Humanizing Fintech – Fintech Goes Human

- Humanizing Fintech Interfaces. Software is becoming more human-like and easier to use. Financial institutions are driving customer happiness by humanized banking software with the use of knowledge and conversational banking human interfaces.

- From Employees to Members/Customers. Today both employees and members/customers of financial institutions are using software that’s hard to use. The best designs still lead to confusion and clutter. While design has improved over time, software is still mostly hard to use.

- Conversational banking tech will be the catalyst. Talking to computers will make it easier to use a computer. The conversations, and subsequently the computers, must be smart, using knowledge to provide the right answer all the time. Devices will be everywhere. Screens, microphones and speakers will surround end-users breaking a decades old paradigm of how we interact with computers.

Software is about to get a whole lot easier to use. Humanizing software interfaces, creating intelligent “Human Interfaces” will change everything in the computing universe. The introduction of intelligent virtual assistants who use natural language as a way of interacting will change everything. Leveraging the various devices that surround you, with their speakers, microphones and screens, the Banking Internet of Things, will change everything.

Computers are becoming more human-like and will become easier to use. We are not talking about robots and automation as much as we are talking about how we interact and engage with computers. From keyboard to mouse to touch and now…. Natural Language.

The humanization of software, and subsequently, computers, has begun. And fintech and the financial services industry are leading the charge. Employees of financial institutions are asked to use a desktop cluttered with a dozen applications – many of which have old, tired user interfaces. Members and customers are using digital banking solutions that, while better than the core banking and processing software used by employees, are still not really easy to use. Human interfaces, leveraging conversational banking technology, will revolutionize how employees and members/customers engage with their financial institution.

Software User Interfaces Are Not Human Focused

Right now, fintech software is hard to use. Both employees of a financial institution and their members and customers are victim to this fact. Employees suffer the most. Their desktops are cluttered with literally dozens of applications centered around their core banking software. To be kind in your assessment would be to admit that user interface design was not a key focus of the core solutions when they were built over the past three decades.

In addition to the core banking solution, the employee uses various processing tools, card processor admin tools, image processing tools, CRM and call center tools and even intranet tools like SharePoint.

Clutter is the reality for an employee as they navigate the myriad of apps and procedures to get stuff done for members and customers. It is no fault of their own that employees struggle. Their desktop has evolved over time. Where once years ago, the core banking solution ruled their universe, over the past ten to fifteen years other tools have crept in and become business critical. Car processing is separate. CRM solutions have become prevalent and even some have cracked building Universal Banker desktop apps. Teller systems at times exist outside of the core solution.

Unfortunately for the employee, all of them suffer from poor design. Some are surely better than others but in general, employee interfaces have not been the focus. Employees see a view of the banking world that is fragmented, and even their customers and members are doing better, using their view of their accounts, digital banking solutions.

Customers and members have thrived on digital over the past twenty years. Self-service has proliferated. In 2016-2017 financial institutions passed an important milestone, as best-in-class organizations started processing over half, 50%, of their customer interactions digitally. Mobile banking growth drove them over the goal. Finally banks and credit unions have taken digital seriously.

The UI on the other hand, has not faired so well. Digital banking solutions have not excelled at user engagement. Many have tried and a few have done it well, or at least done better. Most financial institutions are in fact gated by the design capability of their digital banking platform, and those platforms focus more on launching lots of financial institutions and great design has not been a huge strength.

Mobile design, either mobile-only or mobile-first principles, did make things better. As an example, when mobile design sensibilities worked their way back to the desktop and Internet Banking started to look like mobile (this is still going on), ease of use increased. Calls to the call center decreased. Easier was not easy enough. Digital design still tends towards the cluttered and the more features launched have meant crowded menus and confusing layouts. While banking customers are better off than employees, they still face using hard to use software on a daily basis.

Innovative New Human Interfaces Grow Out Of The Past

Enter Human Interfaces. In the next decade we are going to be making computers more human-like so they are easier to use and we engage with them more. We are going to make human interfaces for software. Virtual assistants will take over from antiquated keyboards and the mouse.

As we pass into this new epoch of design, we must recognize that we have come a long way. It was not too long ago when a keyboard and a screen were all we had. And the screen was a simple character based interface. Green screens, yes, the font most selected was green (let’s not even get in the the function keys) Who would have known we could make one key have so many functions? F1 through F11 keys were cutting edge design and usability at one point.

Over time, we made progress and made software easier to use. Technology evolved. We started using the term “user interfaces” which evolved to “graphical user interfaces” with the introduction of the Mac OS and eventually MS Windows. We introduced the mouse to improve navigation, and eventually evolved to even using a touchscreen and your finger to swipe. All of these innovations made design and usability better. The theories and research behind user-centric graphic design evolved as well. Information architects became a part of the conversation and even the emergence of a mobile-only sensibility helped to simplify and make software easier to use.

Alas, not easy enough.

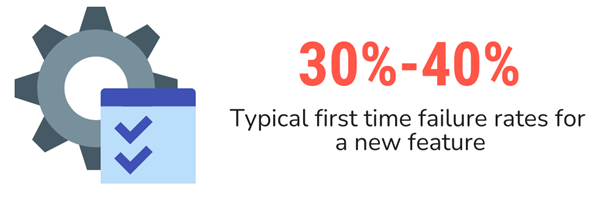

Within the software world we track an end-user behavior called first time usage. How easy is an app to use the first time a user uses the app? First time failure rates are important to track. If someone fails at a task the first time they use an app, they will not come back. As good as we can get modern design, failure rates remain high. Typically, first time failure rates for a new feature range from 30% – 40%. That is surprisingly high. It is hard to design easy to use software. And most software falls far short of gaining high marks when it comes to design. Most software companies are not very good at it and we as end-users are living with the results. Design is not a priority for the modern software organization. Design tends to get the lowest priority, with either product features or technology enablement winning out.

And now, it will change. Human design will usher in a new wave of increased computer usage and engagement. No longer will employees struggle to use their core banking system or deactivate a debit card in the card processor admin tool. Now they will have human-centric virtual assistants to guide them, to make their lives easier. Members and customers will benefit from the ease of use delivered via the digital channels. Conversation and virtual assistants will change everything, forever rendering software delivering humanization and simplified, graceful ease of use.

Why? Conversation, talking to a computer is a more efficient way of interaction. Not only is it easier but it gets the job done quicker. In a test of conversational efficiency, 10 of the most common digital banking tasks (balance, history, transfer, deposit, bill pay, etc.) were reviewed. In every case, using a conversational interface made the transaction faster, up to 65% faster. It is exponentially more efficient to use your voice or type out a question than it is to use a legacy software interface. When the conversational banking conversion is complete, employees and members and customers will be using computer 50% faster than ever before.

Driving Human Interface Change – Conversational Banking Platforms

Behind this revolution is the conversational banking technology platform. Based on artificial intelligence and driven by a deep knowledge base about the financial institution, the platforms is delivering the next wave of digital banking and digital customer service.

First there was Internet Banking, then Mobile Banking and now Conversational Banking where human interfaces take the lead. Within the conversational banking platform, there are three key technologies:

- The introduction of voice and text– natural language processing (NLP).

- The introduction of dual-device interfaces, solutions that use more than one device.

- The use of knowledge to make the virtual assistants really smart.

- New design techniques to improve the screens we see today and to help create a personality and identity for the virtual assistant.

Have a Conversation With a Computer.

When an end-user is able to communicate with a computer by writing a question just like they would speak it, or even just speak it into a mic, and the computer recognizes what they said, this is a human computer interface. An end-user will be able to talk to the computer. Natural Language Processing or NPL makes this happen.

NLP is based on artificial intelligence which is used both to listen or record the voice input and translate it to text and the AI is used to figure out what the intent of the question is that is being asked. NLP now is baked into all of the major hosting platforms (Amazon-Microsoft-Apple) and is very accessible. Computers now have the opportunity to understand what is being asked of them in free-form queries. Keyboard, mouse and touch will now be augmented by speaking or conversing with a computer.

Multi-Device Interfaces – Devices Everywhere.

In the past, we used a single device to interact with the computer. In the future, we will use more than one device at a time. The entire way we interact with computers is changing. We might use one device such as Alexa to talk to the computer and see the output or the results on a screen like our TV. This is happening today, and the voice to TV screen is a great example, who doesn’t want to avoid typing things in on that terrible apple TV remote, after all?

Text is also strongly in the mix. In fact, many conversations today are started with someone typing in a question using natural language. But should the answer back be simple text? What about text and pictures coming back in the response? What about video coming back in the response? It clearly is not as simple as text in and text out. Future human interfaces will combine devices to create a very cool, seamless experience across devices.

Knowledge Drives Virtual Assistants.

A virtual assistant must be able to answer all the questions. It must do the basics of self-service such as balance inquires and paying a bill, but it also must be knowledgeable enough to sell products and answer any service question. It must have very broad knowledge. It must be able to answer the frequently asked questions and the more mundane questions. A bot that can’t answer 95% – 100% of the questions will fail. A virtual assistant that truly has the answers, that has embedded within it the knowledge of the organization, will drive success.

Evolving Design – New Screens and Virtual Assistant Identity.

First, screens will change. Some large portion of the screens we use today in digital banking and on an employee desktop are going to go away. When we crack the new human interface, surely the screens will be different, they will still be there, but probably there will be less of them and they will look different. Data entry screens, as an example, will be potentially non-existent. You will type or talk and back will come a result; you won’t have to use the screen to define the query, your voice will do it.

And what about personality and identity? Virtual assistants will have personality. A designer will tweak the name, the visual image, the voice and the words used to describe the bot and will create an identity for the virtual assistant. In the end, the virtual assistant will drive huge change in how we think about design, and how we implement successfully.

In The End – Humanization

It is all about humanization. Making computers easier to use. Making it easier for a credit union member or an employee of a bank when they reach for their computer of choice. Computers are being humanized and conversational banking solutions are driving the change. Digital banking and employee desktops will be replaced over time with conversational banking solutions and human interfaces. The future of computing in financial services is here.

You May Also Be Interested In:

- Conversational Banking Trends – November 2020

- The Future of Automated Financial Sales

- Knowledge Management Solution Built for Banking

- Conversational Banking Trends – October 2020

- 10 Things You Need to Know Before Implementing a Banking Chatbot

- Franklin Mint FCU Shares 5 Things About Engageware’s Banking Chatbot