Institutions with NPS Over 60 Have 26% Higher Growth

In today’s climate of shifting consumer demand coupled with COVID restrictions, banks and credit unions are focusing on ways to keep customer engagement high, while also ensuring that the quality of each interaction remains a top priority. By offering online appointment scheduling to all customers, financial institutions can ensure a high Net Promoter Score (NPS) as a result of convenient and quality interactions. Here’s how scheduling boosts NPS:

- Improves the overall banking customer experience from the first interaction to post-appointment follow up

- Provides customers access to trusted financial advisors, whether that’s a long time associate or loan or mortgage specialist

- Empowers customers to choose when and how to interact with their bank or credit union

- Creates 360 customer visibility for employees, letting them better prepare for each experience

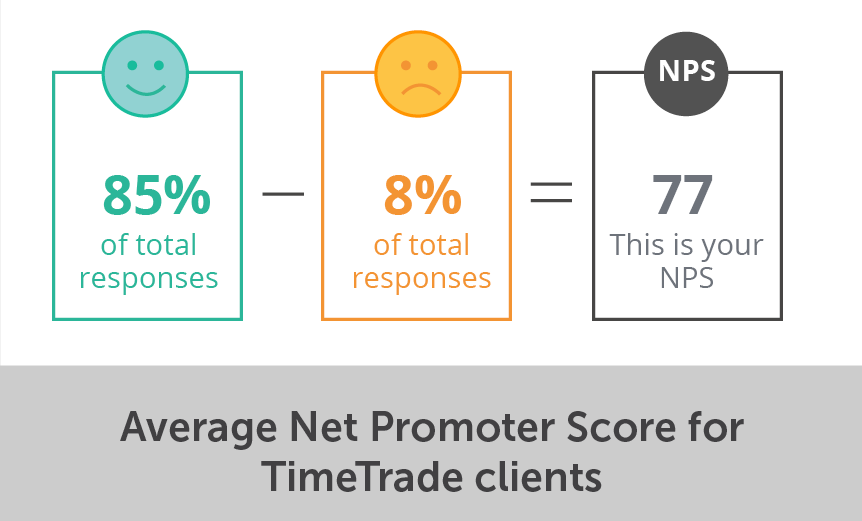

Average Net Promoter Score for Banks and Credit Unions with Engageware Appointment Scheduling is 77

According to industry data, the average Net Promoter Score for Banks and Credit Unions is a 36. Engageware Appointment Scheduling customers have a big advantage here. Based on Engageware’s survey feature, which lets banks and credit unions send out quick, post-appointment surveys to their customers, organizations who use Engageware Appointment Scheduling have an impressive NPS rating of 77. That’s more than double the industry average.

Drilling down even further, additional research found “bank branches with a Net Promoter Score greater than 60 experience growth in operating income that is 26% higher than branches with a Net Promoter Score below 60″

What activities are most important for driving a high NPS? The Customer Loyalty in Retail Banking Report found that the experiences that have the biggest impact on NPS are the ones that customers describe as:

- Quality

- Saves time

- Reduces anxiety

- Simplifies

How Online Scheduling Improved NPS by 18%

Horacio Garcia-Korosec, Director of Business Intelligence at Del-One Federal Credit Union in Wilmington, DE reports that “Engageware Appointments have impacted NPS in a positive way, being able to capture in the moment feelings with our members. Our NPS score went from 66 to 78, and 18% increase after the implementation of Engageware.”

Intelligent online appointment scheduling gives customers more control and flexibility while allowing them to interact with their trusted financial advisors. This is especially important in a COVID atmosphere when consumers are reporting they are maxed out trying to manage work and personal commitments, which is causing daily stress levels to increase.

Banks and credit unions can take away some of that stress, making it easy for them to book an appointment at a time convenient to them, regardless of whether by phone, virtually, or in-branch. Here’s how

- Omnichannel appointment scheduling simplifies the process and helps busy consumers save time. Customers are empowered to create an appointment in their preferred space, including a brand’s website, social, email and newsletters, or even directly from search results using Reserve with Google.

- Text reminders help busy customers stay organized. They can also be customized with messages to help reduce customer anxiety — including reminders of any paperwork or supporting materials a customer should have on hand for the appointment, as well as information about what the bank or credit union is doing to support social distancing and cleaning practices if the appointment is in-person. Text reminders also greatly minimize no-shows.

- As social distancing restrictions continue, In-branch queue management saves time and increases positive interactions. With real-time customer flow for physical locations, queue management tools optimize the on-site experience for both pre-scheduled and walk-in appointments while also providing visitors with accurate wait times based on the number of customers, employee resources, transaction type, and active appointment lengths.

Learn the key questions you should ask when considering an appointment scheduling solution.

Learn MoreScheduling Creates Higher Quality Experiences

And we know that quality experiences result in a high NPS. Appointment scheduling helps boost the quality of each experience between associates and customers by letting bank associates and managers plan their day. The use of online appointment scheduling gives employees preparation time to understand each customer’s needs and personalize the experience, yielding dividends.

Customers purchase 1.8 more banking products per appointment when your employee has time to prepare for a meeting.

Capture NPS and Customer Feedback Immediately

To accurately assess NPS, you’ve got to ask for feedback at the right time. There are three great times to engage your customer with a survey. Post-purchase & post-appointment evaluations happen right after a transaction or appointment happens and are the best time to capture exactly how a customer felt about their interaction with your company. Periodic satisfaction surveys can be used to capture period-specific feedback by blasting a survey to your email list, and continuous satisfaction tracking uses regular post-purchase surveys to track service quality levels over time.

With Engageware Appointment Scheduling, banks and credit unions have the ability to automatically generate a survey at the completion of an appointment, ensuring they gain accurate feedback in the moment.

To learn more, download >> The Shift to Banking-by-Appointment Solves today’s Biggest Customer Challenges brief that details how banks and credit unions can balance customer demands with operational efficiencies.