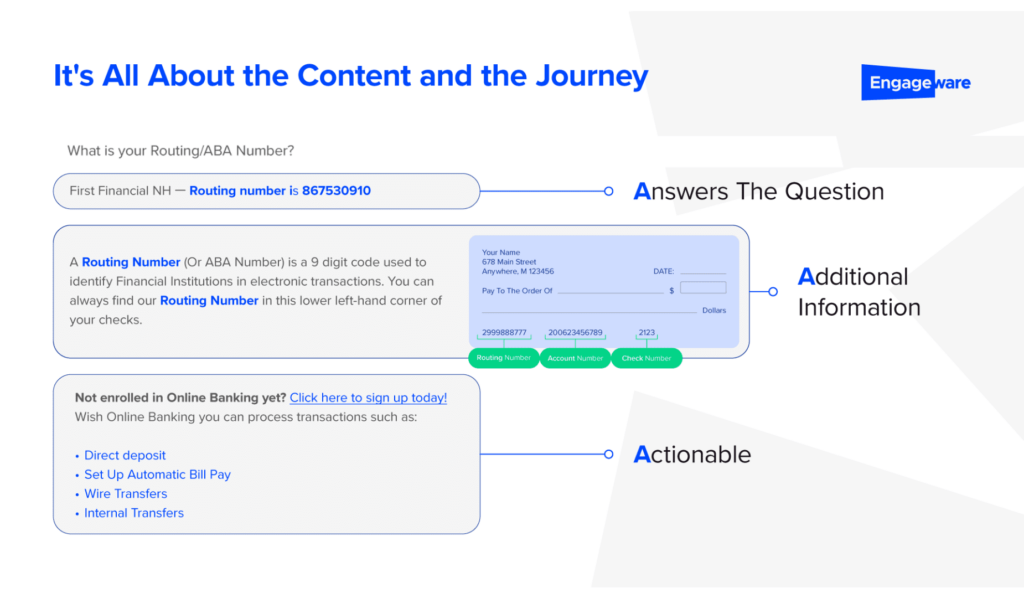

Help members get resolution on the first interaction by answering the common questions they are looking for, digitally.

With new advances in AI, particularly conversational AI, not only can common customer queries be addressed without human intervention, but personalized, context-driven answers can be provided by understanding customer behaviors and past interactions, driving self-service success rates higher. Intelligent virtual assistants powered by AI can engage in meaningful interactions, guiding customers through their journey, providing apt solutions, and even upselling relevant bank products and services where applicable.

27% of banking customers want their financial institution to solve their needs in the first interaction (ENGAGE Report 2024). When we examine the data from millions of customer questions, the top 20 inquiries are the same routine questions flooding your contact center: routing number, transfers, order checks, hours, online banking, login, and general queries related to digital payment platforms. Why are they calling? Because the majority of bank and credit union websites and mobile banking don’t provide basic answers or the context of why they are asking and what they are looking to do next.

Ready to empower your members with customer self-service? Learn how Engageware’s Customer Self-Service Software has helped hundreds of financial institutions improve customer service to reduce costs and improve customer satisfaction with its unique content services and interfaces.

Employee Engagement & Empowerment

An employee intranet powered by a robust knowledge base can empower employees with answers at their fingertips when interacting with customers. If the virtual assistant can’t solve a more complex customer query, then you should provide all the support the employees need to make service more efficient, increasing member and employee satisfaction and loyalty.

39% of banking customers report making it easy to immediately connect with a human when needed is absolutely essential (ENGAGE Report 2024). During a time when financial institutions face staffing shortages and higher-than-ever volumes, speed, accuracy, and confidence matter most. Customers rely on your employees for help when they have a question.

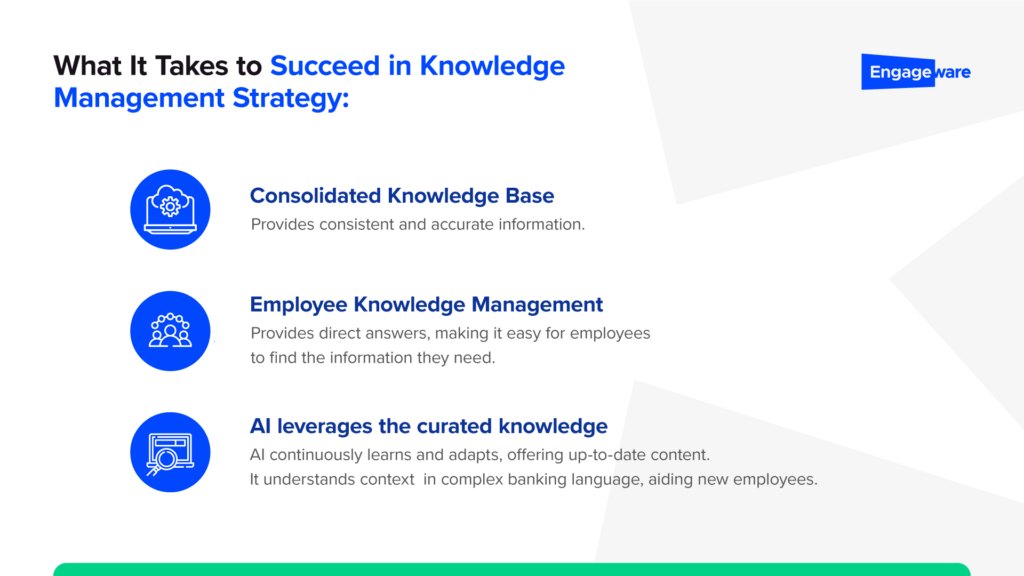

With thousands of constantly changing policies and procedures that your frontline staff needs to know, access to information is critical. The challenge: there is just – too much to know, too much to train on, and not enough staff.

Knowledge management software can swiftly provide necessary information or guide employees through complex procedures. It is supplied with accurate, curated content and data, leveraged by generative AI to offer up relevant information to agents exactly when they need it, helping them provide more personalized and effective solutions.

Ready to empower your employees with instant answers? It takes a partner with the right experience and approach.

Learn how Engageware’s Employee Knowledge Management has helped hundreds of financial institutions empower employees to improve first contact resolutions and reduce handle times by minutes with its unique knowledge management approach.