Customer service professionals have faced escalating challenges, navigating shifting budgets and rising customer expectations in recent years. This constant push to achieve more with less calls for a strategic response. According to over 300 financial leaders consulted in recent research, Artificial Intelligence (AI) is expected to be leveraged for customer service, reshaping how the financial sector manages customer interactions. But how can financial institutions effectively harness AI to redefine both customer engagement and operational efficiency?

AI adoption is now a business imperative for survival and success. According to the Engageware 2024 Report on “AI-Driven Customer Engagement: Navigating the Role of AI in Financial Services“, 88% of financial leaders are convinced that AI virtual assistants will handle all their institution’s customer engagement interactions within the next two years.

Now, let’s explore how AI-powered customer service impacts customer experience and drives operational efficiency, its benefits, and how you can get started.

What is AI in Customer Service?

Exploring AI in customer service opens multiple applications to elevate the overall customer experience. For instance, AI-driven virtual assistants play a crucial role in catering to the specific needs of customers, contributing to an enriched experience through increased automated self-service options.

Imagine a scenario where a customer, beyond regular business hours, requires assistance with a common banking inquiry, such as identifying their routing number or exploring services like applying for a personal loan — AI steps in. Customers engage in a seamless conversation with a virtual assistant, receiving prompt and accurate solutions without the inconvenience of lengthy wait times.

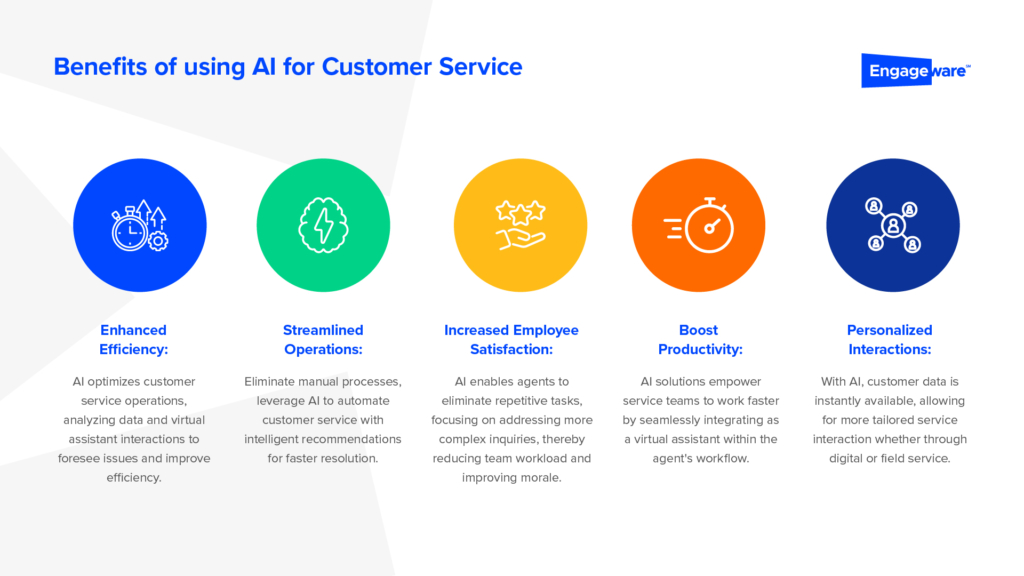

AI extends beyond customer satisfaction, delivering many benefits for customers and service teams. It enhances banks and credit union’s operational efficiency by streamlining internal processes and empowering teams to operate more effectively. Leading support teams to address customer requests promptly and proactively anticipate needs.

Benefits of using AI for Customer Service

As we witness the transformative power of AI in enhancing customer service, its impact extends far beyond, reshaping the operational landscape of financial institutions.

How AI Drives Operational Efficiency and Customer Service in Banking

Boosting Operational Efficiency with 24/7 Customer Support

A notable trend emerges from the customer side, there is no doubt that customers are driving demand for more digital tools. According to 1,700 financial customers surveyed in Engageware’s 2024 Report — 42% expressed a desire for their financial institution to be more technologically advanced to better meet their needs and 62% are comfortable with AI assisting in customer service.

Financial Insights:

Navigate Customer Engagement with AI

Access Report Moreover, emphasizing the limited customer support availability, here is a direct quote from a banking customer:

“Overall, I like my FI, but there are some things they could be doing better technology-wise as well as with customer service. Their app was very outdated and there have been lots of bugs needing to be worked out. Their call center has very limited hours and the online chat feature is limited to the same ones.”

– Response from a 22-Year-Old Female Banking Customer – Engageware Report 2024

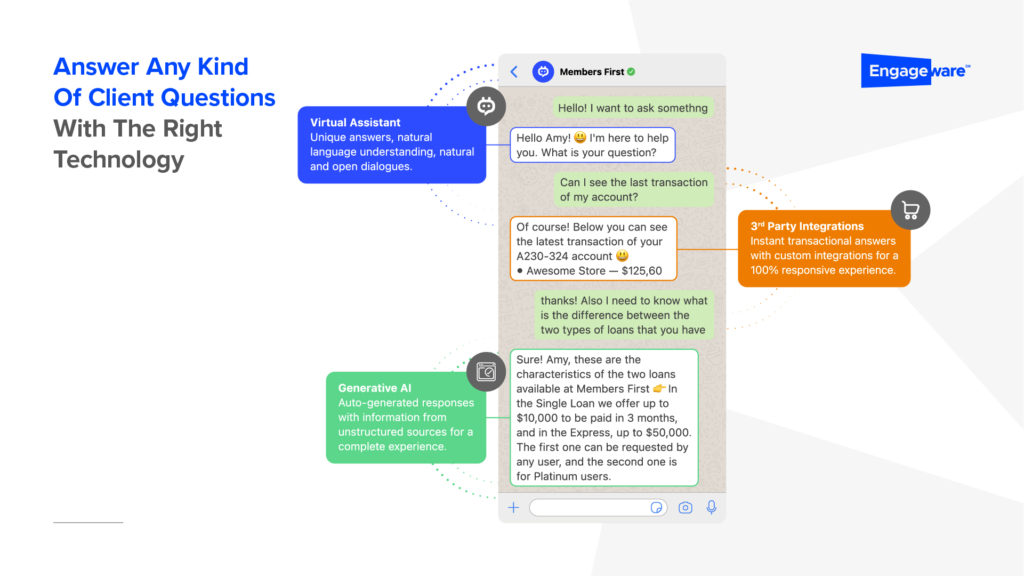

Intelligent virtual assistants powered by AI emerge as key factor to address these challenges. Beyond mere responders, they serve as accurate 24/7 points of contact for customers, providing instant support and guidance. Leveraging this technology for financial customer service requires a clever approach that considers the capabilities of both conversational AI and generative AI —to seamlessly enhance banks and credit unions’ customer interactions and operational efficiency.

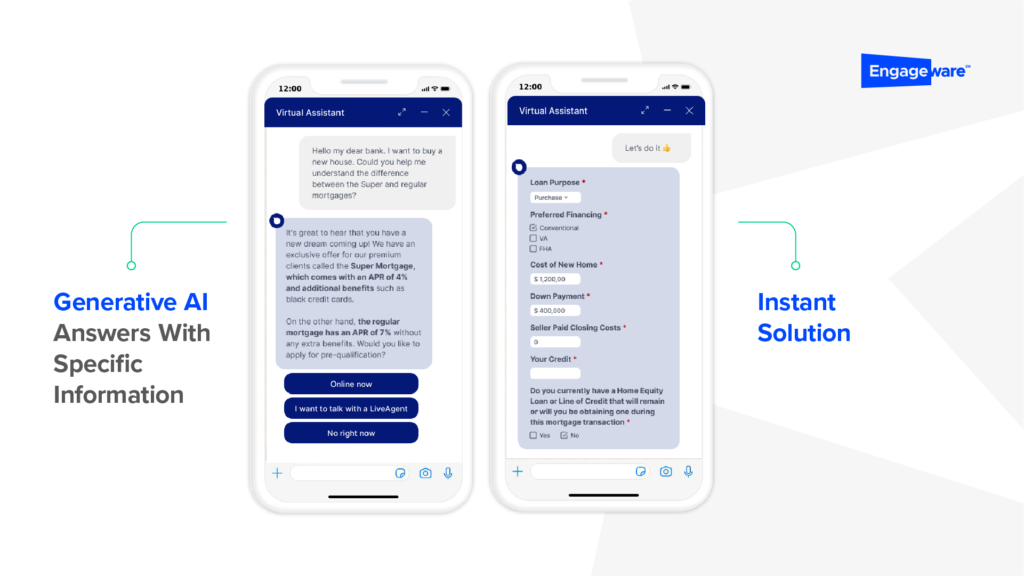

Picture AI as the digital brain. On one hand, the semantic engine acts like a digital librarian, efficiently categorizing and retrieving information. Excelling at recognizing phrases and words in customer queries, it ensures the virtual assistant understands context, reducing the need for users to repeat questions or context, even understanding typos.

On the other hand, think of generative AI solutions as the part of the digital brain that not only comprehends customer data but also creates new, relevant information.

For instance, AI-driven virtual assistants can greet your customers and address routine questions. There can also be adapted custom integrations to provide instant transactional answers. Then Gen AI steps in to address more complex queries, its exceptional ability to generate responses extends beyond predefined content, solving the client’s needs with personalized answers.

Furthermore, it facilitates the creation of shares or suggestions for products and services, enhancing the overall customer engagement experience.

Gathering Customer Insights for Personalized Experiences

By leveraging AI-driven solutions, banks consolidate data from various systems into a unified platform for both customer engagement and internal operations. Generative AI software can gather valuable customer insights, understanding intentions and preferences, and delivering personalized solutions. Providing tailored and automated responses based on customer insights and context.

Balancing the Human-Tech touch in Customer Service

Engageware survey findings, encompassing 303 financial leaders and 1,712 customers, highlight a crucial aspect— 39% of customers consider it essential to have easy and immediate access to human support. Emphasizing the importance of a balance between AI and human interaction in customer service.

Empowering customers with the right technology, such as AI in finance to retain top talent, enhance operational efficiency, improve customer relationships, and conversion rates.

In leveraging AI as a co-pilot alongside human employees, financial institutions gain the ability to anticipate customer needs, refine product recommendations, and automate routine tasks. This collaborative approach enhances employee satisfaction and efficiency, enabling banks and credit unions to scale services without overburdening human capital.

Ron Shevlin, Chief Research Officer at Cornerstone Advisors, emphasizes the potential of generative AI.

“The true path leads to a world where generative AI amplifies human productivity and creativity, acting not as a substitute but as an accelerator. This emphasis is on substantial acceleration, whether it means doubling or potentially increasing productivity tenfold.”

This perspective shifts the focus from merely automating tasks to significantly boosting human capabilities, leading to a future where AI empowers professionals to achieve more with less.

AI’s transformative impact lies in consolidating data and functionalities from diverse systems into a cohesive platform. This platform simplifies the work environment for employees, streamlining the delivery of consistent and accurate information across the service frontline and back office.

The benefits are far-reaching, enhancing customer service and streamlining operations through process automation, boosting employee satisfaction by reducing workloads, and ultimately contributing to the operational success of financial institutions.

Hear from our Customers:

How Institutions automate Customer Service

Learn More How to Get Started

Engageware is leading the industry in redefining how financial institutions connect with customers. We are the game-changer, streamlining operations, personalizing interactions, and offering effortless scalability in the financial sector.

Discover the Engageware advantage with our Generative AI solutions that make a real impact on your organization operational efficiency and customer satisfaction. Schedule a demo today and see how AI can transform your organization’s service strategy.