To overcome the current staffing challenges, banks and credit unions need the late majority and laggards who have been resistant to digital banking to adopt basic online and mobile banking features to ease the burden on the front-line staff.

Read on to learn more

Digital banking and digital self-service have long been considered the future of banking. For years thought leaders, industry pundits, and article after article have promised the future of banking: Digital transactions, online account opening, artificial intelligence, virtual assistants, personalization and on and on.

But something strange happened in 2022. The focus shifted from the promise of digital banking to the need for increased adoption of digital banking. In Engageware’s ENGAGE 2023: Customer Engagement in Banking, Annual Trends Report, over a hundred banking leaders were surveyed to better understand their challenges and priorities for 2023. 53% reported Digital Adoption as their top digital priority for 2023. Why? Because over 50% reported staffing was the number one institutional challenge heading into 2023 (a 66% increase from 2022!) With the staffing shortage, digital banking is no longer a nice to have for its consumers, it is a necessity for financial institutions looking to overcome the reality of today’s staffing challenges.

In their own words

Here are just four of the many quotes we heard in the Engage 2023 survey:

“We need a better solution for the 3,000+ phone calls a month we get asking what the balance in their account is – currently being answered by a live person.”

-$500M asset Credit Union

“Member resistance to change and adoption of technology moving away from how services were traditionally previously delivered.”

-$275M asset Credit Union

“How do we get more members to realize everything they can do digitally?”

-$300M asset Credit Union

“Members continued reliance on physical branches vs. digital banking.”

-$600M asset Credit Union

Crossing the Chasm: What Financial Institutions Can Learn from the Technology Adoption Life Cycle

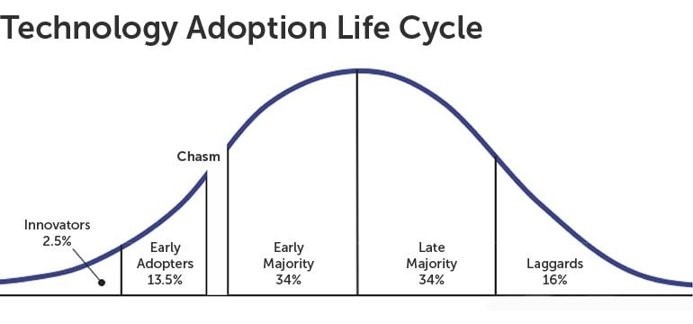

In 1991, Geoffrey Moore published Crossing the Chasm. Here is a brief description of the book: “In Crossing the Chasm, Moore shows that in the Technology Adoption Life Cycle—which begins with innovators and moves to early adopters, early majority, late majority, and laggards—there is a vast chasm between the early adopters and the early majority. While early adopters are willing to sacrifice for the advantage of being first, the early majority wait until they know that the technology actually offers improvements in productivity. The challenge for innovators and marketers is to narrow this chasm and ultimately accelerate adoption across every segment.”

The challenge financial institutions have today is not with the innovators, the early adaptors, and the early majority – the challenge is getting the late majority and laggards to adopt even basic digital banking features to stop the reliance on human assistance for every interaction.

In short – as financial institutions introduce new features to digital banking; they will not instantly be adopted by all. And one of his key takeaways, and one that truly matters for bankers: how you promote new technology to an early adopter is fundamentally different than how you promote new technology to the early majority, and especially to the late majority and laggards.

For the financial institutions to drive adoption with the late majority and laggards, – the tactics that worked to promote digital features to the innovators, early adopters, and even early majority will not work for the late majority and laggards. Statement stuffers, emails, homepage banners, in-app notifications will not work with the late majority and laggards.

Getting Adoption from the Late Majority and Laggards

While financial institutions may never get 100% digital banking adoption for a variety of reasons (security concerns, personal preference, etc.), even a small consistent increase over time will have a significant impact. Imagine the impact of reducing the number of monthly calls asking for account balance from 3,000 to 1,500? What impact would even 25% more adoption of basic digital banking features have on your frontline staff?

When looking at research around technology adoption, two of the top reasons cited for not adopting technology include:

- I did not know it existed

- I did not know how to use it

For the late majority and laggards who rely solely on your staff, the onus must fall on your staff to consistently educate them that 1) it exists, and 2) how to use it. While this may seem counterintuitive given the current staffing challenges, it is reminiscent of the old fishing adage. Give a man a fish, feed him for day. Teach a man to fish and feed him for a lifetime.

As the leader at an $850M asset credit union recently shared:

“When a member does get into our call center and asks us very general questions, we will redirect them. You know, Mr. Jones, I am glad that you called in today. Were you aware that we have this tool on our website on our mobile app, where you can ask this question, you can get some self-help if you need to, especially because we are not here 24/7. Right now, this is a great resource for you to be able to get the answers you need when you need them.”

– Contact Center Manager at $850M asset Credit Union

Overcoming Staff Objections:

This of course, assumes that your staff is ready and able to promote digital. One survey respondent perfectly summed up the challenge facing many of you today:

“Member-facing staff are resistant to digital options – they are unable and often unwilling to assist members who are having trouble because they do not understand and pass the member off to marketing for help.”

– $1B asset Credit Union

The challenge with your staff is the same challenge facing your customers:

- They do not know it exists

- They do not know how to use it

To overcome this objection, you need to empower your staff with knowledge of the different digital banking options (aka what exists), and more importantly, easy-to-access instructions for how to use digital banking (aka how to use it). This could be tutorials found on your website, or tutorials embedded within your internal knowledge base that staff can reference as they educate your customers.

Digital adoption is no longer a nice to have, it is a necessity for overcoming the current staffing challenges. And it must be a goal supported across your institution. As Jeffrey Moore said in Crossing the Chasm, “One of the most important lessons about crossing the chasm is that the task ultimately requires achieving an unusual degree of company unity during the crossing period.”

This unity requires empowering your staff with the resources they need to become your digital advocates for your institution to cross the chasm towards greater digital adoption.

Interested in learning how Engageware’s solutions can help your financial institution increase it’s digital adoption? Book a meeting with one of our experts >