United Heritage Credit Union

How Streamlined Knowledge Led United Heritage Credit Union to Save 10 Months in Manual Training Time

Challenges and Goals

When a Credit Union Outgrows Their Knowledge System

In the heart of Texas, United Heritage Credit Union has 10 branches and a workforce of 250 employees. In recent years, United Heritage has seen exponential growth, evident in the expansion of its employee base, surge in membership, and significant increase in assets. This growth is a direct reflection of its guiding philosophy: The best member experience comes from the best employee experience”, said Laurie Roth, their Learning and Development Manager in charge of enablement and knowledge platforms.

The Credit Union initially used its company intranet to share policies and procedures, relying on its search engine for access. But they knew they had problems when employees reported difficulty finding information: “The search engine was slow and inefficient, with searches taking an average of 13 seconds to produce results,” noted Laurie.

Without a feedback loop, mechanism to assign ownership, or governance workflows available via the intranet platform, UHCU teams were challenged to keep content up to date.

The Solution

The Big Aha: Recognizing Technology Alone Wouldn’t Solve their Problem

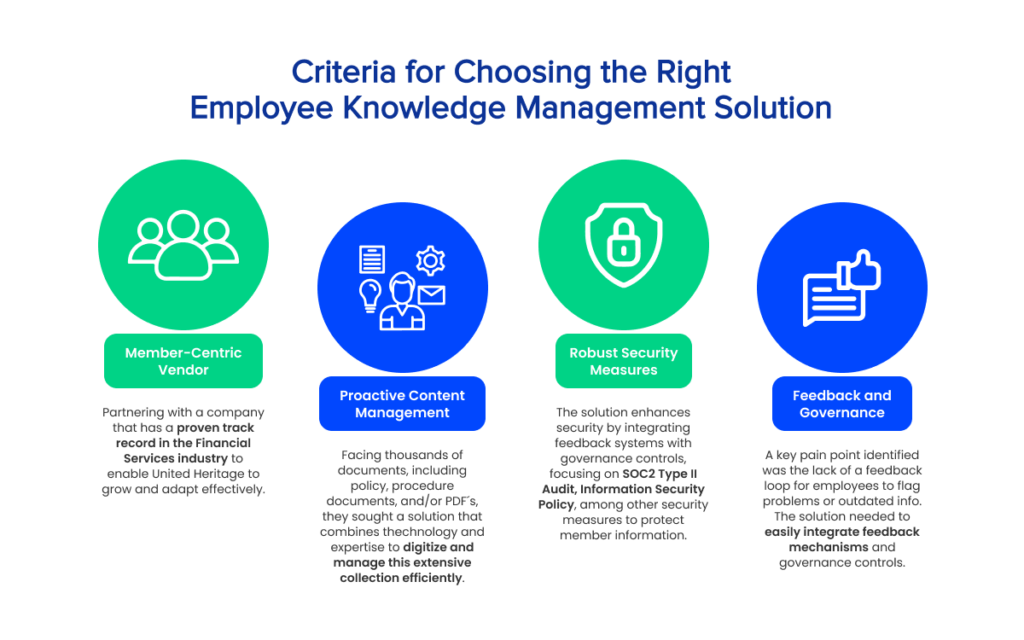

With the employee experience top of mind, United Heritage leadership wanted to address the challenges quickly, and the first step was a detailed analysis to identify the critical pain points. Employees were struggling to access the information they needed, prompting Laurie’s team to conduct a thorough review of the current processes and technology to understand the inefficiencies’ underlying causes.

“We recognized the need to enhance our knowledge management practices and find technology that could back these improvements, alongside a way to organize and streamline our content”, Laurie explained. After consulting with peers and other credit unions, they built a list of requirements for an ideal solution.

After vetting multiple vendors, UHCU chose Engageware’s Employee Knowledge Management. “From our first interaction with the team, we saw it wasn’t a sales pitch at all. It was a consultation”, said Laurie. Their decision was reinforced by Engageware’s 20 years of experience with financial institutions and the confidence after having reference calls with existing customers “who just echoed everything that we had already found to be true” noted Laurie.

Moreover, Laurie highlighted that the decision was significantly influenced by Engageware’s steadfast commitment to excellence and service, demonstrating alignment with UHCU’s core values. She emphasized the decision was “because of their commitment to serving organizations like ours, laser focus on innovation, shared interest in going above and beyond for members/customers, and integrity in addressing our employees/members/customers’ needs from the first interaction.”

The Results

Hitting a Home Run with a Reliable “Shared Brain”

At United Heritage, Engageware’s knowledge base serves as our ‘shared brain’ across every department – a true enterprise-wide solution. “The implementation was seamless,” Laurie remarked. “We didn’t even need to train end users because the platform was so intuitive,” she added. “In a short timeframe, our employees were fully onboarded, and the new knowledge base “became one of the most impactful organizational successes of 2023 for UHCU in regards to the employee and member experience.”

According to Laurie, “Since implementing the solution, our employees have become more collaborative and feel more invested in our collective knowledge. This increased efficiency translated into quicker member service, reducing frustration associated with trying to find information.

304 Hours & 10 Months of Training Saved: Engageware’s Impact

Utilizing Engageware’s Employee Knowledge Management, the Credit Union achieved a remarkable decrease in internal document search time, cutting it down from 13 seconds to a mere 1 second. Over an eight-month period, this enhancement led to employees performing 91,247 searches, translating into a savings of around 304 hours.

This improvement equates to reclaiming 7 weeks of work time, reallocating staff efforts towards more impactful activities. Moreover, the boost in search efficiency significantly streamlined the Credit Union’s training procedures. With easier access to vital information and quicker document retrieval, the organization saved 10 months’ worth of manual training time. This efficiency not only accelerated the onboarding of new hires but also enhances the organization’s overall adaptability.

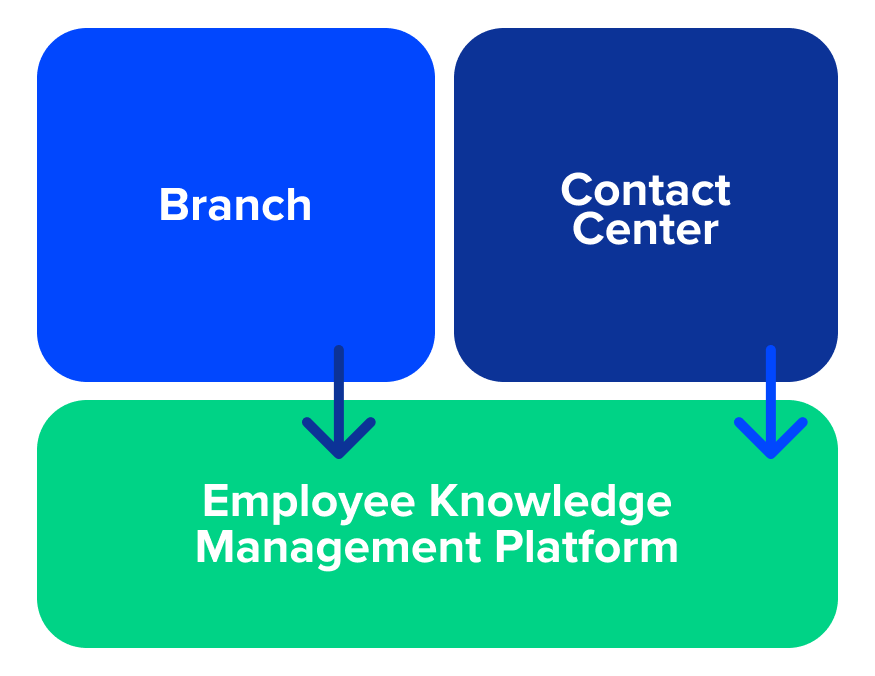

Bridging Service Gaps: A Unified Solution for Contact Centers and Branches

A unique aspect of United Heritage’s Customer Service is that both the contact center and branches can perform similar tasks for members, though the execution methods may differ. Previously, shared procedures required deciphering the specific processes for each service channel.

The introduction of Engageware has transformed this landscape. The platform offers customized content categories designed specifically for the contact center, clarifying the execution of tasks and thereby reducing the time spent searching for pertinent information. Moreover, United Heritage has developed a comprehensive list of content that addresses the most frequently asked questions by members, further streamlining service delivery across all channels.

As Laurie noted: “Because Engageware is really flexible in how you can organize and link content across various areas, it has significantly helped our contact center team save time by quickly finding the answers our members need.”

The Power of Expert Content Management to Close Knowledge Gaps

Laurie’s experience with Engageware highlights the transformative power of expert content management in enhancing operational efficiency at the Credit Union. “Engageware’s content expertise was invaluable in streamlining our processes,” she remarked. The platform facilitated content digitization and organization, ensuring it was user-friendly. “With the help of a dedicated content team familiar with credit union content, including policies and procedures, we were able to efficiently reorganize everything for easy access.”

The partnership with Engageware extended beyond technology; it was instrumental in refining the UHCU’s approach to knowledge management. Laurie noted, “Implementing Engageware helped us in many ways, not just technologically, but also in fine-tuning our knowledge management program and governance model.” The Credit Union was able to establish its knowledge management policy and program, incorporating governance controls and audit processes to ensure the initiative’s success.

About United Heritage Credit Union

Since its foundation in 1957 as Military Federal Credit Union, United Heritage Credit Union has been steadfast in offering comprehensive banking services to its members. Headquartered in the vibrant city of Austin, Texas, United Heritage CU extends its reach across the greater Austin and Tyler regions, operating through twelve strategically located branches including in Manchaca, Slaughter, Georgetown, Lakeway, Kyle, and Tyler.

With assets exceeding $1.5 billion, United Heritage Credit Union has cemented its position as a beacon of financial stability and personalized service within Texas. This significant financial milestone underscores their robustness and reliability in the financial sector. Boasting a network of branches and supported by a dedicated workforce of 250 professionals, they truly embody the Credit Union’s enduring philosophy of “People Helping People”, committed to fostering strong, supportive relationships within the communities they serve.