Exceptional customer service is the backbone of any bank or credit union’s success. In today’s evolving digital landscape, powered by AI and advanced analytics, financial institutions need to be agile, proactive, and always eyeing the next horizon in customer service innovations.

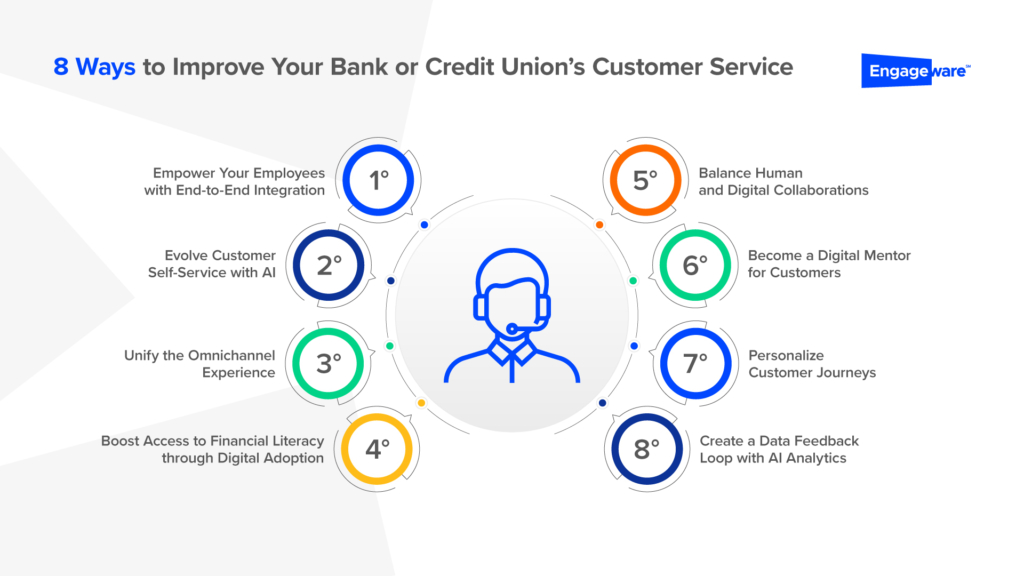

Are you in a bank or credit union seeking actionable strategies for customer service enhancements? Based on insights from the hundreds of financial institutions we’ve collaborated with, here are eight strategies tailored for the current dynamic environment.

1. Empower Your Employees with End-to-End Integration

Your frontline staff are the spirit of your financial institution and the main face your customers see and hear. With the rise of various technologies, systems, and platforms needed to do their job, it can be a frustrating experience for employees to provide quality customer service in a timely manner. It’s time to equip banks and credit unions with streamlined solutions that empower employees to delight customers with first-contact resolution. Engageware provides the only end-to-end customer engagement platform that is secure and compliant, utilizing Generative AI and Conversational AI to solve the customer’s need at the first interaction.

A two-sided customer engagement platform can streamline information search, provide instant answers, and boost both employee morale and efficiency. Banks that fail to adapt to these new banking standards risk frustrating their employees and customers. As Laurie Roth from United Heritage Credit Union noted, “The implementation of Engageware’s Knowledge Management solution was seamless. Our employees have become more collaborative and feel more invested in our collective knowledge, which has translated into quicker member service and reduced frustration associated with trying to find information”.

2. Evolve Customer Self-Service with AI

Following the industry trend, Gartner projects that more than 80% of enterprises will have used Generative AI APIs or deployed Generative AI-enabled apps by 2026. The banking sector must offer a comprehensive digital self-service platform to keep pace.

Engageware’s recognition as a ‘Major Contender’ in the Everest Group’s Conversational AI Products PEAK Matrix® Assessment 2024 emphasizes our leadership and innovation in this space. Conversational AI solutions for immediate query resolution ensure your digital interface feels intuitive and responsive, catering to both simple and complex financial queries. This aligns with our mission to deliver superior customer experiences and operational efficiency.

For instance, ADT implemented Engageware’s AI-driven virtual assistant, which now handles over 7,000 interactions monthly, effectively addressing 97% of customer inquiries. This has significantly enhanced user experience, providing swift and reliable support. Similarly, CEMEX automated its customer service across six countries using AI powered solutions, achieving a 97% resolution rate and greatly improving customer engagement.

3. Unify the Omnichannel Experience

A unified experience across all touchpoints is no longer optional. Customers need frictionless experiences that are easy, fast, consistent, and seamless. With the increase in cross-device activities and fluid digital transitions, maintaining consistency and optimizing interactions is crucial. Whether customers are interacting with voice assistants, mobile apps, or in-branch kiosks, the experience should feel seamless and unified. This also means providing ample access and support across all these channels and letting customers choose what works for them at any moment.

A omnichannel model optimizes how information is presented while maintaining consistency and accuracy across all channels. This is already a focus for many banks and credit unions as they work to keep up with new agile competitors like Fintechs and Neobanks while struggling to deliver the personalized, omnichannel experiences customers want. Our recent ENGAGE 2024 Report noted that 95% of banking leaders agree there is room for improvement in how their financial institution addresses customer engagement consistently across channels.

4. Boost Access to Financial Literacy through Digital Adoption

While traditional financial literacy initiatives remain valuable, modern efforts are needed to empower customers to learn through new financial tools and platforms to help them become more savvy costumers. According to ENGAGE 2024 Report, more than four in five financial services leaders (83%) agree that investing in artificial intelligence (AI) at their institution is essential for customer engagement in 2024.

Additionally, 42% of financial services customers expressed a desire for their financial institution to be more technologically advanced to better meet their needs. Ensure that you are empowering staff to be digital advocates, routing customers to the right channels to learn, and providing consistent information across all channels — with a knowledge base that serves customers, agents, and AI from the same source. This unified approach not only enhances customer understanding but also fosters greater trust and loyalty.

5. Balance Human and Digital Collaborations

Find the right balance to ensure a meaningful customer experience across both human and digital channels.Incorporate innovations and AI-driven financial advice, but don’t forget the human touch.

According to McKinsey, despite the move toward digital self-service, a fifth of customers still value interacting with an agent for more personalized expertise, social contact, and human dialogue.

Our own 2024 research found that customers prioritize being able to immediately connect with a human when needed, with 39% of banking customers reporting it is essential. This underscores the flexibility and array of support options customers demand — and financial institutions need to respond in kind.

6. Become a Digital Mentor for Customers

Financial institutions must provide additional support in times of economic uncertainty, according to our ENGAGE 2024 Report, especially with 37% of banking customers reporting decreased loyalty to their primary financial institution compared to a year ago. Half (49%) of customers are more inclined to shop around for better rates during such times. This trend is particularly strong among younger customers, who are less tied to their primary financial institutions and more open to exploring alternatives. By offering digital advisory services or partnering with tech providers, banks can strengthen relationships with their customers.

7. Personalize Customer Journeys

With the power of Conversational and Generative AI, it’s possible to create hyper-personalized experiences for each customer. According to our report, 95% of banking leaders highlight the importance of a unified customer engagement strategy to deliver experiences that engage customers and make them feel supported. The importance of personalization is further emphasized by the fact that 95% of customers agree it’s important to have the ability to reach a human agent when needed.

Additionally, 34% of customers highlighted the importance of having consistent customer information across all channels, and 33% valued having options to communicate on their preferred channels. This demonstrates that just because a channel is digital doesn’t mean it cannot feel human and customized. Banks can personalize AI and integrate human assistance seamlessly through their digital channels — such as live support, video chat, and online appointment-making for more consultative support and the human touch.

8. Create a Data Feedback Loop with AI Analytics

With the availability of AI analytics, banks and credit unions can continuously analyze customer interactions and feedback. This iterative approach allows for real-time service enhancements, promising growth and improvements to decision-making while ensuring strategies remain responsive to customers’ evolving needs. Banks and credit unions are doubling down on data-informed technology to support relationship banking and financial wellness, as well as physical branch investments such as ITMs, banking by appointment, and physical enhancements to turn the branch into advice centers.

Engageware remains at the forefront of revolutionizing customer service solutions for financial institutions. From our end-to-end customer and employee engagement platform to innovative appointment scheduling tools, we help banks and credit unions navigate the financial digital landscape.

Discover how our solutions can propel your institution to greater customer satisfaction and operational efficiency. Connect with our team to schedule a tour of the Engageware platform and experience the next generation of financial customer service.