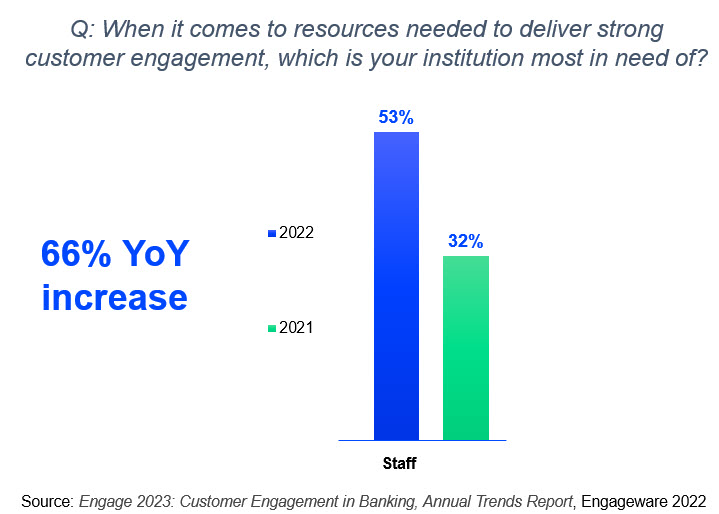

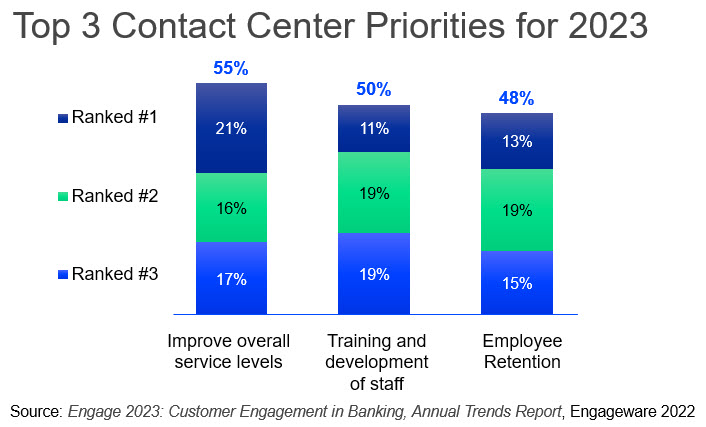

Staffing challenges are impacting businesses across the country and financial institutions are not immune. In Engageware’s ENGAGE 2023: Customer Engagement in Banking, Annual Trends Report, we surveyed over a hundred banking leaders to better understand their challenges and priorities for 2023. 53% reported staffing was the number challenge heading into 2023. When we asked about the contact center the top 3 challenges are all related to staffing: improving service levels, training and development, and employee retention.

What is the impact of staffing challenges and service levels? It impacts not only the customer experience but creates unnecessary pressure on existing staff. While solving staffing isn’t a simple solution, thankfully there are ways to improve service levels and in turn, reduce the burden on your staff.

Optimizing Customer and Employee Self-Service

If you search “improve service levels” Google returns 2,590,000,000 results. That’s over 2.5 billion results – a little overwhelming as to the many different directions you could pursue to improve service levels. However, based on our 20+ years’ experience working with hundreds of financial institutions, we know that optimizing the self-service experience for both your customers and employees drastically helps improve service levels. Here’s why.

In 2021, Gartner researched over 8,000 banking customer’s journeys when they were looking for help or support. What they found was that 70% will start digitally and 30% will call or visit. The problem? Of the 70% that started digitally, only 9% were able to get the answers and support they needed themselves. The rest – required help from one or multiple interactions with your staff.

In Summary: 91% of banking customers looking for help or support were forced to rely on your staff, even when 70% preferred to do it themselves. In a tight labor market with overworked staff and decreasing service levels, improving self-service capabilities for both your customers and employees enables financial institutions to:

- Decrease call volumes by 25%

- Reduce the number of live chats and emails by 50%

- Increase employee efficiency by 30%

Here are 5 ways that financial institutions can reduce abandonment rates and improve service levels by empowering both your customers and employees to self-serve.

Empower Your Customers to Self-Serve

As the Gartner survey highlighted, 70% of banking customers start digitally when they need help or have questions, yet only 9% can get the answers they need without human intervention. Your website has plenty of content, but does it have the right support answers, placed at the right spot, and are your promoting self-service before offering the option to call? The next 3 tips breakdown how to optimize your digital self-service experience to improve service levels.

Tip #1 Consistent Actionable Answers

Provide answers to the most common questions flooding your contact centers (calls, emails & live chats)

Why it matters:

- When we look at the data from millions of banking customer digital queries, the top 20 questions are the same routine questions flooding your contact center: routing number, transfers, order checks, hours, and technology questions such as Zelle, online banking, login.

- Why are they calling instead of getting the answers digitally? Because the most common questions are often overlooked on your digital channels.

What it takes:

- A robust knowledge base of 100+ answers that make up the 80% of the questions banking customers ask

- Great content that Answers the question, provides Additional information, and is Actionable

Tip #2 Surround Your Customers with Access

Surround your customers with multiple ways to access answers (website, mobile banking, search, FAQs, chatbot)

Why it matters:

- 30% of all digital support questions come from Mobile Banking, where there is typically little to no support, while the remaining 70% comes from the website. While you might have some support content, do you know how your users are finding it?

- When we look at the data of how banking customers interact with digital self-service content, 55% use search, 24% are using inline / on page strategically placed FAQs, and 21% rely on a chatbot / virtual assistant.

What it takes:

- Access to digital self-service content in both mobile banking and your website

- Access to digital self-service content from a variety of access points – search, on-page FAQs and chatbot. Different users prefer different ways to navigate.

Tip #3 Lead with Self-Service

Lead with self-service and then transition to the right human-assisted channel based on customer need

Why it matters:

- Banking customers will default to what is right in front them. If you lead with a phone number or click to start a live chat session, then that is what they will do.

- Different needs require different channels for help. A potential customer looking at mortgages should be routed to a mortgage specialist and not a live chat agent. Understanding the intent of the question or need allows the right human-assisted channel to be recommended.

What it takes:

- Leading with digital self-service help on key pages – including on your contact us, product, and technology pages

- A chatbot that sits in front of live chat to deflect 75% of live chat sessions.

Ready to empower your customers with digital self-service? It takes the right answers at the right place, and a partner that knows what those are.

Learn how Engageware’s Customer Self-Service has helped hundreds of financial institutions improve digital self-service success rates to reduce costs and improve customer satisfaction with its unique content services and interfaces.

Empower Your Employees to Self-Serve

During a time when you’re facing staffing shortages and higher than ever volumes – speed, accuracy, and confidence matter. With thousands of constantly changing policies and procedures that your frontline staff needs to know, access to information is critical. The challenge: there is just too much – too much to know, too much to train on, and not enough staff. The next 2 tips breakdown how to optimize your digital self-service experience to improve service levels.

Tip #4 Step-by-Step Guides

Make policy, procedure, and product information easy to find and follow

Why it matters:

- The typical financial institution does not provide its employees with access to consistent policies, procedures, and product information. Improving access to consistent, easy-to-find information reduces average handle times by minutes, while delivering a better customer experience.

- Your frontline staff need to answer questions that require insights from thousands of unique policies and procedures. With access to easy to find and follow step-by-step guides, onboarding new employees can go from months to weeks.

What it takes:

- A consolidated knowledge base that provides consistent and accurate information

- The right insights for managing your knowledge – even the best technology can’t fix bad content

Tip #5 Provide Easy Access

Provide access from the tools they already use

Why it matters:

- The average contact center representative uses 26 applications and tools to do their job. Switching from one to the other is time consuming.

- If tools are hard to find or not front and center, they will not be utilized. Even if you have the perfect knowledge base, without it being front and center, your employees won’t use it.

What it takes:

- Integration into the tools that they use the most – contact center software, digital engagement tools like Glia, and your main intranet like SharePoint.

Ready to empower your employees with instant answers? It takes a partner with the right experience and approach.

Learn how Engageware’s Employee Knowledge Management has helped hundreds of financial institutions empower employees to improve first contact resolutions and reduce handle times by minutes with its unique knowledge management approach.