To thrive in today’s financial services market, banks and credit unions must differentiate their brand through strong customer relationships. The foundation for relationship banking begins with seamless customer experiences that offer fast, accurate, and satisfactory services across all channels.

This is particularly important as our recent research shows that 37% of financial services customers report they are not as loyal to their primary financial institution compared to last year.

While enhancing digital offerings to simplify banking is crucial, the interactions customers have with staff when they need assistance most cement long-term brand loyalty. The key to overcoming challenges like high turnover and the adoption of digital technologies lies in centralized knowledge management, enabling employees to deliver fast, accurate customer assistance.

Why It’s Challenging to Deliver Great Customer Experiences Today

According to the recent ENGAGE 2024 research involving 300+ financial service leaders and 1,700+ banking consumers, key challenges include:

- High employee turnover: 80% of leaders pinpoint this as a major hurdle.

- Understaffed departments: Employees are stretched thin, struggling to keep up.

- Rising support costs: Financial burdens increase as efficiency drops.

- Low employee morale: High turnover and stress lead to dissatisfaction.

- Confusion from multiple versions of the truth: Staff overwhelmed by an average of seven customer engagement systems deployed by their financial institutions.

- Perpetual cycle of onboarding and training: New hires constantly need to be trained, disrupting operations.

New Report:

Empowering Employees for Operational Efficiency in 2024

Download Now Financial institutions grapple with unprecedented questions and concerns about leveraging digital and employee-assisted channels to drive growth, operational efficiencies, and customer engagement.

Failing to support employees with the proper solutions to help them quickly and easily find pertinent policy, procedural, and product information can lead to a myriad of customer experience issues, including longer handle times, frustrated customers, loss in confidence in the institution’s ability to serve accurately and consistently, and a negative brand impact with poor customer service ratings.

Addressing these challenges requires a strategic approach to knowledge management, empowering employees with the tools and information they need to succeed.

Key Knowledge Management Practices for Financial Institutions

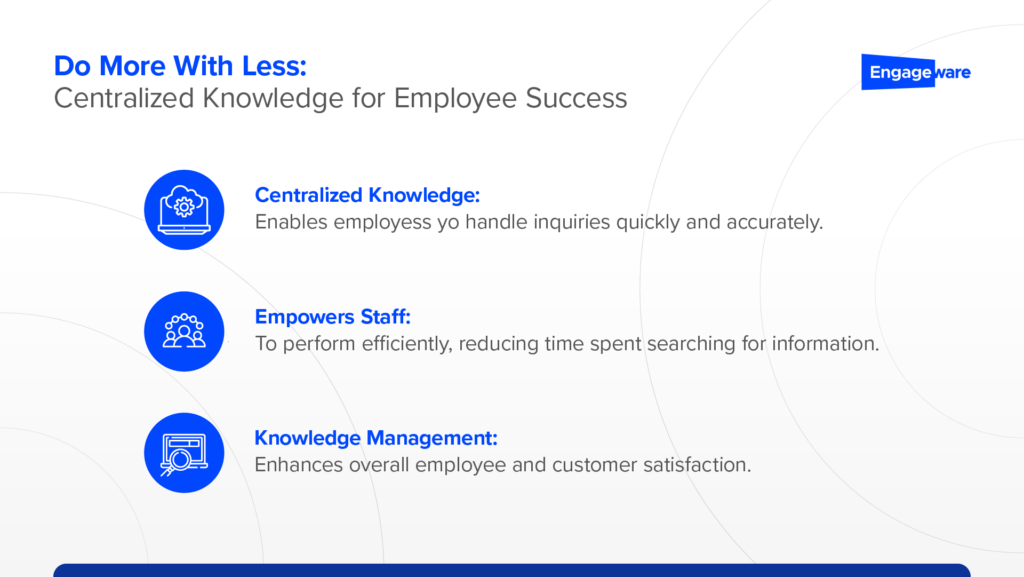

1. Centralized Knowledge: The Backbone of Employee Success

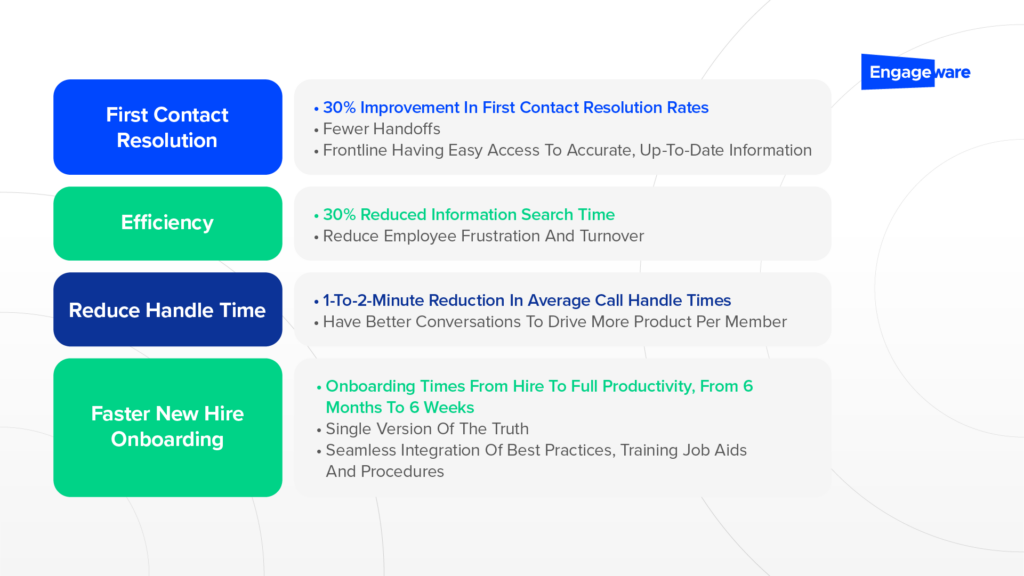

A centralized knowledge base is essential for ensuring employees have immediate access to consistent and reliable information. This consolidation not only reduces the time spent searching for answers but also improves first-contact resolution rates. For example, Arizona Financial CU’s implementation of a centralized KM system led to a significant increase in employee satisfaction, rising to 95%.

Unified knowledge platforms streamline the process of information retrieval, allowing employees to provide accurate and timely responses to customer inquiries. By moving from a “know-everything” culture to a “learn-anything-quickly” mindset, institutions can empower their teams to perform efficiently and deliver exceptional customer service.

2. Knowledge Management to Elevate Employee Training & Morale

Knowledge management significantly enhances employee training and morale by providing a centralized source of accurate information. United Heritage Credit Union exemplifies this success, having saved 10 months in manual training time by implementing an effective KM system. The credit union reduced internal document search time from 13 seconds to 1 second, saving approximately 304 hours (about 2 weeks). This enhancement accelerated onboarding, operational efficiency, and employee satisfaction.

Hear firsthand how United Heritage Credit Union harnessed the power of Engageware Knowledge Management to enhance operational efficiency and improve employee experiences. Watch Video >

3. Streamlining Content and Ensuring Uninterrupted Member Service

Effective knowledge management ensures seamless member service by enabling employees to quickly access the information they need. ITHINK Financial leveraged Self-service options alongside Engageware’s comprehensive Employee Intranet to streamline content access for both customers and employees. This approach not only improved customer satisfaction but also ensured uninterrupted service during high-demand periods, enhancing overall operational efficiency.

Hear from the AVP of Administration and Marketing at iTHINK Financial how Engageware helped make them content easy to find and easy to use for both employees and members. Watch Video >

4. Boosting Efficiency and Accountability

Sharonview Federal Credit Union leveraged Engageware’s Knowledge Management system to answer 1,000 questions daily that would otherwise require in-house resources. This efficiency significantly boosts reduced operational costs and increased employee accountability. By having a reliable KM system, employees could independently find answers, which improved their productivity and the overall customer experience. Read their success story >

Remarkable Outcomes Leveraging a Knowledge Management System

By adopting these best practices, financial institutions can transform their operations, leading to improved employee efficiency, higher job satisfaction, and better customer service.

For over 20 years, Engageware has been helping organizations deliver a better member and employee experience. Engageware’s comprehensive Knowledge Management Software addresses these needs, ensuring that both customers and employees benefit from an efficient and end-to-end customer engagement platform.