While many states are reopening or adjusting their restrictions, banks and credit unions must deliver nimble responses to demands from customers and employees for safety. As COVID becomes a long-term reality, striking the right balance between efficient operations, growth and safety for consumers and employees is key.

To gain insights into the strategies banks and credit unions are deploying to open their doors during the pandemic, we gathered industry experts and banking leaders to discuss Retail Banking’s New Reality and The Future of the Branch. Here are key takeaways from the webinar hosted by Future Branches.

Customers’ Preferred Engagement Channels Have Shifted

“Understanding consumer sentiment is important because it is an underlying factor in how consumers are banking and how they want to engage with brands,” noted Jean-Pierre Lacroix, president of SLD.

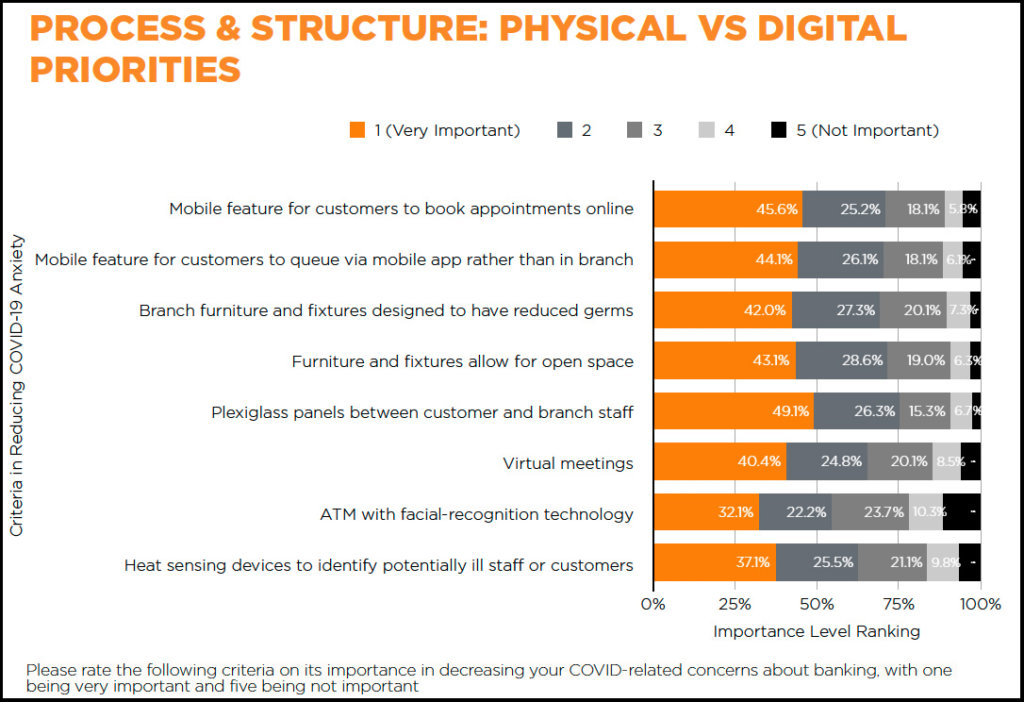

Consumers have two types of requests: they want physical changes to brick-and-mortar branches to alleviate personal safety anxiety, and they show a strong preference for digital engagement options. Here’s the breakdown of specific consumer demands from the recent report, Retail Banking’s New Reality by SLD.

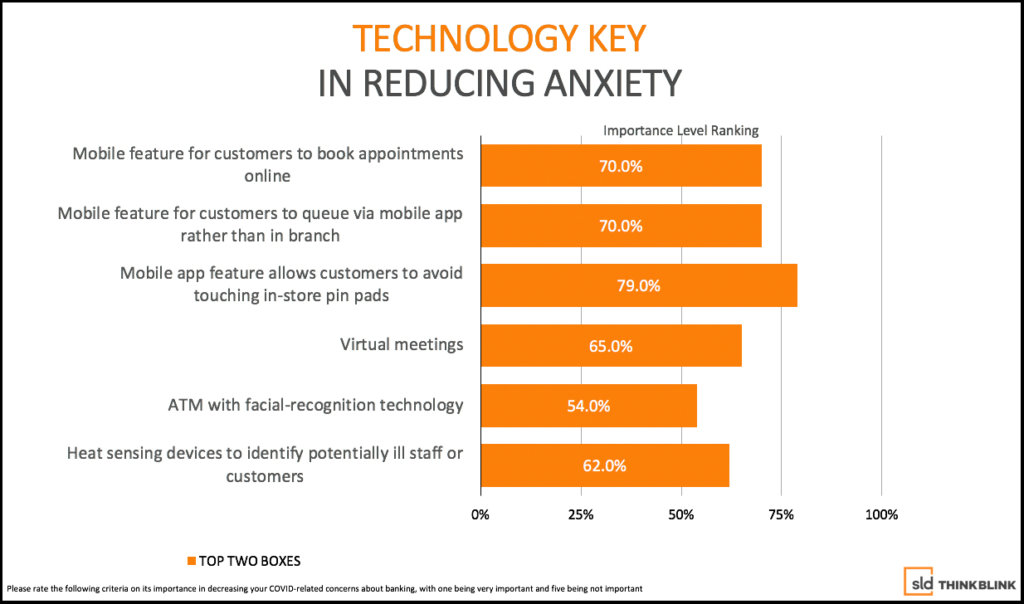

Virtual meetings and online appointment bookings valued as important method of engagement by more than 70% of respondents.

Physical attributes such as signage, marking, and branch layout are the first priority for customers when it comes to post-COVID-19 banking anxiety. The report notes that banks and credit unions must place short-term focus on in-branch signage and social distance marking, as well as branch layout optimizations for wide spaces and sanitation stations.

The second highest priority is the desire for digital engagement features that allow customers to schedule appointments (both virtual and in-person) and check-in online. Overall, industry research and anecdotal stories from bank operations indicate that COVID-19 has pushed the convenience factor top of mind for banking customers, that means engaging with their financial institutions on their terms on their schedule.

Make Customers Feel Safe

Regions Bank, one of the nation’s largest full-service providers of consumer and commercial banking, took an agile approach when COVID-19 hit. They closed branch lobbies to walk-in traffic, opened up more drive-thru capacity, and directed consumers to use online appointment capabilities to pre-schedule meetings for in-branch or phone meetings.

“Our goal is to make our customers feel safe while interacting with us and to ensure our associates feel safe while also creating a stable working environment,” said Stephen Griffin, Senior Vice President, Regions Bank.

“For Regions, a key component is making sure the customer has the option to engage with us on their terms so they can accomplish their financial goals,” Griffin noted. He credits this flexibility and personalized approach to the boost in account openings. With many people still juggling working from home and managing family schedules, giving customers a guaranteed time is critical. Customers who engage on their terms report higher customer satisfaction scores and a greater likelihood to open more accounts or use more services.

“We supported our operational changes with email and personal outreach to communicate the options ranging from mobile banking to the ability to come into the branch with an appointment for more high-touch transactions such as opening a new account.”

The quick response was a definitive success. Comparing pre-COVID levels in February to post-COVID in April, Regions saw a

- 72% increase in appointment volume

- 350% increase in new account appointments

While it’s easy to think all transactions can be made digitally, appointment volumes continue to increase well above pre-COVID levels.

Match Staffing Levels with Customer Demand

It’s not just the customers who are concerned about COVID-19, it’s also the bank and credit union employees. They need to be safe too. It is critical to manage the number of people in a branch at any given time as well as deploy digital solutions that match associate availability to customer requests via phone, or in the branch.

“Having appointment setting allows you to start tiering triage of customers and managing the staff levels in the branch,” Griffin explained. “Associates can plan their day according to the appointments we’ve got. And, we can be more planful about our approach to the customers as they are learning to adjust to COVID restrictions and how they can bank with us.”

Technology is Key for Touchless but Personalized Experience

65% of customers say access to virtual appointments plays an important role in reducing anxiety.

While many banking institutions started their digital transformation journey years ago, the pandemic has accelerated the demand for virtual and touchless options. “We’re moving into the appointment-setting economy,” according to Steve Connolly, Engageware’s Senior Director of Product Management. “Online banking is certainly a safe and secure option for engagements, but it lacks a bit of personalization.”

Engageware, the leader in banking-by-appointment, works with Regions Bank and hundreds of financial institutions to incorporate the appointment capabilities into their online banking. “Oftentimes the customer journey goes from doing something online to check balances to ‘I need to talk to someone for information and advice’. Online chat bots are built into many applications but it’s even better when you can include the ability to create an appointment to reserve time to talk with an associate,” Connolly advised.

Even with all the omnichannel solutions, personal connections still matter in banking. “Human touch is number one,” Griffin added. “We are continuing to develop strategies to understand our customers’ needs and listen to customers. Digital and the physical channels are converging, and we have to focus on both of them.”

Whether your bank is moving to an appointment-only model for customers who must still visit the branch, providing remote access to bankers via phone or video conferencing, or some combination of the two. The Essential Banking package has you covered. For more information, visit our banking by appointment page, or schedule a call with one of our scheduling experts.