The right conversational virtual assistant can delight customers and meet your FI’s growth goals

With all the buzz about ChatGPT it’s a great time to brush up on what this cutting-edge technology means for the financial services industry, and how it can enable banks and credit unions to amplify their sales enablement efforts to power their institution’s growth.

As a financial institution, you probably know the crucial role Generative AI is playing in helping institutions manage risk, deliver customer service, and assist with marketing efforts.

AI-powered chatbots and virtual assistants are reducing wait times, delivering accurate and relevant information, simplifying tasks, and improving customer satisfaction, overall, as measured by net promoter scores (NPS).

Behind the scenes, AI already helps banks, credit unions, and other financial institutions (FIs) streamline internal processes, spot fraud, and ensure better compliance, risk, and data analysis. On the front end, AI also builds a better customer experience, using algorithms to analyze customer data and offer clients more tailored products and services — such as customized investment advice or loan offers.

According to Ron Shevlin, Chief Research Officer at Cornerstone Advisors, conversational AI “has become a competitive necessity – i.e., a foundational technology – not just to provide customer and employee support but because of the need to gather data,” (Forbes: Thanks To ChatGPT, 2023 Is The Year of The Chatbot In Banking).

But AI-based conversational chatbots can do even more. By stepping in where agents are not available, routing clients to human agents at exactly the right time and providing critical self-service information at key moments in the customer journey, conversational virtual assistants are helping FI’s win and retain more customers. In this way, conversational AI is helping banks and credit unions drive growth, sales enablement, and improve NPS.

What are conversational virtual assistants, anyway?

Virtual assistants are computer programs designed to mimic human conversation through text or voice interactions. They are typically used in messaging applications, websites, or mobile apps to automate customer service or other communication tasks.

Conversational chatbots take this a step further. By using natural language processing (NLP) and artificial intelligence (AI), they can hold a natural-sounding two-way conversation — understanding and responding to user requests in real-time. Unlike traditional automated chatbots that rely on predefined responses and follow a strict, predetermined script, conversational chatbots use machine learning to understand and respond to user requests in a more human-like manner.

Conversational chatbots can handle a range of tasks, from answering basic questions to processing transactions. They can ask follow-up questions, provide personalized responses based on user input, and even use humor or empathy to create a more engaging conversation. They can also handle multiple queries within the same conversation, remember user preferences, and provide recommendations based on previous interactions. Best of all, they can be programmed to learn and improve over time.

How conversational chatbots/virtual assistants are being used in financial institutions

Conversational chatbots are increasingly being used in banking to provide customers with a more efficient and personalized banking experience — and also as a critical step along the customer journey. They take some of the pressure off human agents — stepping in where agents cannot be available or providing information at key moments that can help depositors and clients make big decisions.

Banks, credit unions, and other FI’s are using conversational chatbots to assist in:

Customer service triage and direction to a live agent: Chatbots can handle a wide range of customer queries, including account balance inquiries, transaction history, and account-related issues. They can provide immediate and personalized responses to customers without the need for human intervention, reducing wait times and improving customer satisfaction (NPS) — and they can route customers to a live agent when appropriate.

Scheduling appointments: Customers who know they need to visit a branch or who wish to immediately and easily schedule a phone call or appointment can do so quickly and easily at any time with the help of a conversational chatbot.

Account management and routine questions: Chatbots can help customers manage their accounts, such as setting up automatic payments, updating personal information, or initiating transactions. They can also provide real-time notifications about account activity and help customers track their expenses.

Fraud detection: Chatbots can use machine learning algorithms to identify fraudulent transactions and alert customers in real-time. They can also help customers report suspicious activity and initiate the process of blocking or canceling a compromised card.

Financial advice: Chatbots can provide personalized financial advice to customers based on their transaction history and spending patterns. They can also recommend investment options or provide customers with tips on how to save or use their money.

How conversational chatbots/virtual assistants help bank consumers

For customers, using AI-powered conversational chatbots means getting answers and information without the wait and more of a personalized experience. With AI picking up some of the more routine banking questions and tasks, bank customer service agents are freed up handle more complex banking procedures or inquiries.

When AI is integrated into banking websites, mobile apps, and messaging platforms financial institutions can provide 24/7 support to customers, reducing frustration and increasing satisfaction. This leads to better customer experiences and better overall customer engagement — as customers can trust that they will get the information and services they need, exactly when they need it.

Conversational chatbots offer banking customers:

- Personalized experience – Customers can get tailored answers to their specific needs and interests, through a natural, accessible conversation.

- 24/7 convenience – Unlike human agents, chatbots are always available. 24/7/365 chat allows them to quickly and easily get the information they need, without long hold times. This is especially important for banks and credit unions as consumers often search for banking information such as mortgage rates “after hours.”

- Shorter handle times and less ‘runaround’ – Customers can be routed directly to a source of assistance without long hold times, delays, or being passed from agent to agent. If and when a customer handoff takes place, the previously communicated information is passed along — eliminating the need for the customer to repeat themselves.

- Self-service for those who prefer it – Customers who prefer not to speak to a person can get the information they need on their own — or they can quickly and easily make an appointment for a more personal follow-up.

The benefits of conversational chatbots/virtual assistants for banks and credit unions

Using conversational chatbots can be a game-changer for FIs — expanding their ability to help customers exponentially, while helping to reduce costs and increase efficiency. It can also provide assistance for agents when it comes to winning and keeping depositors and other clients.

Conversational chatbots help financial institutions to:

- Shorten the buying cycle – Chatbots are available around the clock — even if it’s in the middle of the night, weekend, or at a peak time. They can field questions and offer customers solutions in real-time. Because they are able to respond in the moment, they can gather information to generate leads, qualify those leads, and even convert qualified leads into customers — all from a single call or chat window.

- Improve customer experience and engagement – Provide a more engaging and interactive experience for customers, leading to increased interest in your products or services.

- Increased customer satisfaction and retention – Conversational chatbots can resolve customer issues quickly and effectively, leading to higher levels of satisfaction and loyalty — and ultimately to stronger customer retention.

- Cross sell and upsell products — Conversational chatbots can recognize patterns and offer customers related products and services based on their behavior and questions.

- Alleviate the burden on live chat agents and branch employees — Chatbots do not entirely replace human agents, but they provide a powerful assistant function. They are able to quickly triage, servicing more routine and transactional requests directly, while routing more complicated or high-touch issues to human agents.

- Facilitate appointment scheduling — There are instances when customers need to or prefer to speak with a human and just want a way to quickly schedule that assistance. Chatbots can serve as a scheduling service and make it easy for customers to choose a convenient time to come into the branch, schedule a video banking session, or receive a call.

- Employee knowledge management assistance – There’s nothing more frustrating for agents than getting questions they can’t locate the answers to. Or worse, having information that is incorrect or inconsistent. A conversational chatbot can be an important resource for your human agents, making information easily accessible for employee use from the same single-source-of-truth it is drawing on to help customers.

The Impact: Results that can be expected with chatbot

- 94% first contact resolution

- 91% customer satisfaction score

- 85% reduction in cost per interaction

- 70 – 100% self-service effectiveness

- 80% appointment conversions

- 40 – 80% reduction in calls

- 25% increase in NPS/CSAT

- 12% reduction in abandoned users

7 Tips: Choosing a conversational chatbot or virtual assistant for your bank or credit union

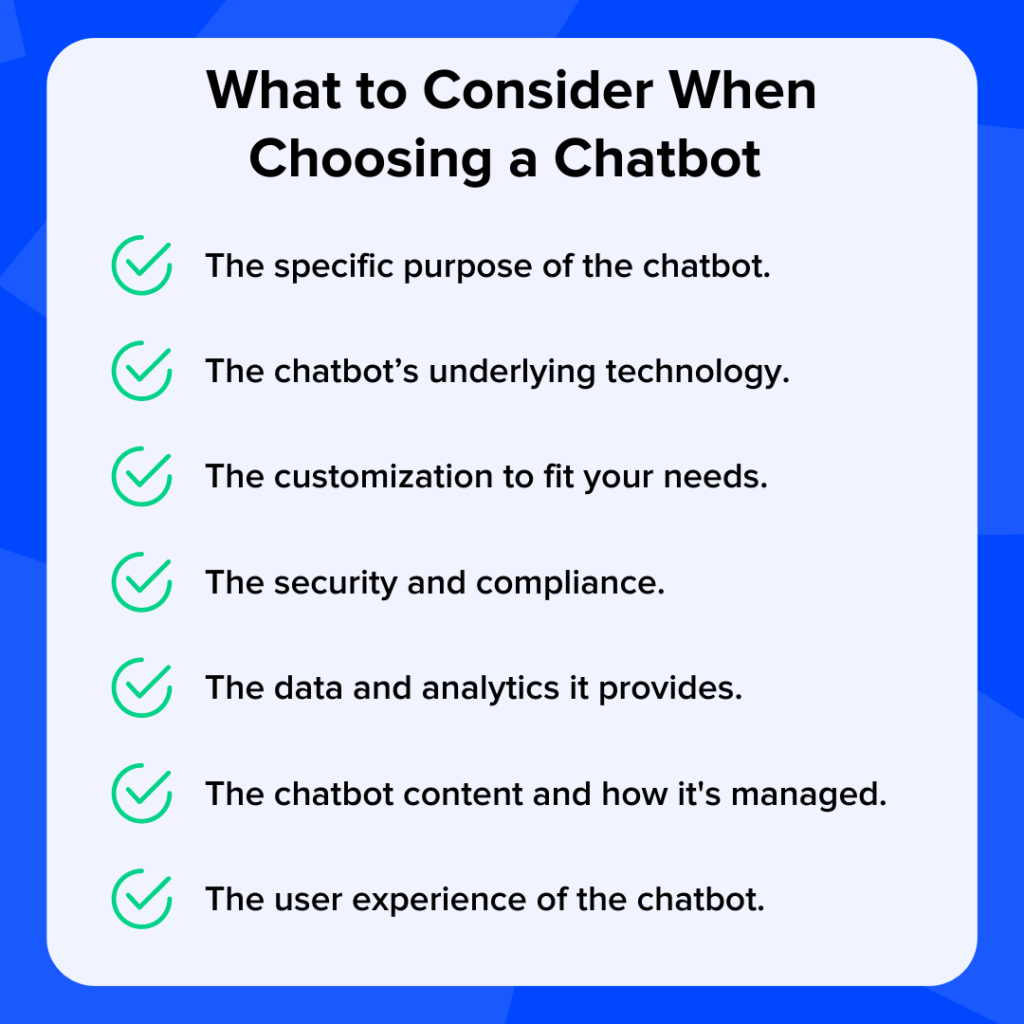

So you’re sold on conversational chatbot and generative AI. How can you go about finding the right one for your FI? Here are seven factors to consider:

1. Purpose

Determine the specific purpose of the chatbot. Is it to handle simple customer inquiries, identify fraud, assist with transactions, or provide financial advice? Different chatbots may be better suited for different purposes, but as a general rule FIs should be looking for a more advanced, conversational choice with NLP, and one that can handle banking-specific needs, such as passing through transactional info and integration with calendars to offer appointment scheduling.

2. Technology

Consider the chatbot’s underlying technology. Does it use NLP to understand customer inquiries? Does it integrate with your FI’s existing technology infrastructure? We strongly advise you to choose a conversational chatbot that can serve as a single source of truth for both your employee knowledge base and customer-facing channels — to ensure everyone is working from the same set of information.

3. Customization

Look for a chatbot that can be customized to your needs. This includes the ability to integrate with your processes, your branding and your customers’ needs. Be sure the chatbot has a smooth handoff to live agents and the ability to schedule appointments or call backs so that customers don’t feel dead-ended.

4. Security

Ensure that the chatbot is secure and complies with industry regulations. This includes using encryption to protect customer data and complying with regulations such as GDPR and HIPAA (for example for EFT or health-related accounts).

5. Data & Analytics

Look for a chatbot that can provide your FI with rich analytics on customer interactions, behaviors and preferences. You’ll better identify areas where the chatbot can be improved and also better understand customer needs and levels of overall engagement.

6. Content management

Select a conversational chatbot provider that provides comprehensive content management services — tailored to the needs of FIs — to ensure your chatbot is populated with the essential content, FAQs, etc. that are most used in an FI support setting.

7. User experience

Finally, consider the user experience of the chatbot. Is it easy to interact with and understand? Does it provide value to your customers and prospects? The chatbot should be customer-centric in its design and made to intuitively route intents and questions to the accurate resource. Make sure the chatbot uses advanced AI/NLP so that customers will be delighted by ease of use.

Engageware: The conversational virtual assistant custom built for financial institutions:

Engageware’s solution is an AI-based conversational chatbot that is custom built for financial institutions. Use it to provide customers and agents with the information they need — exactly when they need it. Our solution is the only conversational chatbot that offers advanced appointment scheduling, knowledge base content, and conversational chat — all drawing upon a single, highly user-friendly source of information.

Learn how leading banks and credit unions are utilizing conversational chat and generative AI to enable their frontline agents to attract more accounts and customers – allowing the institution to reach its growth goals. Schedule a tour of the Engageware platform, today. Schedule a Meeting >