Was it only a few years back that the banking sector was all abuzz about a new technology called chatbots? The advancements in this technology have been head-spinningly fast. If you’re looking to implement a chatbot tool or update an existing one, you might be wondering exactly what the state of the art looks like and what you need to know to be successful. We can help.

To start with, a simple canned chatbot isn’t going to cut it anymore. The standard has evolved from interactive FAQs into an AI-driven virtual assistant that understands context, anticipates needs, and offers real-time action-oriented solutions. Banking now demands quick, secure, engaging digital assistance that feels personalized.

Enter the virtual banking assistant.

The modern AI-driven chatbot is all grown up — not only answering queries but offering an integrated, end-to-end experience across channels. That means routing customers to the information or assistance they need in a way that is often indiscernible from human assistance and can result in more first-touch resolutions. Whether accessing a knowledge base, engaging in text chats, or talking to voice bots, you can now shift customers seamlessly across channels and to human agents when needed. These virtual banking assistants have moved the goalposts for everyone.

With this transformation in mind, here are ten insights to guide your journey into adopting a state-of-the-art virtual assistant for your banking needs:

1. Virtual Assistants are the New Chatbots

Customers are no longer satisfied interacting with static chatbots. Now they expect dynamic assistants that offer predictive and proactive insights, closely mirroring human interactions. Today’s AI-driven virtual assistants have moved beyond canned chat and routine Q&A. They understand context, anticipate customer needs, and provide actionable solutions. Tools such as Engageware’s Studio allow you to create custom workflows that connect to, back-end, web, and API data — automating customer service and instantly connecting customers with the specific, personalized data they are looking for — creating first-touch resolution without needing to send them elsewhere.

2. (Curated) Content is King

A virtual assistant’s effectiveness is only as good as the content it has available. An effective virtual assistant should cater to the diverse needs of your customers, providing detailed answers, supplemental information, and direct calls to action. This means not just having a lot of content at hand but ensuring it’s consistent, accurate, timely, and derived from a centralized source, like a knowledge base. The “3 A’s” strategy below is key, making support less about addressing a query and more about providing a comprehensive, context-rich solution that caters to the customer’s needs while guiding them toward relevant, desired actions.

The 3 A’s Strategy: Best Practices for Optimal Support Content

- Answer the question: Your answer clearly and succinctly answers the question.

- Provide additional information: Supplement the answer with other relevant information and link directly to it.

- Make your content actionable: Give customers related actions to take with prominent calls-to-action.

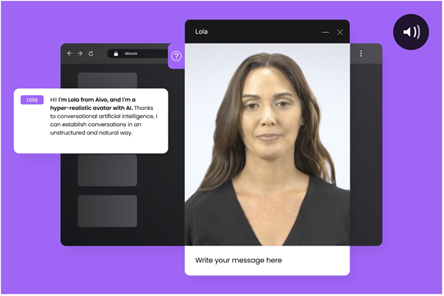

3. Leverage Generative and Conversational AI

Both Generative and Conversational AI have a role to play in helping you deliver a better customer experience! Generative AI works from content on your own websites and knowledge base, understanding, processing and tailoring answers with auto-generated responses. Video Conversational AI puts a more human face on your AI, offering answers to frequently asked questions, and even accessing transactional data with a video presence that helps your customers feel more comfortable.

4. Human Agents and AI Must Work in Tandem

Virtual assistants are incredibly effective at handling routine tasks, but they are not a replacement for human agents. Think of them as tools that can be used to enhance the human service experience. As they take on more of the standard queries, they free up your human agents to dedicate more time to higher touch, more intricate, and more high-value customer issues. Customers and agents alike get the best of both worlds. This kind of balanced blend of automation and human touch is vital, as each complements the other, ensuring enhanced customer satisfaction.

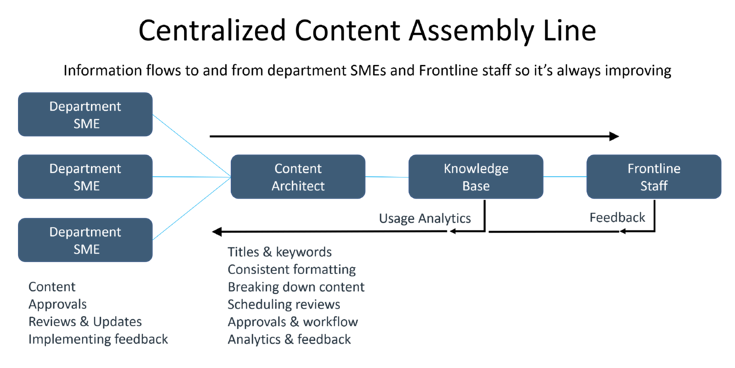

5. Centralized Knowledge is Non-Negotiable

Accuracy and consistency in interactions hinge on a single, up-to-date source of information. It’s essential that your virtual assistant is tapping into the best quality data. Be sure your virtual assistant strategy includes a centralized and updated knowledge base that can act as a single source of truth for AI and human agents alike — ensuring consistency and accuracy in the information you share with customers.

6. Turn your Virtual Assistant into a Virtual Sales Assistant

Your virtual assistant doesn’t need to wait around to be asked the right questions. When you’ve integrated your AI into an end-to-end platform you can be proactive about your conversational journey — making suggestions and offering products to new and existing customers, even when they are offline. With tools like Engageware’s Engage platform, your virtual assistant can solicit contact info and then follow up via SMS or WhatsApp messages, helping to educate, alert, upsell, and build customer trust over time.

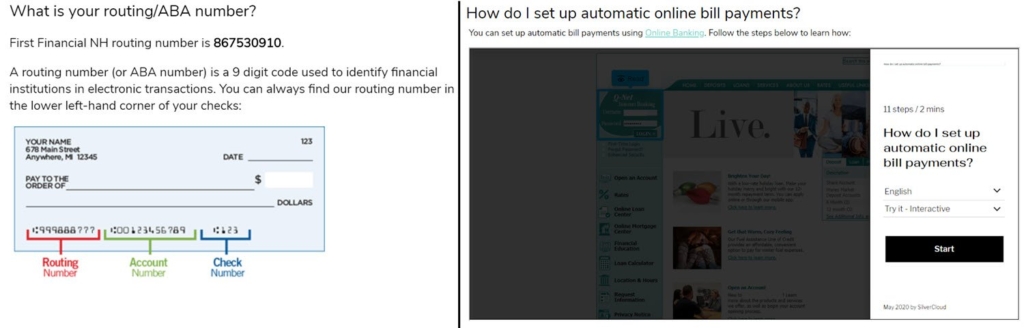

7. Incorporate the Power of Rich Media

Today’s banking solutions shouldn’t restrict interactions to simple text. Visual aids like diagrams, videos, and interactive graphics can often provide clearer and more engaging answers. For instance, a graphic illustrating a banking process or a video tutorial on using a banking feature can enhance understanding and save customers time, enhancing the efficiency of the virtual assistant. Implement this kind of rich media into your virtual assistant’s repertoire to enhance the experience and make support more intuitive and engaging. Here are two great examples of how to add images or step-by-step tutorials/videos to your content.

8. Transitioning Between Systems Must be Seamless for Customers

Offering an efficient, AI-powered virtual assistant allows customers to resolve simpler issues without human interaction. But a virtual assistant should know when to call in reinforcements. If a customer’s query is beyond the system’s scope, transitioning them to a human agent should be smooth and devoid of friction. This transition should also carry over the customer’s chat history and context, ensuring they don’t have to start from scratch with the human agent.

9. Industry Expertise Matters

When choosing a virtual assistant solution, choose a provider with a deep understanding of the banking sector. Providers with deep insights into the banking sector can ensure that the virtual assistant addresses industry-specific nuances and challenges, ensuring a smoother implementation process, and a better, more engaging customer experience. A thorough understanding of the banking and finance industries will not only help to lower risk and ensure you are following the complexities of financial regulatory and compliance concerns — it will also help you to leverage industry best practices and norms!

10. Consistency Amplifies Trust in the Digital Ecosystem

In the world of banking, where customer trust is paramount, providing a seamless, AI-driven interaction platform can significantly elevate the user experience. Consistency is key. When customers have positive, seamless experiences with a virtual assistant, it can enhance their trust in other digital channels offered by the institution. This fosters loyalty and encourages customers to engage more deeply with the bank’s or credit union’s digital offerings. Plus, by demonstrating efficiency, accuracy, and ease, customers become more inclined to use other digital services you’re offering.

Implementing a virtual assistant is not just a technological initiative; it’s a strategic one. It’s about deepening customer engagement, understanding user needs, and providing an interactive platform that delivers consistent value.

By harnessing the capabilities of more modern AI-driven virtual assistants, banks and credit unions can dramatically enhance their customer service offerings, making interactions more efficient, accurate, and tailored to individual needs.

As you embark on this journey, remember to select solutions like those offered by industry leaders known for their deep expertise in end-to-end banking solutions, ensuring you derive the utmost value from your investment. Solutions like Engageware, which emphasizes end-to-end customer engagement, can help institutions take their chatbot game to the next level. And our platform integrates seamlessly with existing systems, ensuring a consistent and enhanced user experience.

Curious? Book a tour of the Engageware platform and discover the next-gen of banking customer service.

Related Resources: