Branch closures and social distancing measures over the course of the last year have drastically reduced the human interaction that differentiate community banks and credit unions. The unfortunate result? Many customers are being left out in the cold.

As we approach one year of COVID restrictions, customers expect that your credit union or bank have adjusted to deliver the same great customer experience, regardless of the limitations on in-person banking. Now that customers need their financial institution more than ever, it begs the question: Are you leaving them out in the cold? Or have you adjusted to meet them wherever, whenever, and however they need?

In this webinar, we showcase three customer engagement strategies that real credit unions & banks have implemented to improve their customer experience initiatives during the pandemic. From self-service to personalized service – learn how financial institutions can continue to win with customer experience despite the chilling restrictions of the COVID 2.0 world.

Consumer Expectations: 24/7 On-Demand Access & Options

From Netflix, to Open Table, to Uber, to Google – we are all consumers living in a 24/7 on-demand world. We have the power to get information, get answers, make reservations, and consume entertainment now – or to schedule or reserve it for later.

In the financial world, digital-only options are rapidly expanding. Players like Venmo, Acorns, Rocket Mortgage, and Robinhood are serving up sleek front-end user experience and technology that remove the common friction points experienced across the digital offerings of traditional financial institutions.

But there is one crucial factor missing from these digital-first FinTech’s – the human expertise and customer service offered by the frontline staff of credit unions & banks.

Human Element Can Shine in a Digital-first World

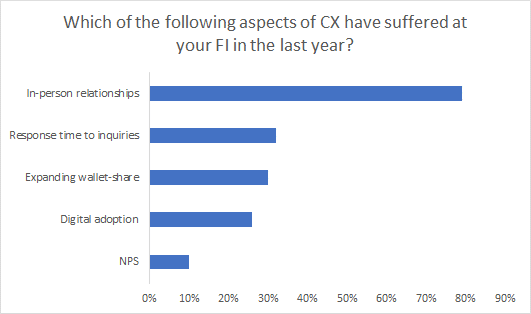

79% of banks and credit unions say the in-person component of their customer engagement strategy has suffered in the last year.

Banks and credit unions can take a page from the books of omnichannel retailers like Best Buy and Apple who help bridge the gap between digital and in-person with their knowledgeable and friendly subject matter experts – more commonly known as the “Geek Squad” or “Genius Bar.”

Even digital-only services like Stitch Fix manage to create a personalized, 1-to-1 connection between customers who subscribe to the personal styling service and receive a personal stylist.

Tip: Leverage the human element in the absence of physical interactions at branches with The Essential Banking Package — appointment scheduling for financial institutions.

How to Win with Customer Experience

- Digital banking experiences must accommodate both self-service and personalized service

- Knowledgeable humans are more important than ever

- Connecting the right person at the right time

The three best practices that will get banks and credit unions there:

- Self-Service: Surrounding customers with access to self-help information across web and mobile.

- Knowledge Management: Empowering frontline staff to deliver an exceptional customer experience with the knowledge they need to handle each customer inquiry.

- Online Appointment Scheduling: Connect customers with the right person, at the right person – whether by phone, video conference, live chat or in person.

Tip: Ah, scalability. The reality is most financial institutions can’t afford to give a human touch to every customer interaction. The level of customer engagement will vary, and there need to be different tools and technologies in place to serve the range of customer needs.

You may also be interested in: The Winning Formula for Delivering Great Experiences to learn 3 trends financial institutions can’t ignore in 2021. Plus, How Del-One Credit Union Delivers Personalized Service to learn how this credit union was able to schedule 800+ member appointments in days.