As credit unions continue to adapt their operations to the COVID-19 pandemic and re-openings, the demand for appointments continues to climb as members look for different ways to interact with their financial institution.

In January 2021, credit unions using Engageware online appointment scheduling saw a 166% increase in the number of appointments scheduled per branch, compared to January 2020. This growth is indicative of increasing demand for a deeper level of engagement between financial consumers and their credit union — a level which has sustained 9+ months following the first wave of coronavirus shutdowns.

As members continue to look to schedule appointments with their credit union, there are several ways credit unions can adapt to meet the demand and expectations around appointments.

By utilizing an intelligent online appointment scheduler, credit unions can connect with members in-person, via phone, or virtually. Engageware offers integrations with the top web conference providers, including Vidyo, Zoom, WebEx, GoToMeeting, POP I/O, Join.me, Google Hangouts, Invo Video Banking and Microsoft Teams, allowing both members and employees to connect in ways convenient to both parties.

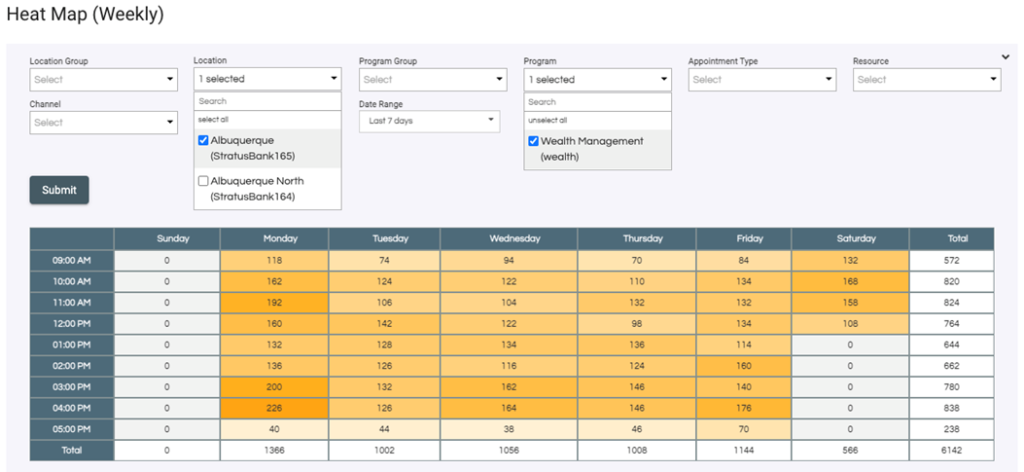

Utilizing Engageware Analytics, credit unions can optimize branch operations and staffing based on the most requested appointment days and times. Managers can drill down into specific departments and branches to understand how demand for appointments can change depending on the location and topic.

For example, a branch near a university campus may see greater demand for student loan account openings, versus a branch in the suburbs that more frequently sees requests for auto loan or home mortgage appointments.

With the sustained increase in demand for pre-scheduled appointments, credit unions can ensure employees are prepared for their upcoming member engagement right from their calendar. With appointment scheduling, credit union employees have a better understanding of the member or prospective member, as well as the reason(s) for their appointment. The employee can pull relevant information, paperwork, or documentation to maximize the member’s appointment time. Having this information ahead of time has been shown to result in increases in customer satisfaction and NPS.

Given the opportunity to schedule an appointment, members or prospective members will take it. This presents a new level of engagement for credit unions and opportunities to expand business with them – be it with new accounts, more deposits, or greater digital adoption.

How are you optimizing your business to align with the demand for appointments from your members?

To learn more about how to capture and respond to the increasing demand for credit union appointments, schedule a meeting with us today.