American 1 Credit Union

5 Ways American 1 Credit Union Empowers Members with Self-Service Digital Support

American 1 Credit Union services nearly 60,000 members with 17 branch locations across southeast Michigan. Operating under the motto, “Boldly Generous. Convenient. Uncomplicated.” American 1 strives to deliver on those words, especially when it comes to making their products and services accessible to their community.

When the COVID-19 pandemic forced shutdowns in the spring of 2020, American 1 realized the power of Customer Self-Service™ to help them stay connected to and service members. Branches were closed for several weeks, and even since fully reopening in mid June, more and more members have taken to digital channels.

American 1 Credit Union aims to deliver a smooth, seamless, uncomplicated member experience. Members are guided through the website, mobile and online banking avenues with consistent, engaging answers via search, FAQs, guided tutorials and chatbot, providing a more intuitive, engaging self-service digital banking experience.

Here are five ways American 1 Credit Union provides members automated self-service across digital channels for uninterrupted service, support, and product information.

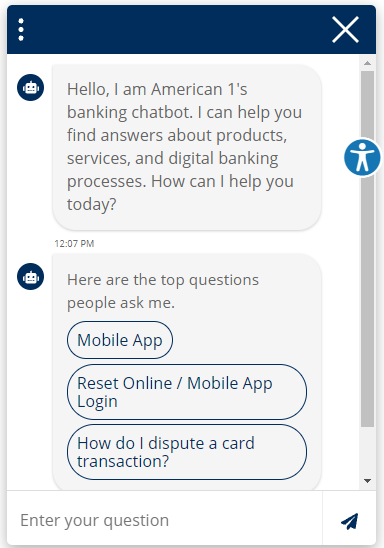

1. Banking Chatbot

Visitors to the American 1 Credit Union website and mobile app can engage with a banking chatbot for immediate assistance. The banking chatbot pulls from the same content that members find through the site’s search engine and FAQs, but is pre-sequenced into decision-tree format to guide users through their questions

Members can launch the automated chatbot 24/7 directly from American 1’s website or their mobile app. The perk to both the credit union and its members? Content served up via the chatbot can be centrally managed and deployed from the same knowledge base providing content to various components on the site. This ensures consistent information for site users, and streamlined content management for the credit union.

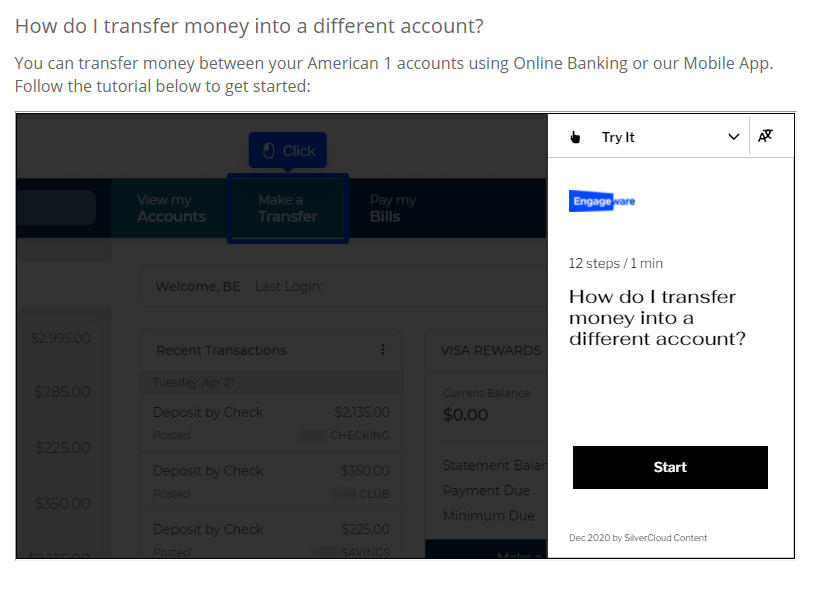

2. Guided Tutorial

To help members with remote banking tasks, like registering to use Online Banking, American 1 Credit Union utilizes Guided Tutorials.

These visual and auditory tutorials walk members through the steps to complete remote banking tasks. Rather than having member service reps walk members through individually over the phone, they can conveniently point members to these concise digital demonstrations hosted on the credit union’s website and mobile app. Members can view the guided tutorial at their own pace, and repeat guidance as needed!

See how a guided tutorial works here.

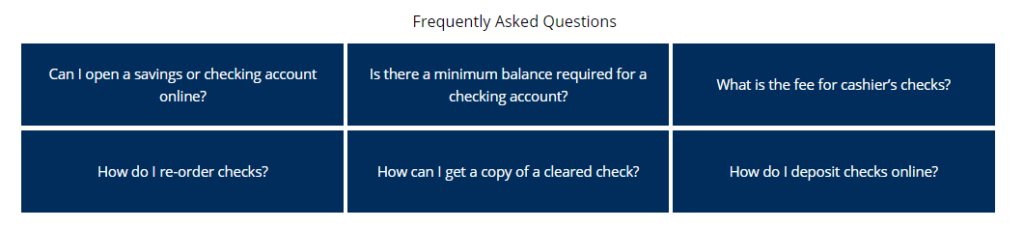

3. Contextual FAQs

An FAQs section on a financial institution’s website is a commonplace best practice to help drive digital adoption.

In addition to a general FAQs page, American 1 Credit Union makes use of contextual FAQs by placing the most frequently asked questions in a highly accessible spot on various web pages.

Contextual FAQs allow for customized placement of the FAQs that appear to be specific to the product or service. For example, when a user arrives at the Checking page, the FAQ widget appears on the page with the most popular FAQs specific to checking at the credit union.

“We are able to provide our members the self-service they want, and also engage members and provide personalized, tailored suggestions focusing on their financial wellness. We recognized self-service as vital to our future success before the onset of the pandemic, however, COVID-19 quickly placed a spotlight on the vital importance of enabling members to conduct business at a time and place that is most convenient to the member.”

– Laura Pryor, Vice President of Member Experience

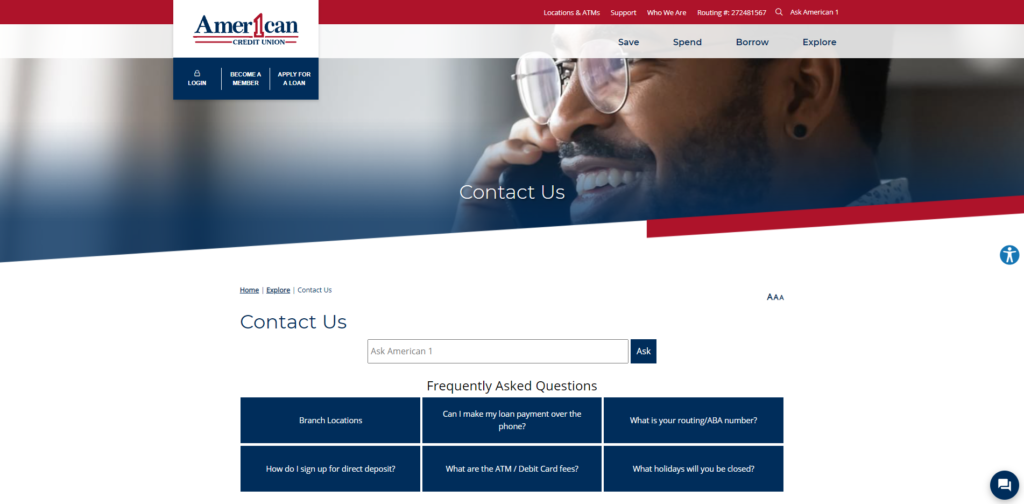

4. Self-Service Before Contact Us

American 1 Credit Union loves to hear from its members. They also love being able to get back to each and every member inquiry, with time to handle the more complex questions with extra care and attention.

In most cases, when members look to contact a support or help center, they are looking for a quick answer to a simple question. Hence, promoting self-service for the most commonly asked questions proves to be a win-win solution for both parties.

When someone navigates to the Contact Us page for a financial institution, they are usually seeking immediate assistance on something or to have a question answered.

Before providing their direct contact information, American 1 Credit Union follows best practices to enable members to self-serve, before they need to place a call. Self-service usually results in faster resolution and a more seamless member experience.

“Anytime a member is seeking information, regardless of the channel, Engageware’s platform ensures they are able to easily and quickly find that information, but then takes this a step further to provide additional information that is relevant, as well as a call to action pointing the member to related tasks that may be of interest. By providing this additional information, our members not only discover new products and services, but are also able to immediately begin the process to either open a new account, register to use a new service, complete an online application or instantly begin using a new tool.”

– Laura Pryor, Vice President of Member Experience

5. Case Management

The Case Management feature is a form that appears on the Contact Us page, below the FAQs. It’s a form submission feature of Engageware’s Customer Self-Service™.

When a member fills out this form, it is submitted to the credit union where the appropriate member services representative can view, manage the “cases” and assign them to the appropriate employee to respond to.

Cases (aka forms) also allow members a quick and easy way to provide feedback to the credit union. This member feedback is used to amplify their existing knowledgebase by informing new content to add or tweaking existing content to be more helpful.

“Engageware has proven to be exponentially more important through the COVID-19 pandemic. We were able to quickly launch a dedicated Coronavirus Information Center that was available to members on all of our digital channels. Engageware’s content team proactively reached out to provide suggestions for support content based on the top questions and concerns from members across the country. Additionally, we followed their proven best practices to ensure all of the pandemic-related information was easily accessible and was automatically updated in real-time across all channels to ensure our members understood the current guidelines, and options available for all of their banking needs.”

– Laura Pryor, Vice President of Member Experience

Explore American 1’s self-service functionality at www.american1cu.org/. Be on the lookout for the following Engageware components:

- Search bar and search results – Top right corner of the site (Ask American 1)

- Chatbot – Accessible universally throughout website in lower right corner

- Guided Tutorials – Step-by-step demonstrations of how to complete common remote banking tasks

- Contextual FAQs – The most commonly asked questions specific to a service or product

- Contact Us Page – Note the prominence of the search bar and FAQs to point members to helpful resources.

- Ask Us a Question – Simple contact form to reach out to the CU on the Contact Us page

- General FAQs accessible through the Member Resources page