Scaling Financial Institutions in 2025 | AI, Automation & Customer Engagement Strategies

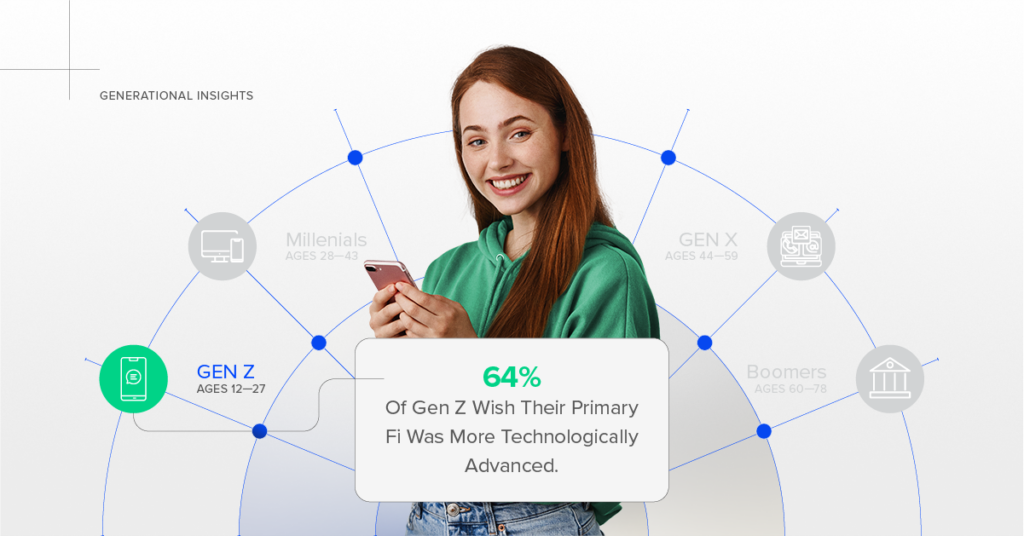

Running a financial institution today comes with some serious challenges. Whether you’re a mid-sized bank, credit union, or fintech startup, three major hurdles stand out: The secret to remaining competitive in a diluted and overwhelming market is adopting scalable solutions that enable adaptability to change while maintaining efficiency and profitability. The playbook for success isn’t […]