As financial institutions prepare for a major generational wealth transfer, with $2.5 trillion expected to shift to younger generations by 2025, staying competitive means meeting the evolving needs of customers across all age groups.

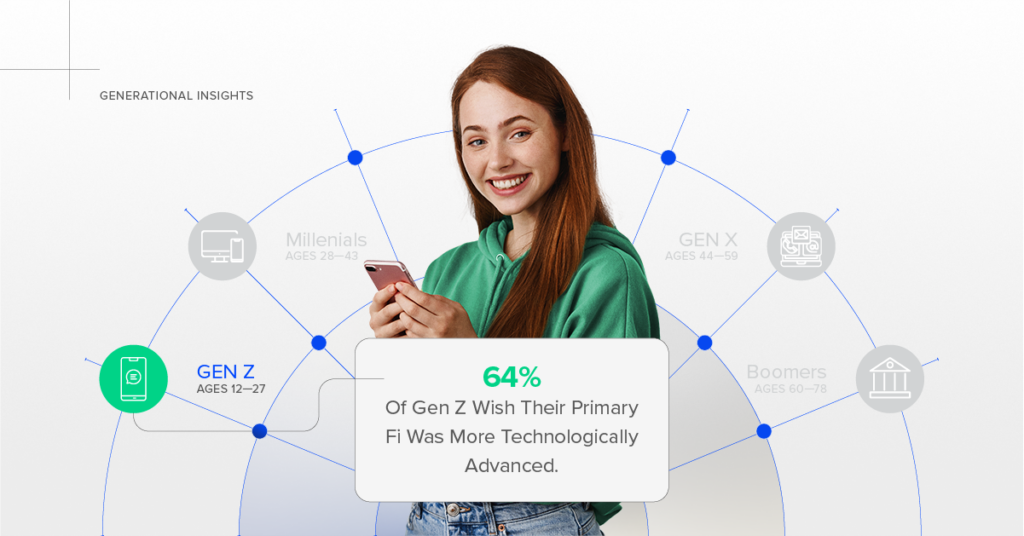

According to industry research conducted in partnership with Harris Poll, 95% of financial leaders recognize the need for improvement in customer engagement as banking preferences change. To remain competitive, institutions must cater to the distinct demands of Gen Z and Millennials, while also maintaining strong relationships with Gen X and Boomers.

Below are strategic insights to help your financial institution stay relevant and foster loyalty across all generations.

1. Prioritize Omnichannel Customer Experience to Maximize Engagement

Across all generations, customers expect seamless and consistent service, whether they’re banking online, through apps, or in branches. Omnichannel customer experience is essential to ensuring that customers can transition between these touchpoints effortlessly.

Offering an end-to-end customer engagement solution ensures that your financial institution delivers a consistent experience across all channels, building customer loyalty and increasing customer satisfaction.

For instance, UMassFive College Federal Credit Union leverages Engageware’s appointment scheduling and virtual assistant solutions to seamlessly manage customer interactions across digital and in-branch channels, providing members with efficient, personalized support whenever they need it.

Similarly, Banorte Bank’s Pension Division uses a virtual assistant and automated messaging to support its retiree customer segment, ensuring prompt responses and tailored assistance on preferred channels, significantly enhancing satisfaction within this demographic.

2. Leverage AI Virtual Assistants Personalized Service Experience

AI-powered solutions such as virtual assistants are increasingly embraced by younger generations, with 70% of Millennials and Gen Z comfortable using AI for customer service and financial needs.

Automating routine queries and offering 24/7 customer self-service options can significantly improve customer satisfaction across all age groups. Moreover, leveraging AI-driven data insights can help craft personalized experiences, driving higher customer engagement and trust in your services.

Learn Strategies to Boost Customer Engagement and Satisfaction Across Generations

Access Report3. Blend AI and Human Interaction for Superior Financial Service

While technology plays a major role in improving customer experience in banking, Boomers remain highly loyal to traditional banking. Additionally, 23% of Boomers expressed a desire for their financial institutions to employ leading-edge solutions, making it essential to balance advanced technology with human interaction to maintain trust and satisfaction.

Blending AI virtual assistants with live agent interactions ensures that your financial institution can provide the convenience of automation while offering the personalized, human touch when needed—especially for more complex customer issues.

4. Empower Employees for Better Service Delivery Across Channels

91% of customers across all generations value the option to speak with a human when needed. Investing in employee training is crucial to delivering seamless service. To ensure that your employees are equipped to deliver excellent service across all channels, it is crucial to provide them with the right tools.

Empower your teams with a knowledge management solution that centralizes information and enhances their ability to assist clients across multiple channels. This not only ensures consistent service but also improves operational efficiency during high-demand periods.

5. Invest in Robust Security Measures to Build Trust

Trust remains a cornerstone of client loyalty across all generations. Implementing advanced security protocols and ensuring transparent communication about privacy measures will help your institution maintain the trust of customers, regardless of age.

Ready to elevate your customer engagement strategy? For over 20 years, Engageware has been helping financial institutions with our AI-powered and omnichannel solutions helping them boost customer satisfaction, streamline operations, and drive long-term loyalty. Schedule a demo with Engageware today!