iTHINK Financial

The Repository Advantage: Centralized Knowledge Driving Efficiency and Innovation

Hear from iTHINK’s AVP of Administration and Marketing, Stephen Johnson.

Challenges and Goals

iTHINK Financial, a dynamic credit union exceeding 100,000 members embarked on a transformative journey with a central foundation — Knowledge Management.

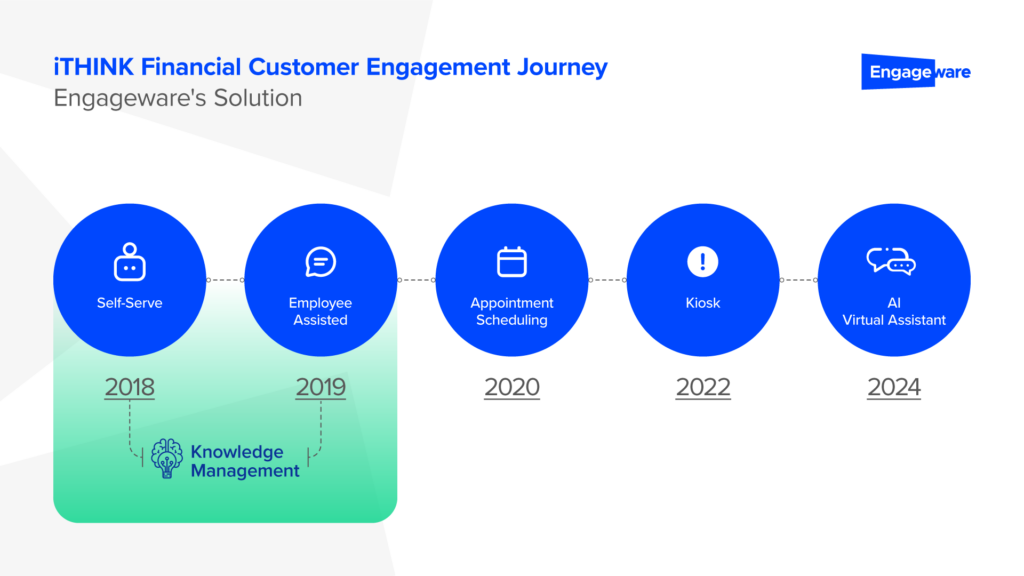

Curated Knowledge played a pivotal role in shaping the iTHINK Financial communication strategy, intertwining member self-service, employee knowledge management, and appointment scheduling and kiosk integration. Moreover, with a strategic focus on including AI in their go-to-market approach, they are gearing up to launch the Virtual Assistant integration for next year.

Recognizing the profound impact of information on employee-member interactions and the importance of consistent, aligned content, the credit union commits to meeting member expectations at every touchpoint. This initiative served as a driving force in delivering a seamless member experience.

Further challenges surface with 9% of appointments being scheduled vs walk-ins. The goal? Flip this ratio, a strategic move to anticipate members’ needs and optimize resource allocation.

Additionally, as the credit union works towards AI integration to its operations, it was clear the imperative need for a centralized knowledge base, not just as technical requirement; but as value-driven vehicle to ensure content consistency, efficiency, and innovation.

Success

End-to-End Customer Engagement

ITHINK Financial embraced Engageware’s end-to-end customer engagement solution. Engageware’s platform emerged as central repository of information, unifying support content and providing a two-way communication for both members and employee assistance.

“I feel Engageware’s value lies in its ability to serve as a repository for us. We can have control over where we store information, without relying on a vendor that may not directly interact with our members. We have the flexibility to determine where we want information and how we shape the member experience.”

– Stephen Johnson, AVP Administration & Marketing, iThink Financial

The seamless integration across self-service, employee support, and appointment scheduling derived from our robust knowledge base. Served as the linchpin for the credit union’s customer service success.

Instant and Personalized Omnichannel Member Service

Since 2018, iTHINK Financial, alongside Engageware, has embarked on an omnichannel customer service journey. Initially with focus on driving member self-service.

Stephen Johnson, AVP Marketing and Administration, highlights the struggle faced by members in navigating through the standard search methods. The credit union aimed to find innovative ways to connect and deepen their understanding of the members’ experience. Engageware self-service solution stepped in not just as reliable knowledge provider; it transforms communication into a dynamic and responsive channel. Engageware’s conversational suite delivers tailored experiences across multiple channels, resolves queries instantly and offers 24/7 customer service.

“We found that the interaction available through Engageware, made it significantly easier for us to understand our members’ conversations and thoughts. This allows us to establish a hierarchy in our approach to improving communication.”

– Stephen Johnson, AVP Administration & Marketing, iThink Financial

Once more, this shift was more than making information available but creating an omnichannel customer service.

Empowered by Engageware, iTHINK Financial revolutionized member interactions, crafting a personalized experience where information and assistance align precisely with individual needs and preferences. This omnichannel approach extended seamlessly across a network of digital touchpoints, driving accessibility and fostering a connected customer journey that actively supports conversions. Further success metrics focus on decreased call volumes and increased self-service options—a smooth transition from chatbot to core operations.

Empowering Employee Experiences with Curated Content

In 2019, iTHINK Financial marked a significant turning point with the addition of Engageware Employee Knowledge Management.

Stephen points out a crucial insight: despite the common emphasis on member satisfaction, many companies tend to overlook their employees. ITHINK Financial, being a credit union with diverse vendors, takes a distinctive approach by recognizing and prioritizing the importance of onboarding and continuous support for its employees. This commitment to a holistic approach is effectively facilitated through Engageware’s Employee Knowledge Management solution, it also resonates with the company’s emphasis on better measurements for employee experience.

Leveraging In-person Appointments to increase High-value Conversations

In the crucial journey to convert customers, every moment holds significance for a credit union, especially when it comes to In-person meetings. These moments offer opportunities for high-value conversations that can shape lasting member relationships.

Recognizing the pivotal role of in-person interactions, iTHINK Financial strategically adopted two innovative solutions Appointment Scheduling and Kiosk integration. Both solutions synergistically contribute to creating an omnichannel and personalized experience for members.

The adoption of Engageware’s Appointment Scheduling platform in 2020 marked a strategic move by iTHINK Financial to leverage in-person meetings for maximum impact. This solution not only efficiently manages resources but also proactively anticipates member needs, ensuring the delivery of a superior level of service.

“When a member has a scheduled appointment, we know what they’re there for. That helps us anticipate the necessary staffing levels, when we need them.”

– Stephen Johnson, AVP Administration & Marketing, iThink Financial

In addition to Appointment Scheduling, iTHINK Financial has seamlessly integrated the Kiosk platform into its physical branches. This platform, as described by Stephen Johnson, streamlines member interactions by allowing them to check in for appointments or communicate their specific needs upon arrival.

“I believe our last addition was the kiosk platform where members come into our branches, checking in for appointments or stating their specific needs. It’s a simple process for members to get done what they need to get done.”

– Stephen Johnson, AVP Administration & Marketing, iThink Financial

The integration of Engageware’s Appointment Scheduling platform and Kiosk solution at iTHINK Financial optimizes in-person interactions, fostering high-value conversations and supporting core conversion goals. This dual approach not only enhances efficiency and employee communication but also streamlines member interactions in branches, exemplifying the credit union’s commitment to innovation and superior member experiences.

Looking Ahead

Future Plans and AI Vision

After attending Engageware’s marquee brand event ReEngage in the Fall, Stephen took the lead in spearheading AI initiatives. He noticed the importance of forging the right partnerships and meticulously navigating the landscape. A key challenge he identifies is the necessity for a central repository of information, a cornerstone for maintaining consistency amid diverse vendor offerings.

“AI can serve as a differentiator with the right partnerships. However, one challenge I foresee with AI is the necessity for a centralized repository of information to ensure consistency.”

– Stephen Johnson, AVP Administration & Marketing, iThink Financial

Thereafter, Engageware became the launchpad for iTHINK Financials’ foray into AI solutions for 2024. As a reliable provider of information, it fueled a vision where the right information impacts every corner. Soon to be integrated into the game is Engageware’s Virtual Assistant solution.

iTHINK Financial envisions AI as a key differentiator, particularly in attracting younger generations. Plans include personalized and interactive content that resonates with a demographic accustomed to video-based, on-demand information.

“I believe it will offer an easier way to get them to feel the essence of the brand, and that’s where I think AI excels. It takes some of that stuffy language and transforms it into a more conversational, digestible approach.”

– Stephen Johnson, AVP Administration & Marketing, iThink Financial

Reflecting on Stephen Johnson’s insight, Engageware stands as continuous partner for the future, guiding iTHINK Financial’s path in elevating both member and employee experiences.

About the Company

Established in 1969, iTHINK Financial credit union proudly calls Delray Beach, Florida home. For over 54 years, iTHINK Financial CU has been a trusted financial partner for its members. As the 14th largest credit union in Florida, iTHINK Financial credit union stewards over $2.1 Billion in assets and proudly serves over 107,000 loyal members.

With nearly 400 dedicated individuals it is committed to providing exceptional financial services to its members and the community. Offering a complete range of products and services including Checking and Savings accounts, Money Market accounts, Certificates, IRAs, First and Second Mortgages, Car Loans, Visa® Credit Cards, Business Services, and more.