Are you among the 93%* of banking leaders who recognize that a customer engagement strategy is not just a competitive advantage but a business necessity?

In recent years, we’ve observed a complete shift in customer engagement in banking, leaning heavily towards the digital side – customers are everywhere, on social media, apps, email, and texts. While this evolution unfolds, banks and credit unions are in a race to catch up, striving to consistently connect with customers where they are.

To equip banks and credit unions in today’s digital landscape with changing member preferences and evolving tech trends, Engageware has unveiled valuable industry leading insights gathered from 300 financial leaders and 1,700 banking customers.

According to ENGAGE 2024 Report: Outlook for Customer Engagement in Banking*, the vast majority of banking leaders believe the industry is on the right track. However, only 64% of customers rate the industry’s performance as excellent or good in meeting their expectations.

This misalignment between perceived industry success and actual customer satisfaction underscores the need for a unified and effective holistic customer engagement strategy in the financial sector. The solution? Enter the customer engagement platform, a pivotal driver shaping the banking landscape with a focus on seamless service across all channels.

What is a Customer Engagement Platform (CEP)?

A customer engagement platform is a comprehensive solution that enables financial institutions to manage, automate and optimize customer interactions across multiple channels. It centralizes customer interactions, offering a unified, single truth about each individual’s interactions with a company.

Unlike regular CRMs, which are all about managing information, CEPs not only streamline engagement but also enhance customer experiences, ensuring interactions across various mediums are consistent. Think of it as the conductor of your customer interactions, smoothly handling and analyzing the entire journey your customer takes with your company.

A key to leveraging a Customer Engagement Platform lies in empowering your team. Equipped with the right tools and information at their fingertips, your employees can effortlessly enhance their interactions with clients. With a CEP, the path to achieving these positive outcomes is straightforward, ensuring your team can focus on what they do best: building meaningful client relationships.

Why Customer Engagement Platforms Matter – A Glimpse into Banking’s Future

In 2024, CEPs are poised to play a crucial role in the banking industry, with 95%* of banking leaders highlighting the necessity for a unified customer engagement strategy.

Despite this, banks and credit unions face many obstacles in managing the customer journey. Engageware’s Report reveals astonishing challenges:

- Seven different systems, on average, are deployed by financial institutions for customer engagement platforms.

- 77% of banking leaders find departmental silos hinder the goal of offering a cohesive customer experience.

- 64% agree that having employees constantly learning new technologies is an obstacle to good customer engagement.

- 80% of banking leaders view employee turnover as one of the biggest obstacles in 2024.

Customer engagement platforms emerge as essential tools for financial institutions, addressing challenges like high turnover, enhancing customer experiences, and preserving a human touch in interactions.

“Overall, I like my financial institution, but there are some things they could be doing better technology-wise as well as with customer service. Their app was very outdated until recently and with the recent updates, there have been lots of bugs needing to be worked out. Their call center has very limited hours and the online chat feature is limited to the same ones.”

– Response from a 22-Year-Old Female Banking Customer – ENGAGE Report 2024

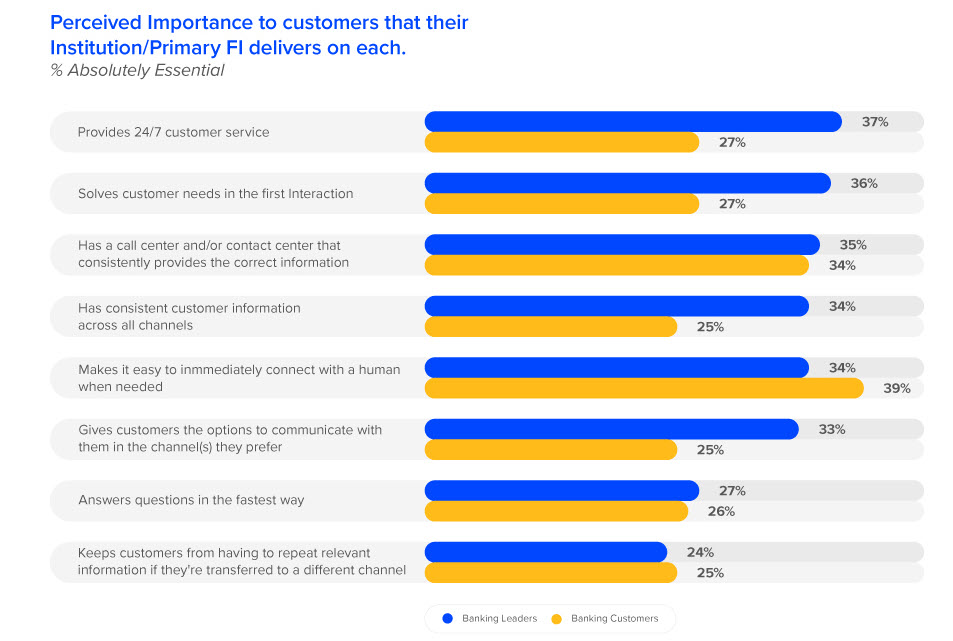

Insights from recent industry survey* present what are the priorities in todays customer service landscape for the financial sector.

Are you delivering what your customers want?

A third of banking customers consider a contact center consistently providing correct information as absolutely essential. Additionally, 27% emphasize the importance of 24/7 customer service, while 25% prefer the flexibility to communicate with their financial institution on their preferred channels.

For financial institutions, the Investment focus is on communication, AI (Artificial Intelligence), and employee tech in banking.

Strategic Tech Focus: Reshaping Banking Landscape

AI leads the top investment priorities for banking leaders in 2024. Moreover, planned investments include specific technologies, with a focus on automation (85%) and AI in self-service and virtual assistant technologies (72%). 94% of banking leaders view investment in technology as also crucial for employee retention and satisfaction.

Knowing that banks and customers alike understand the need for a well-defined strategy in implementing holistic customer engagement, it’s crucial to highlight the substantial benefits of embracing technologies that enable a seamless and unified omnichannel customer service approach.

Benefits of Omnichannel Customer Service – End to End Customer Solution

- Access to Information: Consolidating customer engagement data and enable seamless personalized services.

- Simplified Processes: Interact with customers on their preferred channels, providing exceptional experiences with a consistent service regardless of the channel.

- Streamlined Training: Reduce onboarding time and decrease handling time, optimize resources, improving operational and employee efficiency.

- Improved Response Time: Provide instant answers solving the customer need at the first interaction, enhancing the overall experience.

- Increase Sales and Conversions: Boost conversions by 30% through improved employee efficiency.

- Customized Solutions: Tailor exceptional and customized experiences, fostering customer satisfaction and loyalty.

In today’s engagement economy, customer loyalty has never been more important for banks and credit unions. To succeed, financial institutions must place their customers at the core of every touchpoint by providing flexible, personalized, and trusted engagement solutions. Engageware, a leading company in customer engagement solutions, can help banks and credit unions navigate tech trends in banking customer engagement, retain good employees, and tailor omnichannel customer engagement strategies.

Stay informed about the latest trends and strategies leading the industry! Access the full ENGAGE Report on the 2024 Outlook for Customer Engagement in Banking.

To learn how Engageware’s Customer Engagement Platform can help your financial institution improve customer satisfaction, increase conversions, and retain valuable employees schedule a meeting with one of our customer engagement experts.

*ENGAGE Report- 2024 Outlook for Customer Engagement in Banking