Q2 was a roller coaster ride, to say the least. And not particularly the fun kind.

Dealing with the immediate setbacks of the Coronavirus pandemic crisis, financial customers needed support from their financial institutions more than ever.

In turn, banks and credit unions had to act fast to adapt to the ever-changing climate – and many with limited staff. There were temporary branch closures, limited services, new financial assistance packages to administer, and -well, you know the story – so much more.

With the immediate push to onboard millions of customers to online or mobile banking in the absence or limitation of in-person services, financial institutions saw record activity on their digital platforms.

In Q2, we saw a 50% increase in the usage of our banking chatbot across a platform of 20+ financial institutions.

Here are the 6 most interesting trends that emerged from our banking Customer Self-Service platform of 145 financial institutions in Q2 2020.

#1: It turns out that customers’ interactions with chatbots are very similar to human interactions

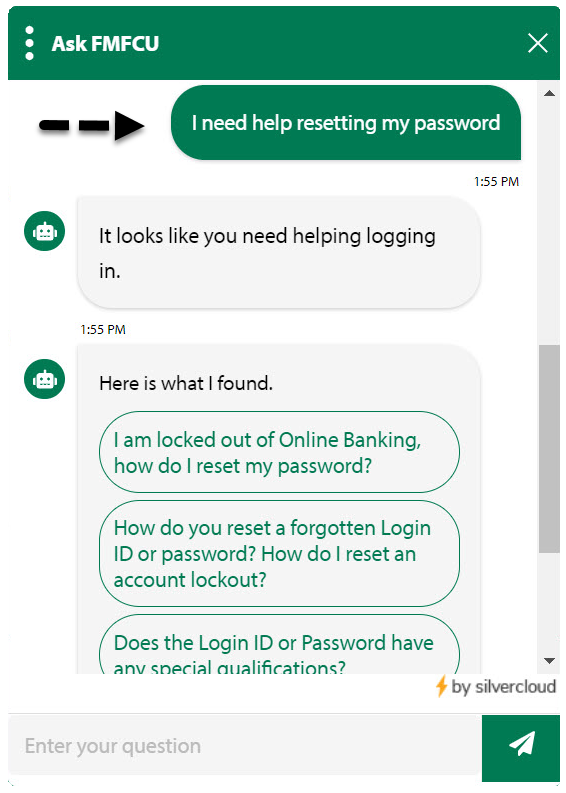

Users typically typed 11.2 words, on average, compared to with 1.4 words typed into a banking website search bar. Despite not needing a live agent to service chats, chatbot interactions are actually conversational. Customers ask questions like “Can I Have My Stimulus Debit Card Balance Deposited to My Account?” or make statements like “I need to change my address.”

#2: Just 13% of chatbot users wanted to speak with a live agent

The Engageware automated banking chatbot uses natural language processing (NLP) and artificial intelligence (AI) to serve up the most likely and most relevant questions and answers banking customers may have. This removes the need for live agents or member service representatives (MSRs) from having to respond to very basic questions. You can, however, offer to connect a user to a live agent within the chatbot. But, when that option is presented, we found that it is very often not necessary.

Imagine if you could deflect 87% of your live chat inquiries to an automated chatbot so your contact center staff can stay focused on high-touch issues?

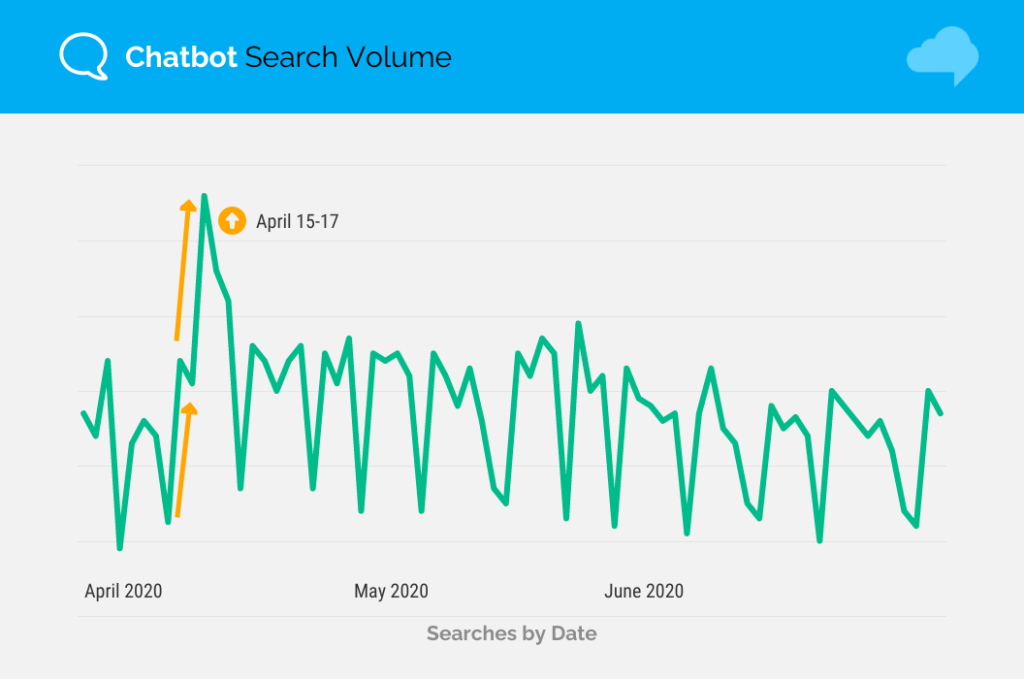

#3: Over the course of Q2, the greatest amount of chatbot activity occurred during the first week stimulus payments were issued, particularly Wednesday, April 15th through Friday, April 17th.

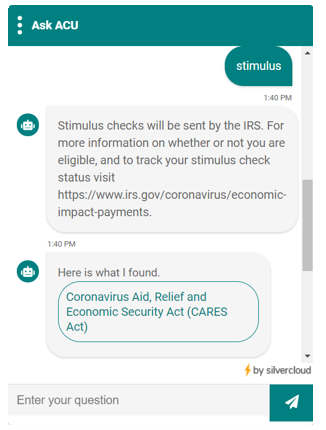

It may or may not come as a surprise – but people had a lot of questions about their stimulus checks. Where was the first place many of them turned? To their financial institution. Some of the most common questions asked included, when and how stimulus checks would be made. Many financial institutions directed customers to the IRS website (the payment issuing authority) and were able to conveniently do so via a chatbot, like the message below.

Are you prepared to handle the questions members and customers will have the next time a stimulus or other financial aid package arrives?

#4: Chatbot usage was usually highest at the beginning and end of the work week (Mondays and Fridays). Chatbot activity was slower during the weekends.

#5: Half of chatbot users utilized Guided Conversations (aka “decision trees”) – a series of predefined questions and answers they click through to get to a desired outcome.

#6: Nearly 60% of chatbot activity in Q2 had to do with financial service offerings (ex. Loans, insurance, credit cards).

Engageware offers each institution three separate bot configurations. The “services bot” is typically catered towards product and service information. The “support bot” caters to the most common technical support topics and questions. And a “mobile bot” caters to the questions and topics that are most pertinent /likely sought after to mobile banking users.

Engageware Customer Self-Service delivers 24/7 automated digital support, service, and sales to millions of banking consumers across 145 financial institutions in the U.S. and Canada.

Learn more about how to launch superior customer and member experience on your bank or credit union’s digital channels.

Related Articles: