AI isn’t hard to buy. It’s hard to use.

That’s the story we hear over and over from banks and credit unions: adoption stalls not because the tools don’t work, but because employees don’t know how to trust them, and customers won’t tolerate inconsistency. Here’s how leading institutions are moving past pilots and actually making AI part of the branch experience and what we’ve learned at Engageware about making it stick.

1. Start Small, Prove It Fast

AI doesn’t have to mean autonomous everything. Start where risk is low and payoff is high.

Take OnPoint Community Credit Union. With over 1,400 employees, they were drowning in knowledge scattered across portals and PDFs. Employees often couldn’t find what they needed without endless clicks. After adopting Engageware’s Enhanced Search with Generative AI, 75% of queries returned instant, AI-powered answers and 100% of staff surveyed said they found those answers helpful.

That early win created momentum: less time hunting for answers, more time helping members.

2. Keep Humans in the Loop

In financial services, trust is currency. That means AI can’t be a black box.

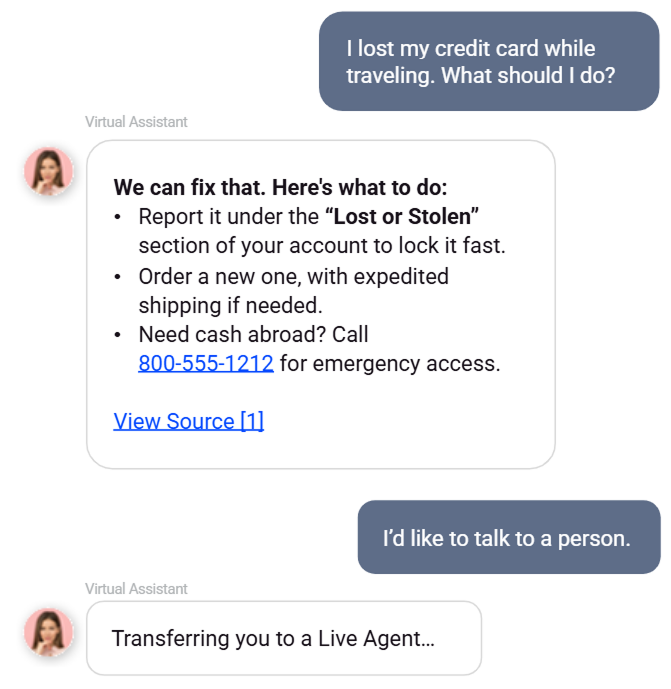

In our June Release Showcase, we demoed what this looks like: a member reports a lost credit card while traveling. Engageware’s Virtual Assistant not only offers the right steps—lock the card, expedite a replacement, provide an emergency cash number—but also includes a “View Source” link that ties directly back to vetted content. And if the member simply says, “I’d like to talk to a person,” the AI gracefully hands them off with full context intact. Automation plus escalation. That’s how you build confidence.

3. Make Compliance Transparent

Adoption dies fast if compliance officers don’t buy in. The answer? Radical transparency. Engageware’s AI doesn’t invent answers. It surfaces them from a single, governed content library, the same one that powers your website search, your chatbot, and your agent desktops. That means updates happen once, not five times, and every channel stays aligned.

One CTO told us it felt like getting a “ChatGPT-like experience” but with the guardrails to actually use it in banking .

4. Show, Don’t Tell

You can’t just announce “we’re an AI-first credit union” and expect adoption. Staff need to see the difference. At OnPoint, the first time employees searched a procedure and got a direct, cited answer in seconds, they stopped rolling their eyes at AI. Usage spiked 36% more searches overall and 80% of staff reported they saved time every week. In branches, demos and live walk-throughs build this same kind of trust. Adoption happens when people feel the tool working for them in real time.

5. Track and Celebrate Wins

If you can’t prove the ROI, the momentum fades. At Engageware, we’ve added Search and Popularity Reports so institutions can see exactly what members are asking and which content is performing. Those insights make it easier for leaders to show the board measurable gains in productivity, accuracy, and member satisfaction.

OnPoint reported a 33% drop in portal interactions and a 23% reduction in unnecessary content views after adopting Enhanced Search. Those results speak loud and clear.

Building Trust, One Workflow at a Time

What makes AI adoption stick isn’t hype or speed, it’s trust. AI adoption in banking isn’t about chasing trends. It’s about building trust one workflow at a time. Here’s how we recommend doing that:

- Start small with high-impact, low-risk tasks.

- Keep humans in the loop.

- Govern your knowledge.

- Show employees the “how,” not just the “why.”

- Measure, celebrate, and share the wins.

That’s how AI shifts from just another failed pilot to an everyday practice inside your branches and contact centers because when customers get consistent answers, staff see it as second nature, and leaders can measure ROI, adoption moves quickly.