From account opening to check deposit to loan application — it’s now entirely possible to do 100% of banking at a financial institution without ever seeing a human face-to-face.

And demand for digital banking is only growing, with more customers choosing some combination of mobile, online, telephone, and video banking — and skipping the trip to the branch. Accelerated by the pandemic, credit unions and banks have quickly expanded their digital offerings to meet consumer demand.

But is this rush to digital banking leaving some customers behind?

While most financial institutions see the benefits of digital transformation, they are also wary of weakening the relationships they’ve worked so hard to build. After all, many people choose local banks and credit unions specifically for their more human touch and prefer to bank where they can build relationships and trust. A lack of awareness and a general reluctance to adopt technology can sometimes cause customers/members to slow their adoption of digital tools.

As your financial institution invests in increasing its digital footprint, are you bringing your customer base along on that journey? How can you encourage customers to adopt digital channels — while still meeting their needs for relationship banking?

The answer lies in how seamlessly you integrate your digital infrastructure with humans — and vice versa.

The pros and cons of leaning in on digital banking

In many ways, the leap to digital has been perfectly well-timed. With hiring still at a premium and AI technology making significant advances, banks and credit unions can use digital tools to reduce operating costs and increase staff productivity. By moving routine tasks, transactions, and inquiries to automated channels, banks can divert their human staffers to more complex, high-value transactions.

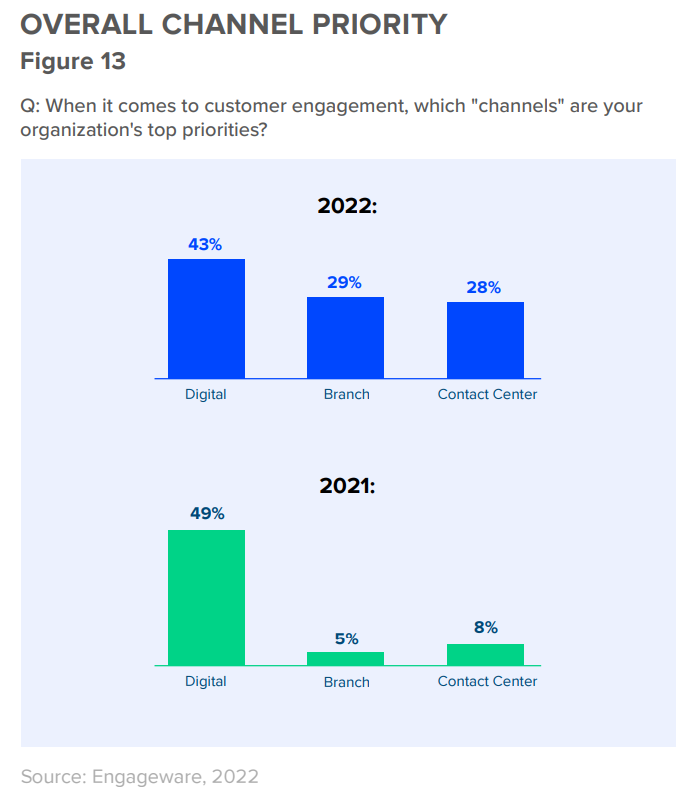

According to our ENGAGE 2023: Customer Engagement in Banking Annual Trends Report, conducted in August 2022, driving digital adoption is top of mind for financial institutions — with 43% of all FI’s saying digital is their top priority in 2023.

This includes a broad variety of virtual banking and customer service technologies, including:

- Virtual assistants

- Online banking

- ATMs and ITMs

- Lobby Management Solutions

- Chatbots

- Phonebots/IVR

- Video Chat

- Appointment Scheduling

The benefits of omnichannel banking for banks and credit unions are already clear. At a minimum, digital capabilities are table stakes for small-to-midsize banks and credit unions who want to remain competitive with the big banks. FIs that embrace digital transformation and offer innovative digital solutions are more likely to attract and retain customers — particularly of younger generations. Additionally, digital banking offers:

- Increased efficiency

By automating routine transactions, such as balance checks, transfers, and even loan applications, FIs can improve efficiency and reduce errors. This helps save time and money and gives your human agents and branch staffers more time to provide personalized service to customers/members. - Improved customer experience

Advances in AI and 24/7 customer service platforms means digital can offer an even more personalized and engaging experience for customers. Online banking and mobile apps allow instant access to accounts and facilitate transactions at any time, from anywhere.

Conversational AI chat can provide immediate assistance and help customers with common questions and concerns, freeing up staff to focus on more complex issues. Appointment scheduling can help customers book meetings with branch representatives at their convenience. - Improved data analytics

Digital transformation also allows banks and credit unions to collect more data about their customers and their behavior — and tailor products better over time. This data can also be used to offer personalized recommendations and improve marketing efforts.

Of course, there are also challenges wherever technology meets humans. Digital transformation can be a big investment, especially for smaller credit unions or those with legacy systems that were built before the era of digital banking. It is important that digital technology be properly balanced with human customer service and calibrated to customers/members needs to ensure that investment is paying off.

This last part is especially important, as some customers may be hesitant to adopt new technology, especially older or less tech-savvy customers. Financial institutions need to ensure that they provide adequate support and training to help customers navigate new digital solutions.

How FI’s can drive digital adoption to boost engagement, productivity

and growth

Download eBook Challenges of digital adoption

While mobile banking has taken hold for many, many customers are not yet ready to make the leap across the board. 53% of financial institutions surveyed for our ENGAGE 2023 report cite ‘improving adoption of digital tools’ as a top digital priority for 2023. Newer technologies in particular, like video banking and virtual chat, are still less familiar (or mainstream) and have lower adoption rates.

Q: How often do you interact with your primary bank/credit union using the channels listed?

According to the 2021 Citizens Bank Banking Experience Survey, though “69% of consumers prefer banking online some or all of the time and 64% agree that technology will completely change banking as they know it, a similar number (65%) agree that they prefer human expertise when receiving financial advice.”

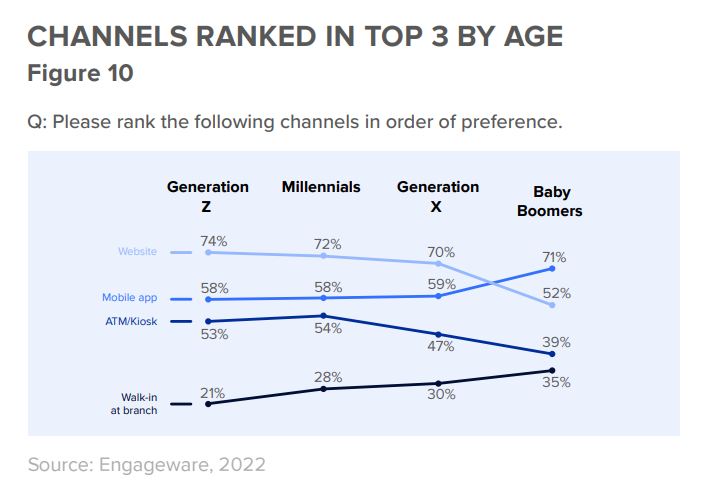

There is something of a generational divide at work here as well. Older customers/members, who grew up in an age of passbooks, are more likely to walk into a branch, and are more comfortable with visiting a website than banking by smartphone app.

Naturally, channel preferences will continue to differ among different demographics. In reality, it’s not always clear to consumers which channels should be used for which things. As banks and credit unions progress into later phases of digital transformation, they must bring their customers and customers/members along with them — educating them and easing change.

The secret to increasing adoption is threefold; it requires:

- Finding and maintaining the right balance of digital and human assistance

- Providing continuous education and support to onboard/assist with the usage of digital tools

- Providing ample training and resources for frontline staff to enable them to be digital advocates

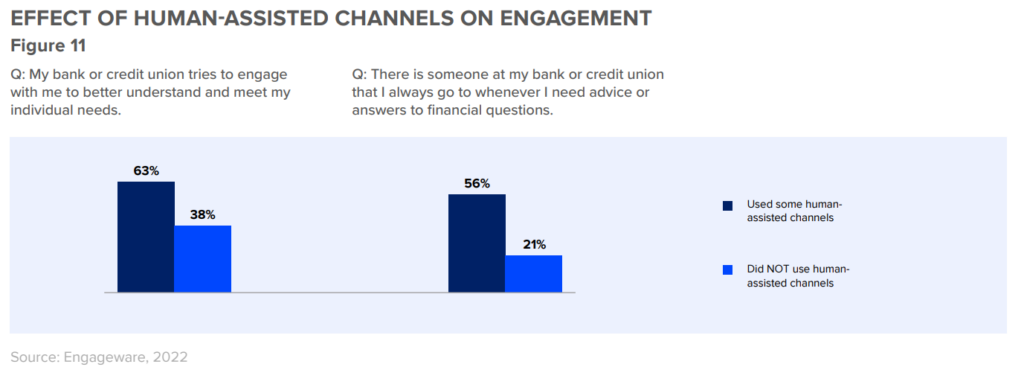

Ultimately, a mix of human and digital channels will be important to delivering high-quality relationship banking. Our ENGAGE 2023 research has found that customers who use human-assisted channels in addition to digital channels are much more likely to agree that their bank or credit union tries to engage with them to better understand and meet their needs. They were also much more likely to say there is someone at their bank or credit union that they always go to whenever they need advice or answers to financial questions.

5 tips for increasing digital adoption without losing the human touch

Here are five tips for banks and credit unions who are looking to ramp up adoption of digital channels and still keep banking customer engagement high.

What is Customer Engagement?

1. Meet customers/members where they prefer to bank

Letting customers/members self-select their channels based on their transaction type and personal preferences will increase customer engagement. Provide clear education for customers/members on the best use of channels, but give them more choices around where they prefer to connect.

Corporate America Family Credit Union uses Engageware’s Customer Self-Service solution to empower members while reducing hold times and member frustrations.

2. Ensure maximum consistency across channels

It’s critical that customers get the same answers and service levels no matter which channels they choose. Ensure that you are adequately supporting all your banking channels in a consistent way ‚ whether human or digital. Make sure each channel is fully aligned with your brand and pulls accurate information from one single source of truth. This will create a more consistent customer experience and improve trust.

3. Make every channel a path to an answer

More seamless handoffs among channels can increase comfort levels and uptake for digital solutions. Instead of specializing or isolating channels, make them work together and use tools as gateways to humans. Aim for seamless transitions that can lead to a single-call resolution.

4. Using digital enablement to strengthen your human customer service

Customers don’t even need to use digital channels for them to reap the benefits of your digital infrastructure. A strong centralized knowledge base informs your automated attendants, but it also increases the confidence and efficiency of front-line staff. Digital solutions can likewise assist with staff training and provide digital data and analytics to improve and personalize products.

5. Use staff as ambassadors for digital tools

In addition to using digital tools as gateways to humans, you can also use humans as gateways to your digital tools. Branch staff can help to acclimate customers/members to tools by introducing them during live or in-person conversations. Using tools such as kiosks, appointment scheduling, and lobby management in branches can further bridge the gap between the human and digital channels in your bank or credit union.

Looking for more information on how banks and credit unions are improving digital adoption? Download a complimentary copy of our eBook Empowering Customers to Adopt Digital Tools.

Related Resources: