We live in an on-demand, self-service world. Consumer expectations have changed as our brains have been rewired. We demand the ability to consume content, binge-watch media, browse catalogs with the scroll of a thumb, shop with two-day delivery, catch a ride on the fly, and multitask while speaking commands to a home speaker system with built in digital assistant.

We want simple answers to simple questions, discoverable on our own, and on our own time. Whenever, wherever – as long as it’s quick and easy. We’ve been trained by companies of the likes of Netflix and Amazon to demand this of more and more aspects of our lives. Banking is no exception.

The Changing Nature of Banking

Like consumer expectations, banking has also changed, and continues to evolve. We have gone from having real face-to-face conversations with tellers in person at the local branch, to calling into a call center, to mobile banking, to chatting online with a chatbot.

With the advent of digital transformation, the art of conversations in banking has gradually become more and more diluted as banking becomes more transactional, and less conversational. There are fewer opportunities to have a true conversation with a financial institution, whether it be in person or online. But that’s not to say that consumers no longer want to have meaningful conversations. They just need to be delivered in a different manner.

What’s “Conversation” Got To Do With It? — Delivering the experience your consumers want and need.

When the conversation is lost, financial institutions – particularly small and mid-tier banks – are at a disadvantage as it removes their number one asset from the equation — their employees and customer service. Financial institutions miss out on the opportunity to engage more deeply with their consumers and create relationships that result in more products per consumer. With less conversation, there is less partnership, less trust, and a lesser likelihood to become the primary institution of choice.

Furthermore, the more technology is introduced into banking, the more questions it presents from consumers. Questions like, “How do I reset my password?”, “How do I enroll in online bill pay?”, “How do I transfer funds?”, etc.

Companies like Amazon, Netflix, Google, and Uber have trained us to demand answers to these types of questions on our own terms, in the moment, on our own devices. This in essence, is self-service, and consumers are demanding that from their banking institutions, just as much as they are from their ecommerce, entertainment, and transportation solutions.

According to a study conducted by ZenDesk, 67% of respondents prefer self-service over speaking to a company representative. The reality is that the majority of banking interactions are occurring in digital channels today. According to an ABA survey, two-thirds of Americans use digital banking channels most often. The real conversations here may be limited, but that does not mean that they are dead. At the crossroads of self-service and digital, there lies a massive opportunity for real conversations to occur through the presence of meaningful content.

67% of respondents prefer self-service over speaking to a company representative.

So, what can credit unions and banks learn from a company that excels in enabling self-service via it’s digital channel with meaningful content? We did a case study on Netflix to illustrate just that.

What Bankers Can Learn from Netflix

Netflix — the beacon of streaming entertainment central to so many households. It provides great content, portability, mobility, personalized curation, and most importantly — complete self-service.

While the worlds of Netflix and consumer banking may seem further apart than alike, there is quite a bit that credit unions and banks can learn from the media giant when it comes to serving up a stellar self-service experience.

4 Tips for Delivering Self-Service Banking at Your Financial Institution

1. Create a World-Class Support Center with Robust Content

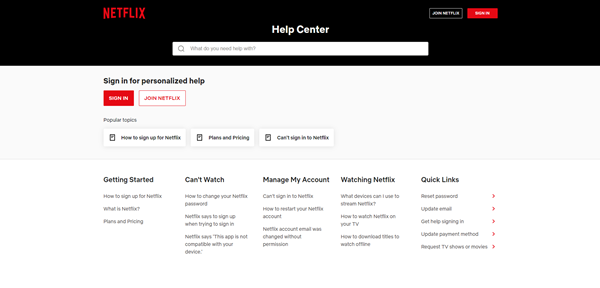

Netflix makes browsing, watching, and asking questions easy. With 139+ million users worldwide in over 190 countries, there are a lot of questions being asked (for example: how do I find a movie?, how do I turn on subtitles? How do I set parental controls?). Netflix isn’t answering all of the questions via a massive call center. They make it easy to self-service consumers’ tier one questions directly within their app via the Help Center.

The Help Center eliminates the need to call a live customer service representative. The content is clear, categorized, and searchable. Consumers can resolve their question or trouble shoot their own way to a fast and easy resolution all with the help of excellent support content.

2. Place Speed Bumps Ahead of Live Support

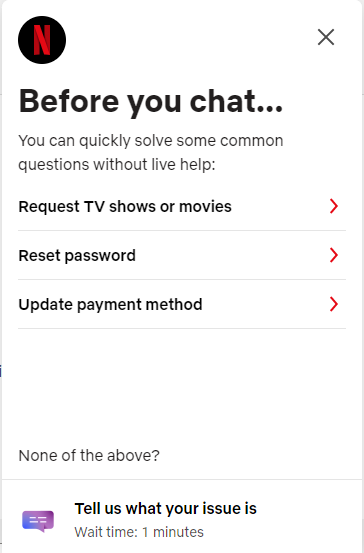

Netflix does offer the opportunity to chat but they put up a speed bump before allowing the consumer to initiate, presenting once again, the most common support questions and answers.

3. Put Support Front and Center, in Front of the Pin

The mistake many financial institutions make is burying support content in hundreds of web pages. To enable the greatest level of self-service, companies like Netflix, Verizon, and Comcast place their Support links right in the main navigation of their digital channels so it’s hard to miss. The option to self-serve is obvious and within reach, no matter what the device.

4. Remove Your Contact Phone Number

It may seem counter-intuitive, but sometimes the best way to provide great customer service is to enable your consumers to self-serve. To help them find their way first to support content, this may mean removing your customer service phone number from plain sight, and pointing instead to FAQs or a Support Center with the most commonly asked questions.

The Importance of Enabling Self-Service in Banking

Other than the obvious reasons (to improve customer experience, reduce call center volume, reduce support costs), enabling self-service with robust content allows you to capture thousands of opportunities to engage more deeply with you customer. Questions aren’t just queries; they are opportunities to capitalize on customers’ intent, and bring them further down the customer journey.

The impact of not having a self-service strategy is far more severe then not answering a few customers’ questions. The impact trickles down to the core of your business — to the quality and level of mobile banking adoption, to NPS, to wallet share and to efficiency ratios. To avoid these costs, the customer experience can be made as frictionless as possible with the addition of great support content on your web and mobile channels.

Self-Service Solutions via Engageware

We’re a company that focuses on customer engagement for credit unions and banks. We enable financial institutions to provide meaningful and helpful content to their consumers and employees in a manner that is easy to find and understand.

For consumers, Customer Self-Service enables them to find answers to questions in a fast and easy way in your digital channels, and guides them along a journey to engage with more products and services.

For employees, Employee Knowledge Management includes breaking down, organizing, and serving up complex banking procedures, policies, and product information in a manner that is easily accessible and understandable so employees can self-serve to find answers to their questions efficiently, to deliver exceptional service to consumers. Schedule a meeting to learn more.

Related Resources You Might Enjoy:

- 9 Stats Pointing To Why Customers Want to Help Themselves

- How To Support Your Banking Customers During the COVID-19 Crisis

- Staley Credit Union Delivers Digital Support to Members’ Fingertips in Less than 30 Days

- Why Every Credit Union and Bank Website Needs a Prominent Search Bar

- 8 Ways to Improve Your Bank or Credit Union’s Customer Service

- How To Support Bank and Credit Union Employees During the COVID-19 Crisis