The Problem with Banking Policies and Procedures

Regardless of whether you call the problem a procedure management, policy management, knowledge management, knowledge base, or intranet problem, Banks and Credit Unions all struggle with the same issue. Your policy, procedure and product Information is typically stored as docs or PDFs. Its nearly impossible for your frontline staff to find or follow basic information as they dig from one doc to another and then navigate 25+ pages. It’s impossible to manage as your staff are saving information in email, print outs, and different locations. Because of this, you have siloed information, multiple versions, and little visibility into what staff are using, what’s working and what’s not working.

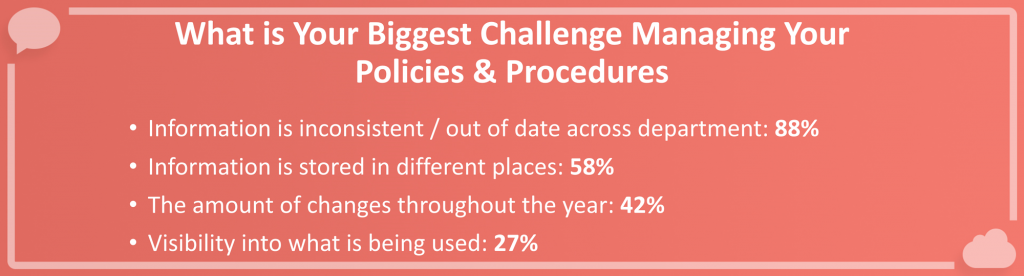

There are lots of solutions on the market that claim to solve this problem – SharePoint, document management, policy management, knowledge management, intranets to name a few. But when we ran a survey of hundreds of your peers asking them the top challenges with managing your policies and procedures, the answers all point to a bigger issue:

The Impact

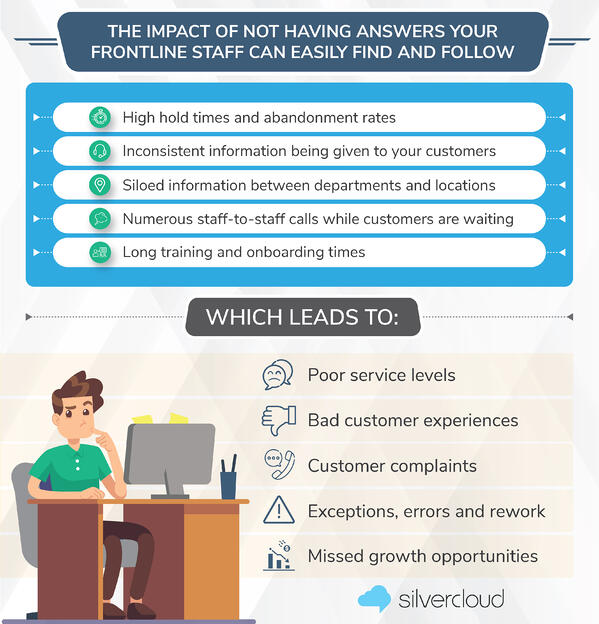

Many don’t fully understand the impact hard to find, follow, and manage policies and procedures have on your institution and its ability to deliver a better customer experience, grow and become more efficient. Truthfully, many banking executives don’t even realize that it’s a problem or that it can even be solved.

What impact do you think your institution would have if you were able to help improve poor service levels, reduce the number of bad customer experiences, customer complaints, exceptions, errors, and missed growth opportunities? The good news for you – we are going to show you how you can become the hero of your institution by outlining the exact steps you need to finally fix your policies and procedures.

The Solution for Fixing Banking Policies and Procedures

Fixing your policies and procedures and the top 4 challenges listed above requires an approach that ensures you create a single source of truth that is utilized across your institution and recognizes that fixing this problem requires a consistent approach that involves content, process and the right technology.

What It Takes to Fix Your Policies and Procedures

Content

Optimizing your content to be easily found, followed and used. It means establishing consistency and following best practices like keyword and title optimization and establishing proper formatting conventions. It’s breaking complicated documents into easy-to-follow steps that provide the right prompts to guide them to the logical next step.

Process

Providing the ability to make it easy to manage your content across the multiple silos within your institution. It’s a process that ensures information is always up to date as well as visibility into what is being used, what isn’t and what needs your attention.

Technology

Banking-specific technology that meets the needs of bankers. This means security, version control, audit history, reporting, review dates, notifications and much more.

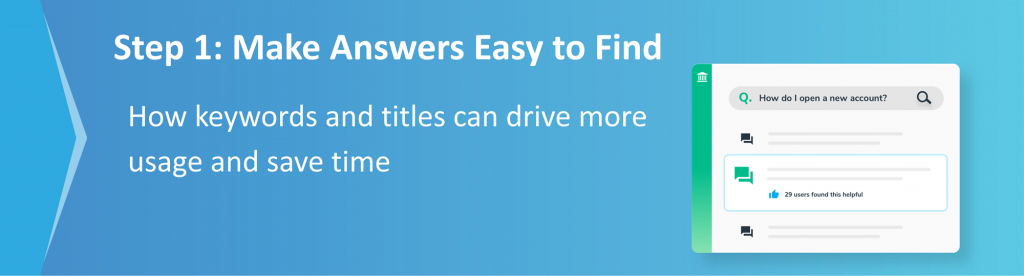

1. Make Answers Easy to Find

One of the top challenges for your frontline staff is giving them the ability to easily find the information that they are looking for. This is not just about making the answers easy for your search engine to find, it’s also providing clear and obvious titles so they know what to click on.

Best Practices and Key Takeaways:

- Keywords: Keywords are a great way to tell your search engine what the content is about. In our review of over 2 million employee searches, we found that the use of a single keyword doubles the number of views a content item gets. Our data also shows that the optimal number of keywords is between 8 and 9 per content item. And this makes sense; how one employee searches is going to be slightly different from another. One may search for “open account”, and another might search for “business checking” and yet another might search for “account opening”. Having 8 to 9 keywords per content item allows you to cover all of those unique queries and returns the best results for your frontline staff

- Titles: Titles are important for search, but what they really help with is usability for your staff. Good, descriptive titles provide your frontline staff with enough context so they know exactly which content item to click on. When we work with banks and credit unions, we see titles as one of the biggest obstacles to how they are managing content today. There are no title conventions as different departments and subject matter experts each use different labeling / title conventions. Think about the impact on your frontline staff when they see titles like “Account_HelpDoc_2020” or “Account_PlacementOps_2020”. Instead – use intuitive, user friendly titles that clearly describe what it is – “Personal New Account Opening Procedure” or “Business Account Overview Start Here”. Our research shows that the optimal title should be between 5 and 7 words. That is just enough to be descriptive without being overly complicated or too vague.

“Before, the branch hot phone would ring, and we would end up answering the same question 20 times. And now, if they call, the first thing out of their mouth is ‘I’ve looked and I couldn’t find what I needed, this is why I’m calling’. We’re now dealing with the unicorns that we should be dealing with, rather than the common questions that they can find through the system.”

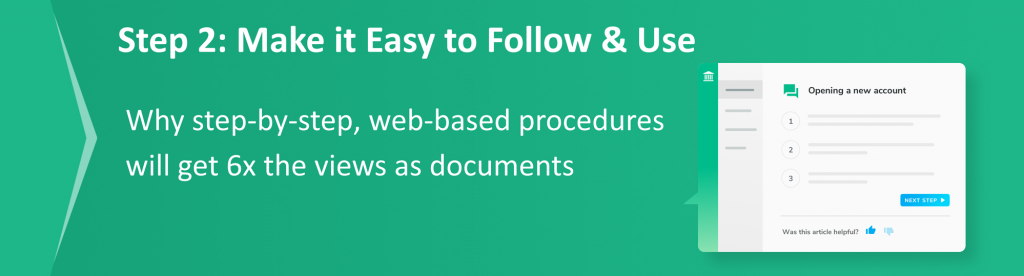

2. Make it Easy to Follow & Use

With proper use of keywords and titles, your frontline staff will be able to easily find answers, but now you have to make it easy for them to follow. Time and time again we see 30 to 50 page documents that are chalk full of great content, but are very hard for your staff to follow. Typically, it’s hard to clearly see where one step stops and the next one starts. It’s also hard to be able to easily know, based on the situation, are they supposed to skip to page 14 or start on page 1 and go page by page. The best solution is to break down long, complicated documents into web-based step-by-step procedures.

Best Practices and Key Takeaways:

- Step by Step Procedures: In our research, we have found that by breaking down long, complicated documents into step-by-step procedures, increases the likelihood of being used by 6x. And it also empowers your frontline staff to be having the right conversations – aka cross-sell and better usage of all of your services (mobile banking, bill pay, direct deposit, debit cards etc). So instead of just giving that 37 page document that is hard to follow, break down the process into steps that are easy to follow as well as allow them to jump to the specific step they need. Here is a high-level example for “Open New Account” with each of the different sections broken down with good, descriptive titles:

- Learn About the Member

- Use the Credit Report to Cross Sell

- Use Credit Report to Enhance Score

- Deposit Products & Additional Services to Recommend

- Opening a New Primary Account

- CIP for New Primary Accounts

- ID Scanning Procedure

- Adding Additional Accounts & Products to New Accounts

- Adding a CD to a New Account

- Adding Checking Product to a New Account

- Creating a New Debit Card

- Document Printing & Disclosures

- Applying Electronically for a New Account

- You May Also Need

- Learn About the Member

“Staff no longer have to research multiple platforms, nor call various departments to get the answers they need. This also improves our member experience. The faster the frontline is able to access a resource that will help them assist the member, the faster and smoother than transaction will be for the member.”

3. Make it Easy to Manage

Your policies and procedures are a constantly evolving and improving “process”. While the information might not be changing, they need to be consistently evaluated to ensure they are meeting the needs of your staff. While information might be “technically correct”, analytics and feedback tools from your staff can help you identify the gaps you have, what information needs improvement or clarification (aka outdated screenshot or unclear step) as well as where you focus your time and attention.

Best Practices and Key Takeaways:

- Analytics: Our data shows us that 20% of your content will generate 80% of the views. These are the content items that you want to focus on first. Yet, without analytics to understand what content items are those 20%, how do you know where to start. Most knowledge management tools today provide basic analytics and scheduling time to review these consistently is important. Our data also shows that on average, 23% of all policies and procedures aren’t ever used. The challenge is understanding why? Are they not relevant to the frontline staff, or are they just not optimized to be found?

- Feedback: Empower your frontline staff with basic feedback tools and processes that enable them to provide insights into your policies and procedures. These can be basic “was this helpful Yes / No” features or internal processes that allow your frontline staff the ability to submit their feedback on specific steps or procedures. Think about how much better your policies and procedures could be if you had a centralized process for receiving real-time feedback from your staff. This would allow you to know which policies and procedures were clear, which needed updates or clarity or which were generating the most questions.

- Links: One of the easiest ways to help you manage your policies and procedures as well as help your frontline staff is using embedded links within your policies and procedures. One of the top challenges is having multiple versions of a policy or procedure and then within one step, referencing a second policy or procedure (for instance within the open new account procedure, referencing eligibility requirements or the ID scanning process). Most likely, you only want to have one version or process for those. However, if they aren’t separated out, you will most likely have multiple versions. Even if they are separated out, what is the likelihood that a frontline staff member will stop, search for that policy and easily find the right one? That is why links are so helpful. It allows you to have one version and makes it really easy for your frontline staff to use it as they are going through different procedures.

“We had a lot of old procedures stored on SharePoint and no way to control how many versions were on there or when they were last updated. Branch staff would always come to me asking questions about procedures because they weren’t able to locate it on SharePoint, and if they did – it may have been an outdated version. Now, they can navigate the platform on their own and find what they need, and we’re able to keep procedures up to date.”

4. Create One Version of the Truth

One of the top challenges we hear from your peers is “Multiple versions of the truth” – there are old versions live, there is a lack of version control across departments and subject matter experts, so your employees fall back on what is easiest – asking their co-workers or managers. And the solution to fixing that is creating not only a single version of the truth, but a centralized process that brings all of your information into one, consistent tool that includes:

- Procedures

- Policies

- Product Information

- Rate Sheets

- Links to other tools / resources they need

- Links to and between all of the above

Best Practices and Key Takeaways:

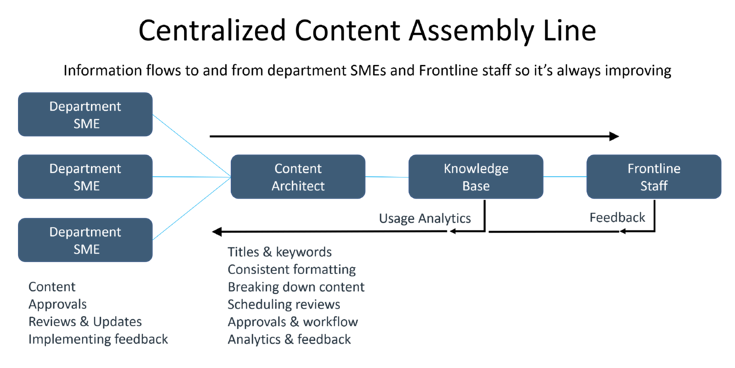

You are probably thinking my institution already has a centralized knowledge base or intranet that houses this information and it’s still creating confusion for our frontline staff and my back office staff trying to manage it. The reason – creating a single version of the truth requires more than just technology – it requires a centralized content assembly line approach:

Centralized Content Assembly Line Approach

With the centralized content assembly line approach, you still leverage your department subject matter experts to develop the content. But they are no longer responsible for loading these onto your knowledgebase. The content architect is now responsible for the tasks that ensure consistency, usability and accuracy:

- Ensuring keywords are being used

- Following best practices for titling, formatting and linking

- Breaking down complicated documents into step-by-step procedures

- Removing old versions (or better yet, updating old versions and having the audit history keep track of version control)

- Working with the SMEs for accuracy, reviews, approvals

- Looking at analytics and frontline staff feedback

But one of the biggest differences is providing your frontline staff the ability to provide real-time feedback. Basic features like “Was this answer helpful”? If no, tell us why. Also providing tools that allow them to give more robust feedback (I wasn’t able to find the answer to this question), provide insights into what is missing or possibly even not optimized to be found. Usage analytics also give great insights into what is being used more frequently and what isn’t while allowing you to dig deeper into what is actually happening.

“Following this model has been huge for our bank. Our end users have embraced it and are really helpful in providing the feedback to improve our knowledgebase. The more that they know we’re looking to help them, the more they are willing to use it. Our content owners have also really embraced it as they are now able to see first-hand feedback from the end users. They have a completely different perspective on usage, usability of their content and how they can make it better for the end users. It has created a whole new mind set within our bank.”

View all 4 Ways to Make Your Policies & Procedures Easy to Find, Follow, and Manage Slideshow:

Resources

What To Do Next

Ready to fix your policies and procedures, but not sure where to start?

Wee have plenty of resources that give you the information needed to finally fix your policies and procedures.

Check out these resources that outline common mistakes, pro-tips, and case studies rom other institutions that have followed these best practices and explain the impact it has had for them.

Case Studies:

- Jefferson Financial FCU Solves Procedure Management Challenge with Engageware’s Employee Knowledge Management

Learn how Jefferson Financial FCU transitioned from SharePoint to Engageware’s Employee Knowledge Management to achieve optimal procedure management for its frontline in 60 days. - How Sharonview Federal Credit Union Reduced Exceptions & Increased Employee Accountability

Before Sharonview Federal Credit Union, a $1.4 billion institution headquartered in South Carolina, fixed their policies and procedures, the number one employee complaint was the inability to quickly find policy, procedure, and product information. - Institution for Savings Utilizes Engageware’s Employee Knowledge Management to Improve Training Procedures and Enhance Internal Efficiencies

As one of the oldest mutual banks in the country, Institution for Savings was in search of a way to improve internal efficiencies, bank training procedures and easily update vital documents.

Articles:

- 10 Proven Tips on Writing and Managing Bank & Credit Union Policies and Procedures

The policy and procedure manual is often the lifeblood of a bank or credit union’s customer service team. Too often, however, this manual is written in a way that makes it difficult to find or overly complicated for front-line staff to adequately leverage. These 10 tips can help you write policies and procedures so that they are as useful as possible to the people who need them most, your front-line customer or member service team. - 4 Ways A Centralized Knowledge Base Will Improve Your Employee Training Program

A centralized knowledge base is at the heart of successful employee training. In this post, we outline 4 ways it can transform how your financial institution trains, retains, and ramps up frontline employees for success – so you can spend less time on re-training, and more time on coaching and development. - Choosing the Right Knowledge Base for Your Bank or Credit Union

There comes a point in time when every bank or credit union searches for a solution to serve as a central repository for information. Often times this begins with a search for knowledge bases. As important an endeavor as this is, we’ve put together this blog post to help you mitigate your search, and a few banking-critical things to think about where a traditional knowledge base solutions provider may fall short.

Talk:

We have helped over 200 banks and credit unions fix their policies and procedures and would be happy to walk you through our approach, outline best practices we’ve seen other financial institutions follow and share learnings on the steps to fixing your policies and procedures. Speak to an Expert