Maximize Productivity and Sales with Appointment Scheduling

Trusted by Top Wealth Management Firms

Improve Satisfaction, Grow AUM, and Scale with Ease

Harness the power of personalized conversations to elevate sales effectiveness, drive client engagement, and boost advisor productivity with Engageware. Intelligent Appointment Scheduling saves countless hours and helps wealth managers deliver a superior client experience.

-

54%increase in web conversions

-

45minutes saved on administrative tasks each week per representative

-

60%reduction in back and forth email and phone tag

Elevate Your Client Experience with

Intelligent Appointment Scheduling

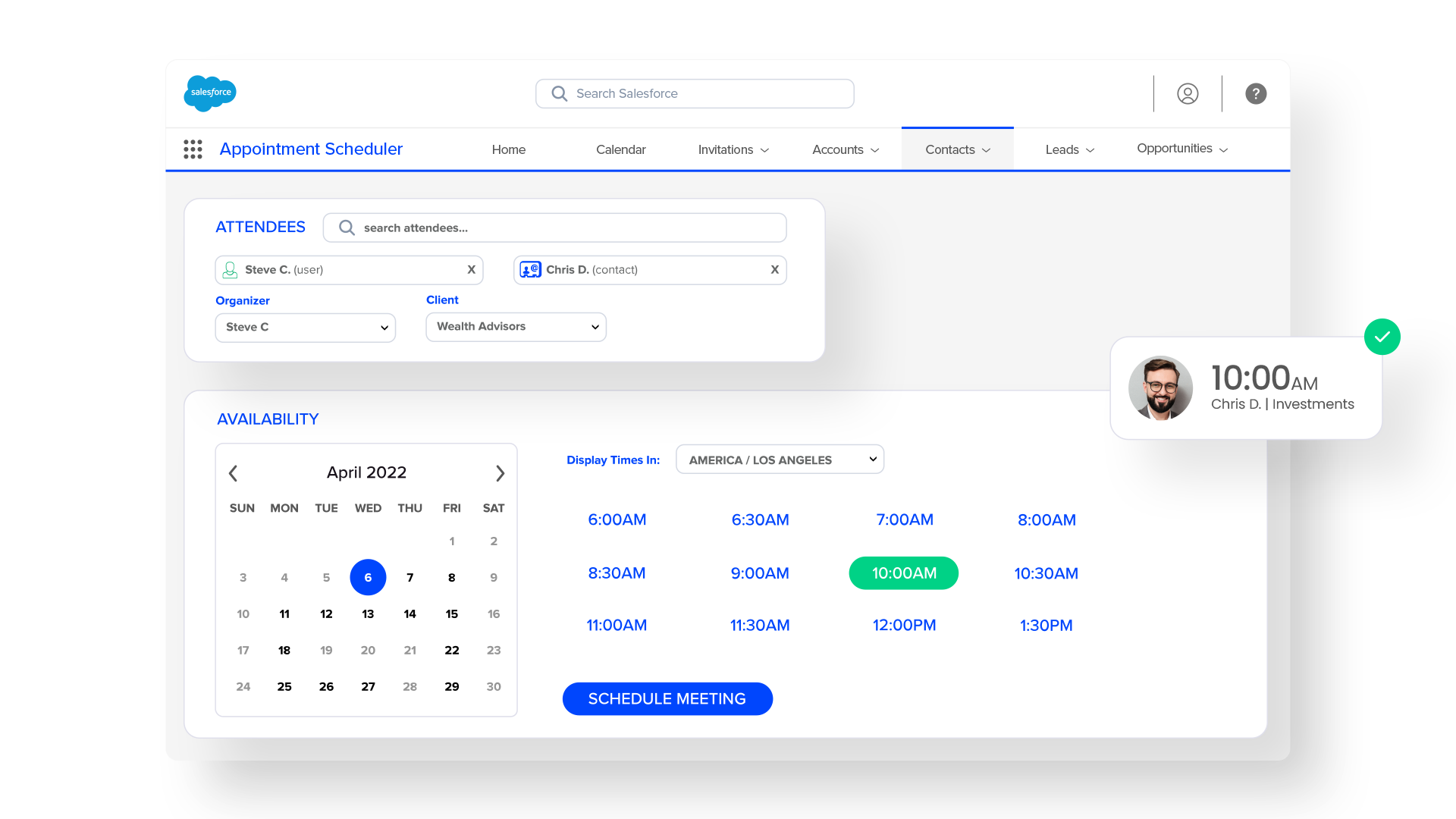

Manage and track appointments right within Salesforce

Engageware’s Scheduler for Salesforce enables advisors and reps to manage their appointments within Salesforce—where they can easily offer and schedule meetings right from a lead, contact, or person account record.

Built-in Process Builder workflows automate appointment scheduling requests based on client stages, such as annual account reviews. Track all appointments offered, scheduled, rescheduled or missed right within Salesforce for easy access and reporting.

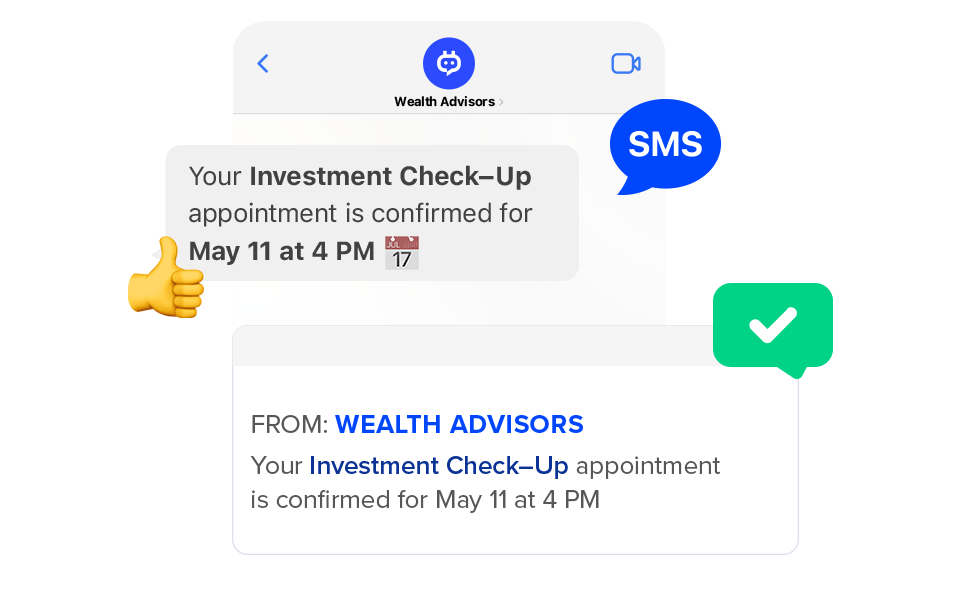

Drive personal meetings with omnichannel engagement

Intelligent Appointment Scheduling enables wealth management firms to convert prospects from every marketing channel—website, email, digital ads, social media, automated phone systems, and text messaging—into personal meetings with the right advisor, broker or fund manager at the right place and time.

Connect with clients easily. Deliver personalized advice, whether in person, over the phone, or virtually. Engageware integrates with popular video conferencing platforms to automatically add virtual meeting details to appointments, ensuring privacy.

Meet with a Group—or 1-on-1

Easily schedule 1-on-1 consultations or group meetings with clients and stakeholders. Available appointment times automatically reflect the availability of all participants on a unified calendar, making it simple to coordinate discussions on investment strategies or financial planning. Every attendee receives confirmation and reminder notifications, with appointments seamlessly added to their Salesforce and personal calendars, ensuring a smooth and professional client experience.

Appointment Scheduling Simplified

Increase client engagement with simplified booking experiences through Scheduler for Salesforce. Custom Booking Pages empowers users to create personalized booking experiences within Salesforce that display all appointment offerings in one place without the assistance of a Salesforce Administrator. The end result is a seamless experience for clients and prospects that allows them to more easily find and select an appointment that best suits their needs whether it is face-to-face, over the phone or using a supported web conferencing provider.

Match clients with the right advisors—every time

Engageware understands why clients are reaching out and which advisors have the right skills to address their needs. Our patented Smart Matching technology routes each client to the advisor or team best qualified to discuss their unique goals—from wealth building and retirement planning to college savings or other financial objectives.

Maximize your appointments while minimizing no-shows

Intelligent Appointment Scheduling can increase meeting bookings by up to 28% while eliminating time wasted chasing clients to schedule appointments. Automated email and SMS reminders greatly reduce no-shows—Engageware customers enjoy up to 90% client show rates for scheduled appointments.

The Trusted Choice for Leading Wealth Management Companies

Engageware is deployed by more than 700 enterprises worldwide, including top wealth management companies in North America. Instantly deployable and proven secure, Engageware meets the unique needs of your organization with a smart blend of robust built-in functionality and extensive customization options.

Cultivate happy clients, attract and grow assets—one conversation at a time.

-

Retirement Plans

Provide a superior customer experience with more meetings, fewer no-shows, and more effective conversations.

-

Brokerage

Elevate client relationships from transactional to conversational and increase customer value, satisfaction, and loyalty.

-

Fund Managers

Build trust and become the go-to resource for institutional buyers and independent advisors by easily sharing your availability.

-

Independent Advisors

Spend more quality time with clients. Improve your “face time to admin time ratio” and build stronger client relationships.