How Financial Advisors and Relationship Managers Can Create Personal Connections that Build Trust and Drive Growth with Appointment Scheduling

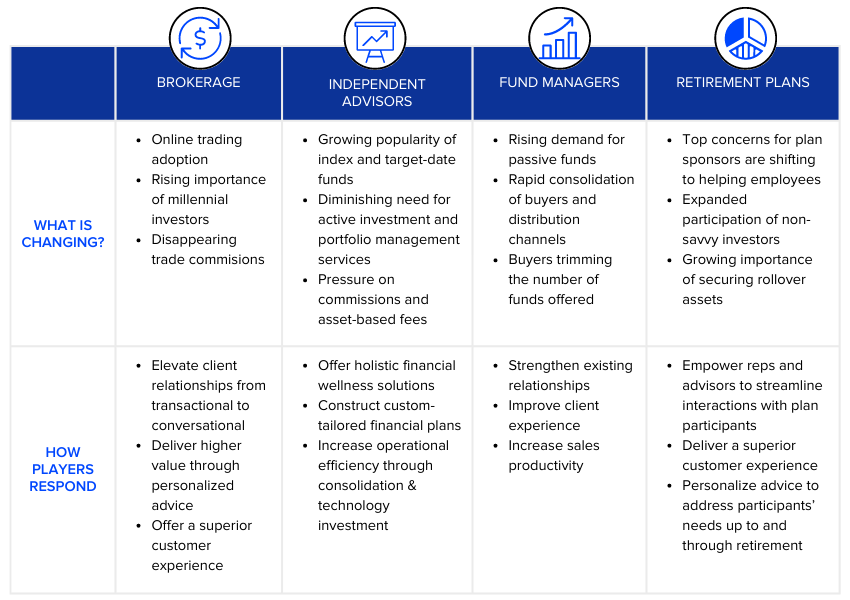

As Financial Services battlegrounds are redrawn, there is a renewed urgency for more personalized client interactions.

The financial services industry is in the midst of a major transformation. Driven by technology advances, shifting US demographics, and changes in consumer behavior, the balance of power is tilting further and further towards the customer. These fast-changing dynamics are affecting every segment of the financial services industry, with a particularly profound impact on investment and wealth management providers. The ability to redefine client interactions and earn customer trust will determine which firms survive the transformation and emerge as the providers of choice for a new generation of investors and intermediaries.

The Impact Across the Industry

Broker Dealers

To win over a new generation of customers, brokers must elevate client relationships from the transactional to the conversational, and deliver value through personalized advice, all while delivering a superior customer experience.

Independent Advisors

To justify charges, firms must demonstrate value and deliver holistic solutions, driving advisors to spend more quality time with clients and construct custom-tailored propositions.

Asset Managers

As their distribution channels shrink, fund managers must strengthen relationships with institutional buyers, retirement plan sponsors, and independent advisors in order to stand out from the competition and become a preferred provider.

Retirement Plans Providers

Responding to concerns around helping employees secure their financial future, leading providers are investing in tools and processes that empower reps and advisors to streamline interactions with plan participants and deliver a superior, highly personalized client experience.

Investment management firms are deploying new, customer-facing strategies to reposition themselves for the next generation of investors.

Time is of the Essence: Helping Clients Help Themselves

While Americans aspire to be financially prepared for the future, 97% of them simply aren’t making time to do so.

The average American adult spends less than two minutes a day managing their finances. (To put this in perspective, they spend almost 3 hours a day watching TV).

Winning over modern investors requires a new level of client experience, one that is streamlined, engaging, and highly personalized.

Despite the rise of digital technologies, communication between investors and advisors is primarily done via traditional channels such as phone (73%) and in-person meetings (61%). At the same time, investors expect a new kind of meeting experience, including frictionless appointment booking, personalized reminders and notifications, and highly efficient interactions that focus on their personal needs.

- 88% of US investors say they want to see technology that complements human advisors, not replaces them.

- 92% of consumers say it’s important or highly important to have a live meeting with their financial services provider when facing an important financial decision.

- 75% of asset owners are looking for more service customization.

- 69% view time constraints as a limiting factor to effectiveness, seeking new ways to make better use of their precious time.

Investing in an Improved Client Experience Drives Both Engagement and Asset Flow

Engaging institutional buyers in the digital age requires a combination of the right people, the right processes, and the right technology to support them.

Firms that invest in client experience applications see a 36% increase in reverse inquiry (inbound) sales, boosting both sales productivity and profitability.

The firms that prioritize investment in customer engagement technology also gain higher net-new asset flow compared to those that lag in their investment.

What are the advanced digital capabilities that make a company attractive to advisors?

Streamlined Advisor Engagement

To start, a streamlined onboarding process and easy access to support are key success factors in winning the attention of every advisor. Advisors appreciate the ease of using Intelligent Appointment Scheduling to connect with recruiters and salespeople at their preferred time and place, eliminating the time-consuming and frustrating phone and email tag they may have endured in the past.

“As it grew, the sales organization needed a streamlined way to schedule appointments between recruiters and new advisors to join the LPL team. Using Engageware, scheduled appointments increased more than 3X within just a few months.”

Cynthia Santana, AVP of Business Systems

Personalized Client Experience

Next, advisors want to extend these same capabilities to their clients. Looking to win new prospects and grow existing relationships, advisors can differentiate themselves by establishing a cadence of wellcrafted personal interactions to create and nurture connections with clients.

According to Accenture, access to the advisor is the most important factor to a client-advisor relationship. Intelligent Appointment Scheduling empowers clients to schedule a meeting on their own terms, ensuring their advisor is there for them whenever they need to connect. Prompting all participants with the information needed to prepare in advance, meetings are efficient, effective, and focused on delivering value to address client needs.

Intelligent Appointment Scheduling: the Quickest Path to Superior Client Experience and Asset Growth

Spending quality time with clients is where the rubber meets the road to higher Assets Under Management (AUM). Research shows that even the slightest improvement in customer experience (CX) scores can yield significant growth in AUM.

Yet obstacles to greater client engagement and a better customer experience persist:

- Scheduling a meeting can be a time-consuming effort, and busy clients are often reluctant to engage in the process.

- There is always the threat of something “more important” popping up, resulting in high rates of cancellations and no-shows.

- With no advance visibility into the topic or goals for a specific meeting, multiple sessions are often required to complete research, provide a thoughtful response and complete the required paperwork.

Intelligent Appointment Scheduling not only automates the process, it also puts the client in control, allowing them to select the best time and place to meet with their advisor, while eliminating the frustrating email and phone tag involved in traditional scheduling methods.

Most importantly, it ensures that every meeting is highly effective and that both the advisor and the client arrive prepared with all the necessary information and documentation, minimizing the need for additional appointments or follow-on paperwork.

“The traditional back-and-forth to schedule an annual review was painful for both clients and advisors. I recently sent a personal email to clients to schedule a meeting through Engageware, and approximately 50% of them had scheduled within three days.”

Jason Hill, CEO

Empowering Remote Advisors and Sales Reps

As consumers grow more comfortable with the use of technology, remote reps and advisors provide a cost-effective option for connecting with clients.

With Intelligent Appointment Scheduling from Engageware, clients can schedule phone or virtual appointments with a remote advisor just as easily as they would schedule an in-person meeting.

Support teams are also better prepared to serve clients by automatically routing service requests to the best resource based on current needs and historical activity, reducing hold times and providing a better experience across all channels.

Driving Relationships & Growth with Intelligent Appointment Scheduling from Engageware

According to J.D. Power, financial advice satisfaction is directly linked to trust, retention and advocacy. Positive, ongoing connection with clients is the engine that drives engagement, action, and asset growth.

Increase Client Engagement

Automated Intelligent Appointment Scheduling can increase the number of meetings booked by up to 30% and eliminate more than 90% of no-shows.

Elevate Client Satisfaction

92% of consumers say it’s important to have a live meeting with their financial service provider. 78% are seeking personalized advice, and 89% say they benefited from advice when received.

Build Client Trust

A majority of investors would like to collaborate more with their advisor to make investment decisions. Being accessible when needed is the #1 reason clients view their advisor as a good fit.

What a Trusted Solution Looks Like

Trusted by more than 500 organizations, including ten of the largest 20 banks in North America and premier investment management firms such as Charles Schwab, LPL Financial, Black Rock and Lincoln Financial, Engageware is the leading provider of Intelligent Appointment Scheduling for the financial services sector.

A Streamlined Experience Across All Channels

In-person and virtual meetings can be easily scheduled through any communication channel at the time that works best for the client, increasing meeting bookings by up to 30%.

Secure and Enterprise Ready

Our scalable architecture is customizable and deployable in any environment. Engageware is proven successful for top-tier financial institutions, exceeding enterprise requirements.

Productive Meetings That Generate Results

Advance knowledge of meeting topics and goals allows both advisors and clients to prepare all the required information and documents ahead of time, eliminating the need for multiple meetings.

Simplified Tracking and Reporting

Advisors and sales leaders can track meeting activity in real-time to ensure clients are well-served and engaged.

CRM Integration

Leverage built-in integration to book meetings directly within Salesforce, including Financial Services Cloud, or use our global Event Notification System or API for easy integration with other systems.

Meetings That Are Easy to Keep or Reschedule

Automated reminders and easy rescheduling options substantially reduce no-show rates by 90% or more.

“User feedback is super positive. With so many different business units coming and asking for it, it is a testament to the value and ease of use Engageware provides.”

Cynthia Santana, AVP of Business Systems

Ready to see how Intelligent Appointment Scheduling can build your assets under management? Schedule a Meeting with an expert or learn more about Appointment Scheduling for Financial Services.