The coronavirus pandemic forced banks and credit unions to pivot quickly to retool their operational strategies. Banking-by-appointment was deployed at warp speed to ensure customers had uninterrupted access to their trusted and knowledgeable experts for everything from financial advice to account services in spite of social distancing and limited branch access. Banking by appointment shifted from a nice-to-have option to an operational requirement overnight. Now, institutions that recently deployed online appointment scheduling are learning what the early adopters already knew: the wide-ranging benefits to customers and the bottom line are significant and offer long-term advantages.

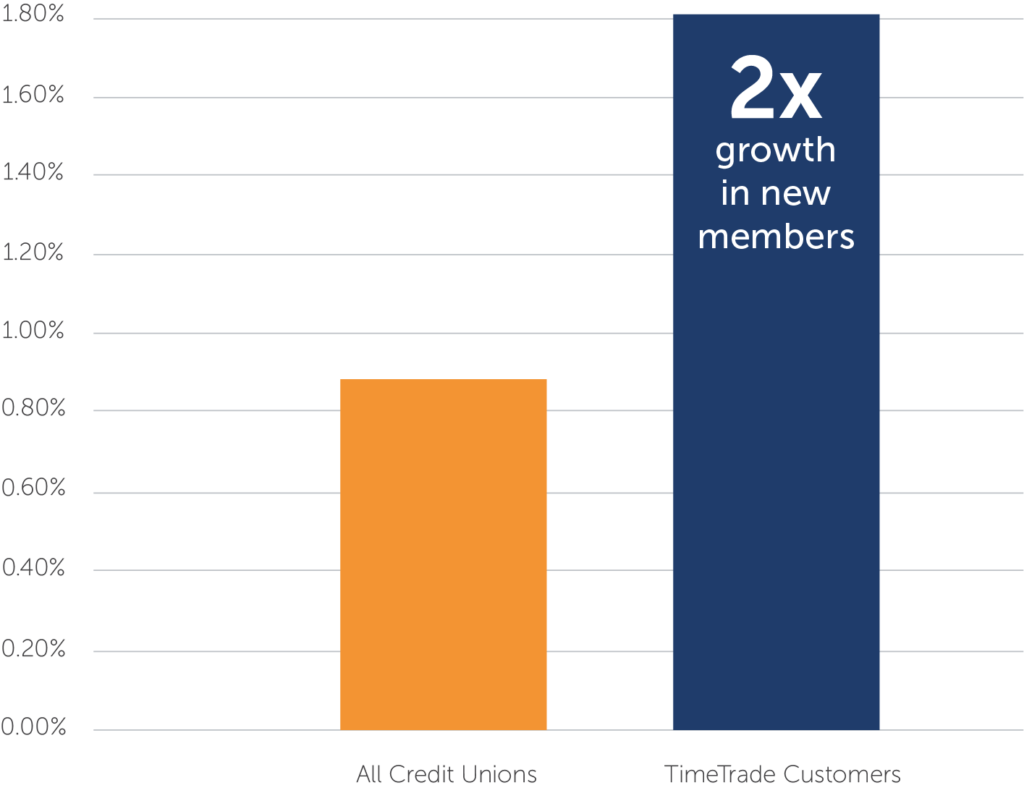

2X Growth in New Members

Credit unions that offer appointment options are primed for growth. The National Credit Union Association (NCUA) Quarterly Report revealed that credit unions added 4 million members to reach a total of 122.3 million in the second quarter, down slightly year over year. Let’s face it, Q2 2020 was erratic for everyone. Comparing Q1 2020 to Q2 2020, credit unions grew membership by .86%. In contrast, Engageware customers using banking-by-appointment doubled new members during the same period.

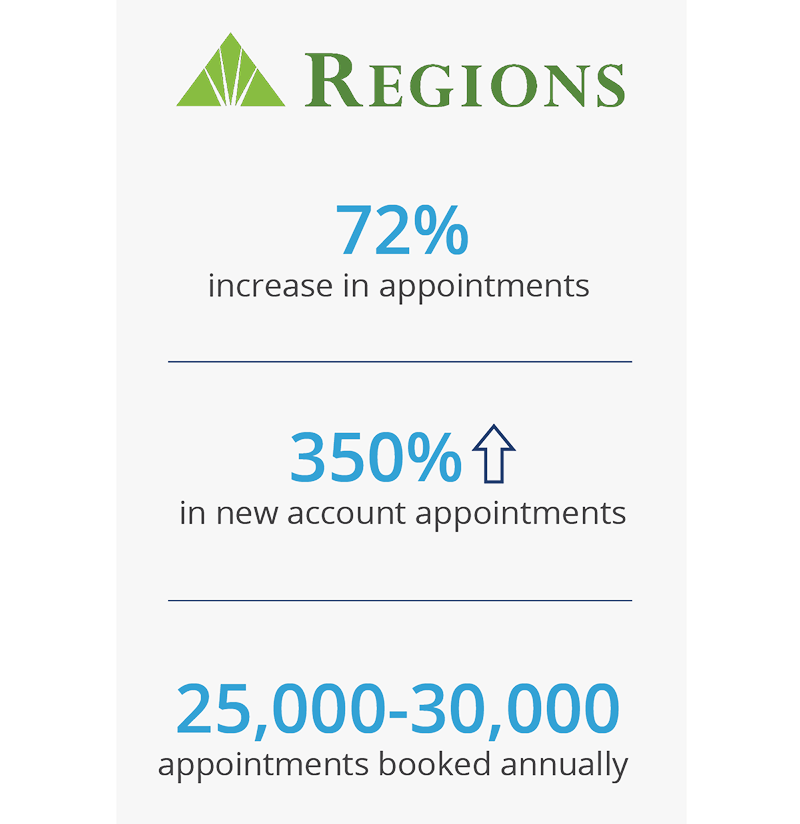

350% Increase in New Accounts

Making it easy and convenient for customers to connect whenever or however they want is a competitive advantage, especially when used for new account activity.

In one case study, Regions Bank, who ramped up appointment options in tandem with personalized customer outreach, reported a 350% increase in new account appointments post COVID vs the same time the previous year. “A key component [to our success] is making sure the customer has the option to engage with us on their terms so they can accomplish their financial goals,” said Stephen Griffin, Senior Vice President, from Regions Bank. He attributes this flexibility and personalized approach to the boost in account openings. He added, “Giving customers a guaranteed time is critical.

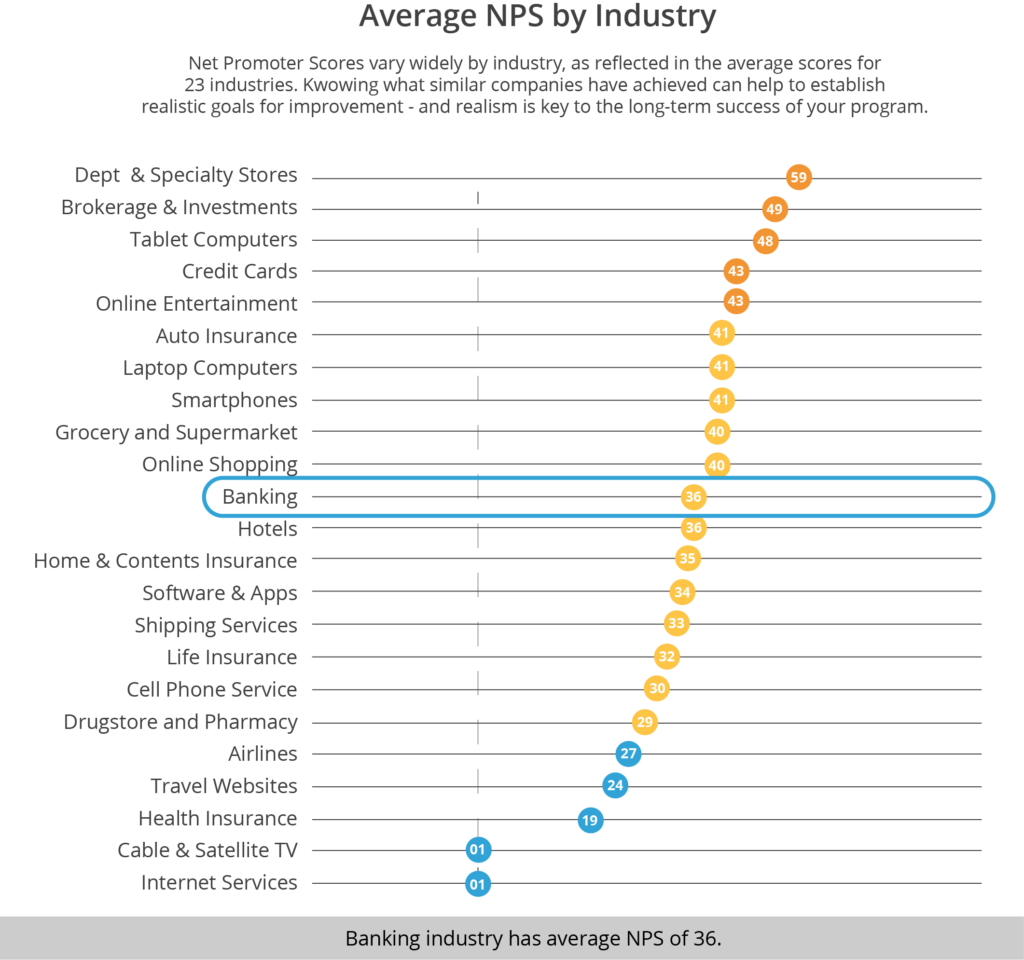

18% Increase in NPS

Financial institutions that offer customers the option to engage on their terms via intelligent appointments report higher customer satisfaction scores. The data shows that U.S. consumers gave banks and credit unions that use Engageware online appointment scheduling higher loyalty scores versus financial institutions that don’t. And these rates of higher satisfaction and engagement are one of the key factors driving higher growth and revenues.

According to Satmetrix industry data, the average Net Promoter Score for banks and credit unions is 36. However, organizations who use Engageware have an impressive NPS of 77. That’s more than double the industry average. That data is collected using Engageware’s survey feature, which lets banks and credit unions send out quick, post-appointment surveys to customers for immediate feedback.

Another Engageware customer, Del-One Federal Credit Union, reported an 18% increase in their NPS rating after implementing banking-by-appointment. “Engageware appointments have impacted our NPS in a positive way, letting us capture in-the-moment feelings with our members,” noted to Horacio Garcia-Korosec, Director of Business Intelligence at Del-One. “Our NPS went from 66 to 78.

In a show of overwhelming customer demand, over 800 appointments were booked in the first week that Del-One rolled out appointment scheduling. Today they are averaging 4000 appointments per month.

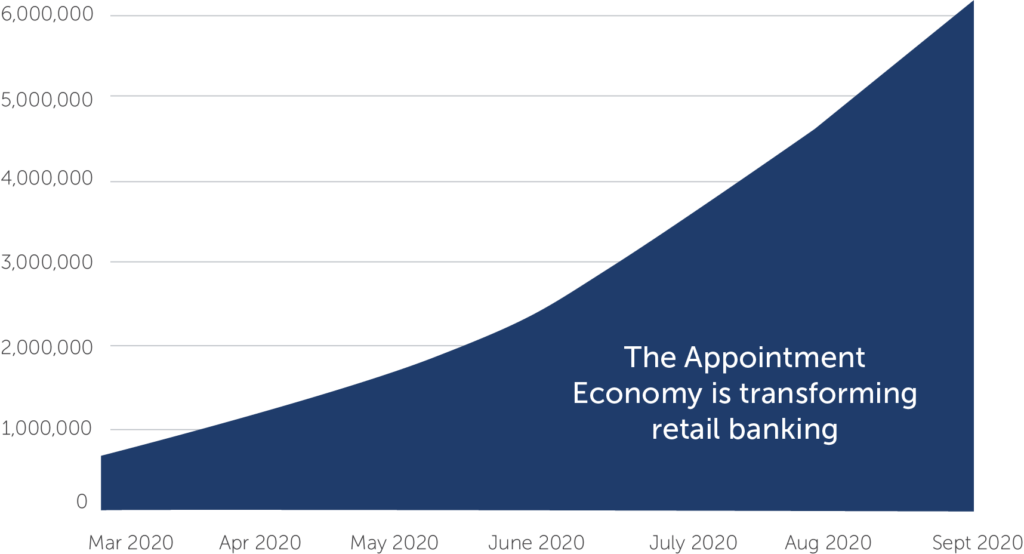

Over 6 Million Appointments Booked Across the Industry

Personal interactions with knowledgeable bankers still matter. The pandemic accelerated banking-by-appointment, but this momentum will continue beyond the current crisis. Banking-by-appointment is the right technology to enable long term benefits including customer growth, increased operational efficiencies, and higher Net Promoter Scores. And those improvements ultimately lead to increased revenues and happier employees.

Given the change in consumer habits and preferences, now is the time to lead with convenience and empathy in banking.

“This is an opportunity for financial institutions to offer true relationship-banking,” noted Anuji Shahani, Vice President of Comperemedia, in a recent article. “If consumers see their banker frequently and schedule appointments with them specifically, they will be more likely to move all their investments to that one institution.”

And that customer demand to meet with trusted financial advisors remains strong, even during the pandemic. Since March, Engageware has served over 6 million appointments to connect banks and credit unions to their clients and members.

Learn more about the shift to banking-by-appointment as more financial institutions rethink their growth and customer loyalty strategies. Download our Banking-by-Appointment industry brief to see how omnichannel appointment scheduling has become a critical factor to modernize, drive rapid ROI and deliver remarkable service.