A common issue afflicting many banks and credit unions is knowledge management. Policies, procedures and employee guides are hard to find, follow, and use — and even harder to manage.

The situation has become exacerbated with many banking employees working remotely amid the Coronavirus crisis, and therefore no longer as easy to rely on asking for help from a nearby coworker or subject matter expert.

But even in “normal times,” we consistently hear variations of these same things day in and day out from our community of bank and credit union employees:

As banking continues to grow more complex, the need to effectively manage your policies and procedures will only continue to remain a thorn in the side of most institutions.

While truly fixing this issue requires more than just technology (check out The Ultimate Guide to Fixing Your Policies and Procedures for more on that), technology remains a key component in the overall solution.

We outlined the five key components that should be considered when evaluating knowledge management solutions (maybe you call them intranets, procedure management, knowledge bases, document management or something else) for your institution.

1. Web-based Content

While web-based may seem obvious, the key component to this is ensuring that your actual knowledge (content items like procedures, policies, product information, guides, etc.) is also removed from documents (PDFs, and work document files) and broken down into web-based content items.

The challenge with loading documents onto a file server is one of the root cause issues and one that a well designed web-based solution easily fixes for four of the top challenges:

Searchability

Allowing your employees to easily find what they are looking for

- While most document management and intranet solutions allow for basic search functionality like keywords, the biggest flaw is that most don’t allow the search results to search the content contained in the document, or take the user to that specific step or section of the document.

- Web-based knowledge items are broken down into unique content items that allow for better searching at the step level.

Usability

Making knowledge easy to use and follow

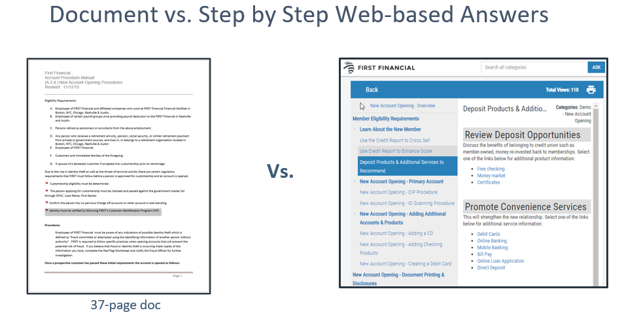

- Making information easy to find is only half the battle. You have to make it easy to use for your team. As an employee, which would you rather use: a 37-page PDF or a cleanly designed navigation system that breaks down all of the steps and substeps with clearly labeled titles and easy to navigate next steps?

Version Control

Enabling your team to make updates in real-time (versus simply uploading the next version of a document)

- One of the top challenges we hear is that there are multiple versions and only one is correct. Inconsistent file names make it virtually impossible to know which version to use (and which version to remove).

- With web-based content items, simple updates can be made within the content item and easily saved, ensuring one version of the truth.

Audit History

Ensuring that all changes are tracked and stored in one solution

- In a heavily regulated industry like banking, audit histories are critical. Document management and intranets capture information around when documents change, but what your auditors and compliance teams need to know is exactly what changed and when. Web-based knowledge management solutions allow for detailed version histories that outline exactly that.

Side Note: There will always be exceptions to this rule and PDFs, documents will be required for some instances (i.e. forms that require signatures), but the bulk of your content can and should be web-based.

2. Content Loading & Structuring

The average mid-sized bank or credit union has over 3,000 unique steps related to their policies, procedures, product information and guides. That is a LOT of content that needs to be loaded into a web-based knowledge management system (see above), especially when broken down into logical, web-based steps (aka removed from PDFs and DOCs).

When considering knowledge management software solutions for banking, it’s critical to ask the following questions:

- Who will be responsible for loading all of the content? Is that an extra cost (in addition to the annual contract)? Are there limits to the quantity or is it a variable cost per document?

- When the content is loaded, is it loaded as is (aka copy paste from documents) or is it optimized and structured following best practices for not only making the ongoing management easier, but also for your team with:

- Intuitive titles

- Search-optimized keywords

- Categorization

- Who is responsible for ongoing updates? Not just the day-to-day but big changes (like core changes, new technologies, new processes)? Is that part of the annual contract or handled separately each time?

3. Analytics & Reporting

Unfortunately managing your policies and procedures is not “set-it-and-forget-it,” and chances are that your knowledge management system won’t be perfect from day one. That is where analytics and reporting really come in handy.

It gives you the visibility to understand:

- The overall knowledge base usage

- What content items are being used the most and the least

- What content items are not being used

- What content items have feedback from your team

- What needs to be reviewed and/or approved

- When the last time a certain content item was updated or reviewed

The list goes on and one, but analytics and reporting give you the visibility to truly understand what is happening and where attention is needed to improve your content and its usability.

4. Ongoing Support & Customer Success Optimization

We often say that technology alone won’t solve financial institutions’ inherent problems with policy and procedure management. What will solve it is a combination of technology, content optimization, and success-oriented customer support.

A knowledge management software or solution will only be as good at the content inside of it (hence why #2 is so important) and 100% employee engagement. When looking for a knowledge management solution provider for banks and credit unions, be sure to consider one that provides ongoing support well beyond the implementation phase.

What to look for:

- Proven implementation process

- Onboarding strategy and employee adoption tactics

- Dedicated Customer Success Manager

- Regular check-ins (be it weekly, monthly or quarterly)

- Ongoing recommendations from the provider on how to continue optimizing the solution

- Insights reporting

5. Banking Expertise & Know-How

In addition to being heavily regulated, banking is also a unique industry. From the terminology (check out our Ultimate Guide to Banking Acronyms to get a taste of what we mean), to the processes, to the operations and services. Banking is also a close-knit industry, with many associations, organizations, and annual conferences that lend themselves to the highly beneficial sharing of industry info and insights.

The challenge with solutions that serve many industries is that they lack the laser-focus on one particular vertical. This one-size-fits-all approach does not bode well for an industry as niche and regulated as banking.

When comparing knowledge management software solutions and vendors for your financial institution, check to see if they provide the specific features banks and credit unions need most, like:

- Review dates

- Workflow approval

- User Feedback

- Scheduling and Expiration of Content – For example, the ability to make things like promotions / dated changes publish and unpublished according to pre-set scheduling.

- Guided Conversations (or decision trees with the built in If / Then Logic)

Selecting a knowledge management software or solution for your financial institution doesn’t have to be laborious and drawn out. If you keep in mind these 5 key features, you’ll be on your way to finding the perfect match sooner rather than later.

Ready to resolve your knowledge management issues?

Learn more about Engageware’s Employee Knowledge Management solution.

Related Articles:

- The Ultimate Guide to Fixing Your Policies & Procedures

- Choosing the Right Knowledge Base for Your Bank or Credit Union

- 4 Things to Consider When Searching for an Employee Intranet for Your Bank or Credit Union

- How To Fix Your Bank’s Intranet and Boost Productivity

- 3 Reasons Your Bank’s SharePoint is Failing Your Frontline Staff