Meeting the full-service advisory needs of individuals, families, business owners and senior executives, this award-winning, fast-growing firm has earned a reputation for solid counsel combined with innovative client engagement.

Jason Hill, founder and president of Client Focused Advisors, sat down with Engageware to share his “10 Tips for Financial Advisors for Client Loyalty.”

Founded in 2013 by a team of experienced financial professionals, Client Focused Advisors serves over 1,200 clients in the NY/NJ/CT Tri-State area. Here are Jason’s Tips:

Tip #1: Take Time

It often surprises me that some advisors I meet don’t take the necessary time to fully discuss and explore clients’ complete needs. In my experience, that’s a penny-wise/pound foolish way to do business. Without tooting my own horn, I must be doing something right since Kelly Kearsley of the WSJ WEALTH ADVISOR featured my approach in a column she wrote titled A Simple Way to Earn Client Loyalty. In that piece, I described how spending extra time answering a prospect’s simple question helped me to find a new, long-term client. As I said to Kelly: “Even if I spend too much time upfront, it always comes back to me whether through a referral or a client needing help

Tip #2: Get Personal

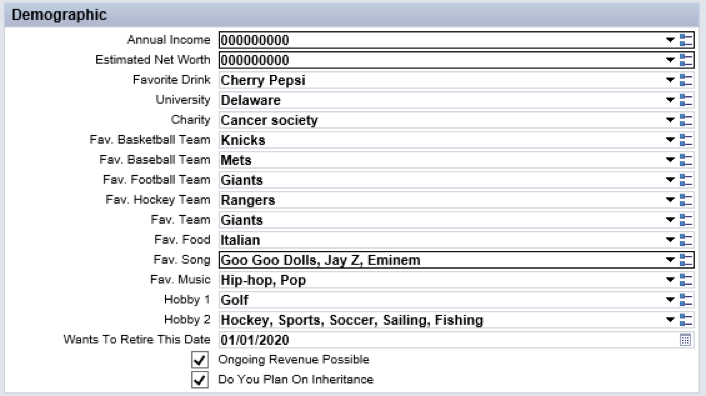

While our connection to clients is first and foremost a professional relationship, we’ve found it’s beneficial to get to know them personally as well. By going beyond financial matters alone, learning more about an individual client’s family, career, and personal interests helps to build the relationship. To assist that process we conduct a survey of new clients through which they can share their hobbies, favorite, sports teams or musical performers. That information is entered into our CRM system for immediate access.

Tip #3: Give to Get

Amplifying my last point, it’s gratifying to know that clients really love when their financial advisor makes a small gesture of generosity. Whether it’s hosting a client appreciation event, or attending a charity fundraiser – little acts of kindness help us build client goodwill and loyalty.

Tip #4: Help Clients Make Smart Decisions

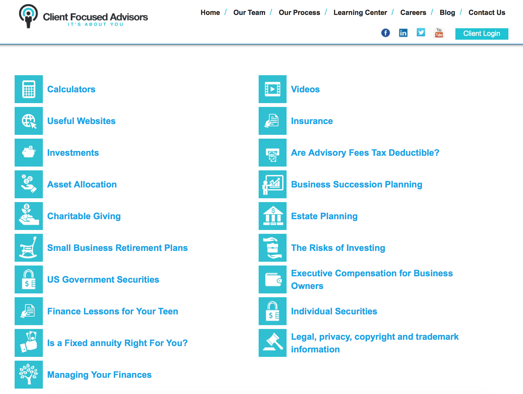

While our clients rely on us for advice, they also like that we provide them with valuable resources to help them make their own informed decisions. One of those is our website’s Learning Center, a curated collection of educational tools and informative materials (from calculators and videos to articles on topics ranging from “Asset Allocation” to “Finance Lessons for Your Teen.”) Additionally, we give each client their own Personal Financial Website: a secure portal that provides a dashboard of their assets, as well as tools for planning and budgeting.

Tip #5: Financial Planning = The Whole Picture

Many financial professionals are tied to the products of one company vs. evaluating and implementing a strategy to help ensure individual clients’ wealth and security. That whole picture should include a tailored balance of financial planning and management services, insurance, investments, retirement savings, and other elements.

Tip #6: Respect Generational Diversity

This is the first time in history that 3-4 generations are employed at the same time. As members of the Baby Boom, Gen-X and Millennial generations use different technologies; learn and communicate in varying ways – it’s essential that financial advisors let clients ‘have it their way.’ Interacting with each demographic in the ways they prefer to be engaged builds perceived value and contributes to client loyalty.

Tip #7: Leverage LinkedIn

Used in a respectful way, LinkedIn is a very powerful and essentially ‘free’ tool to help advisors to cultivate new business and strengthen relationships with your client base. I spend a lot of time on LinkedIn each week and find that most people I reach out to are amenable to scheduling a short “get to know each other” call. Getting to know their issues and needs beats a “hard” sales approach every time.

Tip #8: Make It Easy To Meet

Online appointment scheduling has significantly simplified how I book time with clients and when they’d like to meet with me. By embedding hyperlinks to my appointment calendar in my email signature, my bio on our firm’s website, and by encouraging site visitors to ‘Click the following link’ for a Complementary Investment or Life Insurance Review – I’ve made it easy for prospects and clients to set up appointments.

Tip #9: Don’t Go It Alone

With a large number of practicing financial professionals over the age of 55, our industry has a major issue as none of these solo advisors have a strategy for their clients if and when something might happen to them.

For that reason, Client Focused Advisors has always followed a team approach. Through that, in the event that a client’s ‘regular’ advisor is unavailable, no longer with our firm or has retired — we can offer continuity of personal service, something they truly appreciate.

Tip #10: Be Thankful

While this might seem like an obvious tip, I think it’s important for all financial advisors to remember that it is our duty to serve clients to the best of our abilities, through creative and ethical services. Once lost, a client’s trust can rarely be recovered. For that reason, don’t forget to let your clients know that you truly appreciate their business and thank them, early and often!

For more detail on how Jason Hill and his colleagues stand out as first-rate financial advisors, click here to read a case study of how Client Focused Advisors Lives Up to Its Name.

Registered Representative/Securities and Investment Advisory Services offered through Signator Investors, Inc., member FINRA/SIPC, a registered investment adviser. 290 West Mount Pleasant Ave, Suite 2300, Livingston, NJ 07039 (973)994-0100. Client Focused Advisors is independent of Signator Investors, Inc.

374-20160525-296326