COVID-19 has impacted us all. But as financial institutions, what impact has COVID-19 had on customer retention and switching? In a recent webinar our friends at Rivel revealed the latest data from the Rivel Banking Benchmarks that outline the impact that COVID-19 has had on customer experience and the top reasons consumers and businesses are looking to switch.

What are the Rivel Banking Benchmarks?

Rivel conducts bi-annual brand & customer experience studies of financial institutions across the United States. It’s most recent survey conducted in the late summer and early fall of 2020, consisted of over 170,000 banking consumers interviews, over 4,750,000 reviews from 2,793 banks and credit unions.

The Results: At a Glance

The recording and slides below walk through in great detail the state of banking today, including the variations from market to market across the country. A few stats at a glance:

What percentage of the US market is vulnerable or defecting today?

- 25% of US households are vulnerable today

- 29.9 million US households are actively looking to switch today

- 30% of US businesses are vulnerable today

- 8.3 million US businesses are actively looking to switch today

Who performs better: Local and Community Institutions or Large Banks?

- 80% of community banks / credit unions households said they are happy with their institution

- 73% of large bank households said they are happy with their institution

- 72% of community bank / credit unions businesses said they are happy with their institution

- 71% of large bank businesses said they are happy with their institution

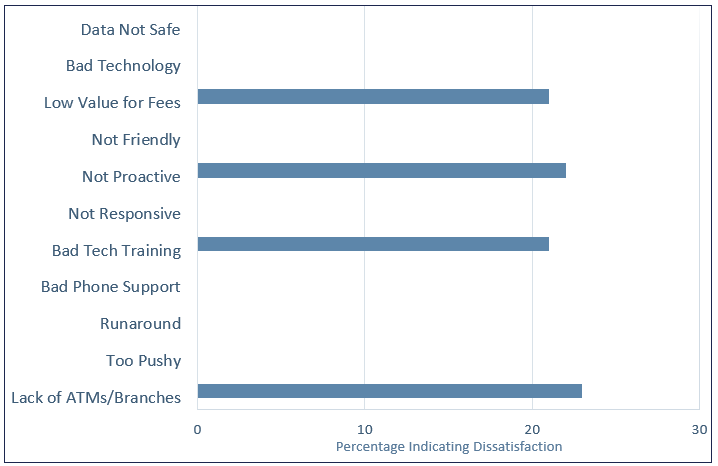

Why Are Customers Unhappy?

At a macro level, banking customers are looking for convenience, experience, and value. The top 4 reasons customer cite when expressing frustration with their current financial institution:

- Lack of ATMs / Branches (24% of respondents)

- Not proactive experiences across digital and human channels (23% of respondents)

- Bad technology training when asking for digital support (22% of respondents)

- Low value for fees (22% of respondents)

As financial institutions look to retain and attract new customers, it critical to remember this:

As bankers, this information needs to be considered for not only your customer retention strategies, but your marketing efforts in attracting new customers.

To see the full top 10 reasons customers are switching, click to slide 12 in the presentation below.

Related Resources You’ll Love

- Providing Digital Support as Banking Customers Shift to Digital

- Staley Credit Union and Engageware Deliver Digital Support to Members’ Fingertips in Less than 30 Days

- Why Every Credit Union and Bank Website Needs a Prominent Search Bar

- Self-Service in Banking: 4 Easy Ways to Deliver the Experience Your Consumers Expect

- The Best Customer Service is Self-Service: 9 Stats Pointing To Why Customers Want to Help Themselves