Loan growth is a hot topic and consistently ranks 1st or 2nd for strategic priorities for banks and credit unions. Lending is a complex business that extends across many different tools, processes, and people within the institution. We understand that, and this article is NOT the definitive guide to lending – instead we want to highlight WHY and HOW appointment scheduling should be a key component in your loan growth strategy.

Before we get into the specifics, let’s look at the data:

Banks and credit unions who leverage appointment scheduling consistently, quarter after quarter, outperform the industry average for loan growth by 2 to 4 times. Here are the two most recent examples (Q2 and Q3).

Why Appointment Scheduling Helps Grow Loans?

Appointment scheduling software bridges the gap between consumer behavior and consumer preferences. It is the perfect call to action to convert visitors with high interest looking for guidance from a lending expert at time and location convenient for them.

Here is why:

Using the typical calls to action of 1) call / visit a branch and 2) apply online misses a large portion of your audience that are researching nights and weekends AND want human expertise. Intelligent appointment scheduling bridges that gap.

How Appointment Scheduling Helps Grow Loans?

Here are 3 ways forward-thinking banks and credit unions are using appointment scheduling to drive more loan growth.

1. Convert Digital Visitors Exploring Lending Options

Convert the 70%+ of visitors who are starting online to research lending options

You need to surround your audience with the right calls to action in the right places to convert digital traffic. This means not only the main navigation and support pages, but also the content associated with loans. Remove the friction and present the right calls to action at the right time. This means having the option to Apply Online as well as Meet with Us to ensure however visitors prefer, they can easily take the next step:

Learn the key questions you should ask when considering an appointment scheduling solution.

Learn More2. Convert Contact Center Calls, Chats, and Emails Related to Loan Questions

Convert the 30% who start by calling in to speak to a loan officer

Even in 2022 there is a segment of your customers that are still going to start by calling. Unfortunately, for most the typical experience isn’t seamless or efficient (see the typical process below). With appointment scheduling software for banks, the customer service representative can easily schedule an appointment at a time and place convenient for that customer. This removes the typical friction of requiring a call back and converts prospects at their highest intent moment.

3. Automate Reminders and Confirmations to Drive Loan Applications

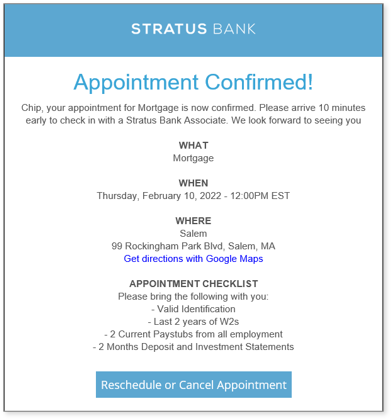

With an appointment scheduling solution, reminders and confirmations are automatically sent to both the consumer and your loan officer. These can be sent at various intervals and by the channel of choice (email or text). Not only does this remove manual tasks from your staff, but it also drastically reduces no-show rates.

One of the biggest advantages of reminders and confirmations is that they can be used to ensure the consumers come prepared with the right information. Consumers are 60% more likely to convert into an application if they come prepared with the necessary information required to apply (valid ID, recent pay stub, tax returns, etc.) at their first appointment.

Bridge the Gap Between Consumer Behavior and Preference

Appointment software is the perfect tool to bridge the gap between consumer behavior and preference. It allows you another option to convert prospects at their highest intent time (typically nights and weekends) how the majority want (with the expertise of your loan officers).

Engageware Appointment Scheduling customers outperform the industry average for loan growth by 2-4 times. Schedule a quick meeting with one of our experts to discuss how Engageware Appointment Scheduling can help your specific financial institution hit your loan growth goals.