Banco Comafi

Banking’s Virtual Assistant Success: Elevating Customer Service and Digital Excellence

Goals and Challenges: Leading the Way in Innovation

Banco Comafi stands at the forefront of innovation and the adoption of modern technologies in the Argentine banking industry.

In 2019, Banco Comafi identified key challenges – the rapid evolution of technological advancements in banking, changes in expectations of customer experience and the increasing demand for instant solutions.

With these factors in mind, Banco Comafi approached Engageware with the clear objective of implementing a new communication channel that would offer 24/7 support instantly, personalized, with a high-resolution rate.

According to Fabián Mealla, Digital Banking Manager at Banco Comafi, they looked for “a new way of communication that is simple, fast, and secure, available 24/7 to complement internet banking.”

Success: Sofia, AI-driven Virtual Assistant, Front and Center of Service Excellence

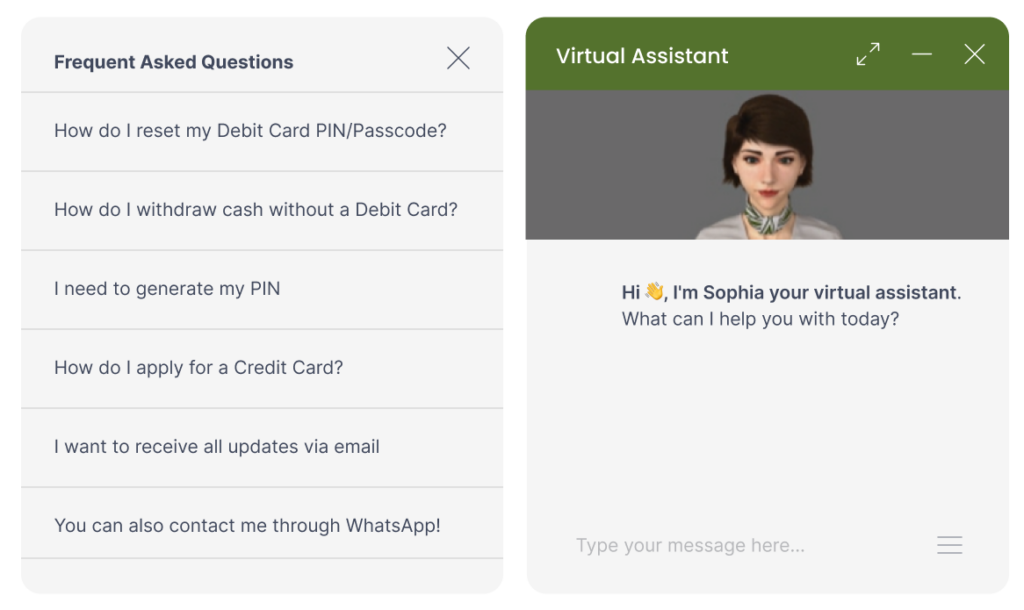

Sofia, the identity Banco Comafi gave to Engagewares’s AI-driven Virtual Assistant, was initially integrated as the first point of contact to address inquiries about products and services.

From its origins in online chat to its expansion to mobile with WhatsApp, Sofia stood out for its personality, empathy, and human touch, creating identity and human connection. Its avatar evolved from a 2D version to a 3D version, positioning itself across diverse digital bank channels.

“We embarked on an ambitious journey with Engageware, defining and executing a functional roadmap. We started with an initial version enabling chat support on our digital platforms, providing direct service and immediate answers to simple customer questions.”

– Fabián Mealla, Digital Banking Manager at Banco Comafi

Virtual Assistant with Instant Resolution via WhatsApp

In 2020, Sofia, Banco Comafi’s virtual assistant, emerged as a crucial channel, marking a notable shift from in-person to online platforms. This transition simplified customer interactions with the bank.

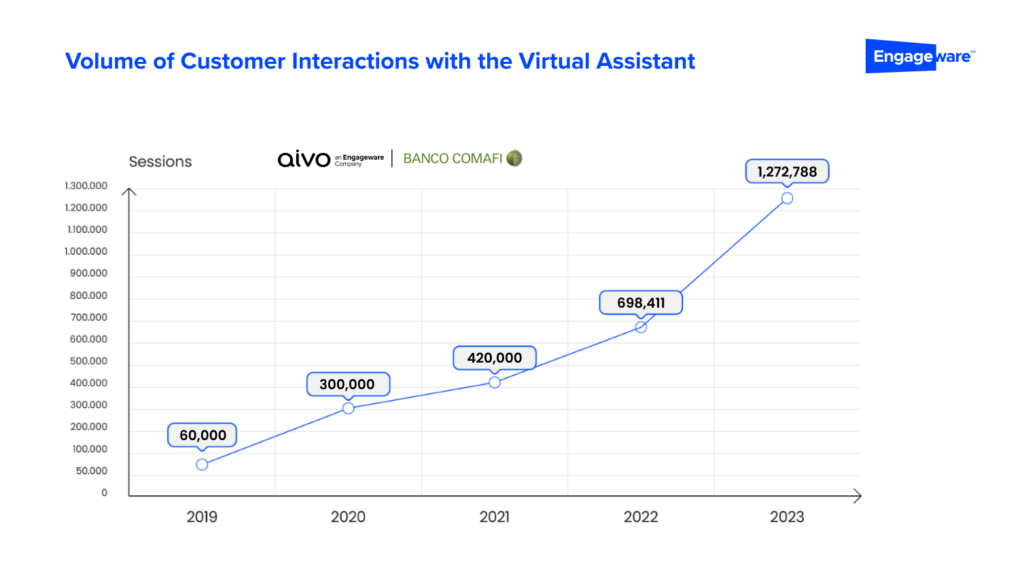

The AI virtual assistant joined the WhatsApp channel and achieved greater customer adoption, leading to a 387% surge in virtual assistant interactions.

The growing demand for customer interactions, combined with the commitment to consistently deliver quality service, led Banco Comafi to integrate with Engageware’s Studio.

Studio, an Engageware solution, is a low-code integration designer, that empowered the bank’s team to efficiently design, build, and implement custom integrations, tailored for their WhatsApp channel.

This integration paved the way for the evolution of virtual assistant Sofia to version 2.0, enabling the resolution of online queries and personalized information delivery.

Studio automation enabled unique features like cardless ATM withdrawals and PIN blocking via QR codes. Banco Comafi became a digital pioneer, with a focus on expanding integrations to develop fully resolution experiences, with WhatsApp standing out as the primary channel for enhanced customer engagement.

Virtual Assistant Empowering Customers with 100% Self-Management on WhatsApp

Banco Comafi not only achieved but surpassed its goals for 2023, marking a pivotal year for the bank. The primary objectives included:

- Achieve a 10% growth in Customer Interaction Volume.

Solidifying Sofia, their versatile virtual assistant, as the bank’s main customer service channel.

- Empower Customers with 100% Self-Management on WhatsApp.

Banco Comafi achieved the remarkable goal of enabling customers with complete self-management on WhatsApp.

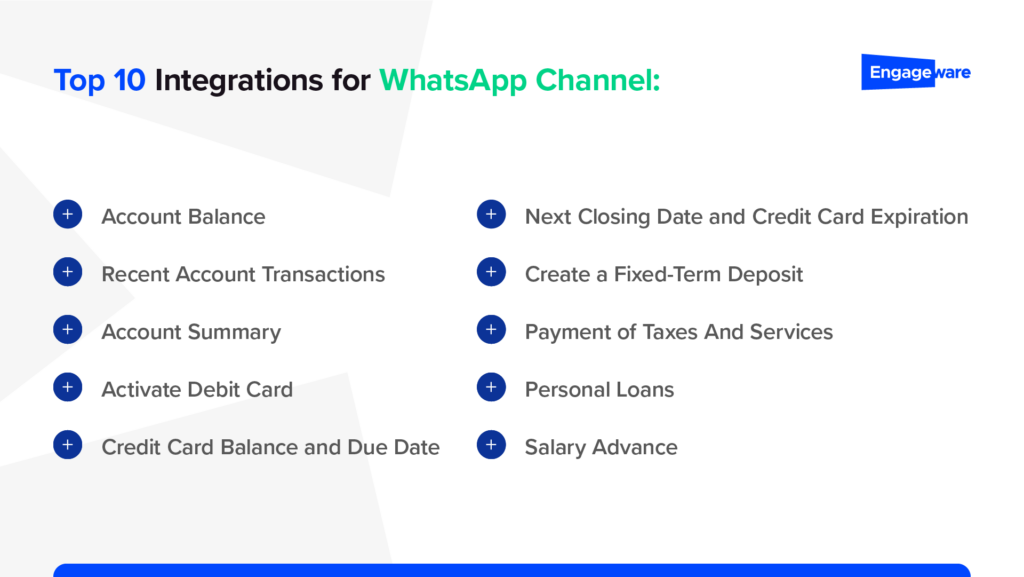

Through this innovative tool, the bank automated and customized a comprehensive array of 34 key banking integrations tailored for the WhatsApp channel.

Integration refers to facilitating banking operational activities, such as account balance inquiries and recent account transactions.

The capability of Sofia, the virtual assistant, to manage multiple tasks on WhatsApp is truly remarkable. Today, Banco Comafi’s customers perform 34 banking transactions directly through the virtual assistant, coupled with a 98% resolution rate and 100,000 monthly interactions, making Banco Comafi a high-value Engageware client.

Highlighting Banco Comafi’s efficiency in handling several processes and promptly addressing customer queries. Enriching and unifying the customer experience.

Value-Driven Campaigns: Elevating User Experiences through Automation

In 2023, Banco Comafi successfully implemented Engage, Engageware’s campaign management solution fostering personalized connections via SMS or WhatsApp.

With Engageware’s support as strategic consultant, Banco Comafi developed an exceptional end-to-end strategy for personal loans. The bank sent an impressive 1.5 million outgoing messages via WhatsApp. These messages included loan offers, seamlessly integrated with the Studio solution for instant approvals, eliminating the need for human intervention.

Launched in December 2023, the campaign achieved a remarkable 93% ROI within two months, thanks to the key orchestrating role of the virtual assistant throughout the entire process.

Banco Comafi’s blueprint revolves around seamlessly connecting with customers and delivering effective financial solutions.

Results: Growth, Engagement and Consolidation

2020 Foundation:

- The foundation of Sofia, the virtual assistant, started in 2020, with an astonishing 387% growth.

2021 Efficiency:

- In 2021, the virtual assistant achieved a 95% customer query resolution, earning an average rating of 4.5 out of 5 in customer satisfaction.

2023 Milestones

Virtual Assistant’s Growth, Engagement and Consolidation:

- During 2023, the virtual assistant exceeded the client’s objective with over 10% growth in customer interaction volume.

- Maintained an impressive monthly average of 100,000 interactions, solidifying Sofia as the primary customer service channel.

- Stating an average engagement time of 2 minutes and 30 seconds, growing effective resolution to 98%, and only 5% of interactions transferred to a human agent.

- In October 2023 achieved a record of 158,000 sessions, demonstrating continuous impact.

Engage Campaigns and Communication Channels:

- Implemented Engage campaigns with 1.5 million outgoing messages.

- Amplified customer interactions, establishing direct communication through WhatsApp.

- Reduced reliance on other channels such as calls and emails.

Studio Integration and Transaction Digitization:

- Through Studio, achieved the milestone of conducting all transactions in a single channel, WhatsApp, aligned with the bank’s goal to digitize their entire portfolio.

Moreover, Banco Comafi prioritizes Sofia in all its banking strategies. Apart from consolidating it as an additional channel, they use the avatar in marketing and communication campaigns. For instance, they have recently integrated Sofia into the digital signatures of corporate emails for company associates. On their Instagram profile, the bank incorporates Sofia’s personality into various external communications.

Looking Ahead

These accomplishments underscore Sofia, the virtual assistant’s, outstanding transactional nature and effectiveness. Opting to collaborate with Engageware is Banco Comafi’s preferred choice, driven by their appreciation for the freedom to develop tools, providing increased flexibility and agility in expanding service channels.

The bank highly values Engageware’s support team, guidance, ongoing monitoring, and strategic consultancy.

For 2024, Banco Comafi remains focused on prioritizing the growth of transaction volume, session levels, automation, and integration. Their goal is to attain 5 or 6 flows per customer session. This strategic evolution broadens the range of tasks within the same WhatsApp channel and places emphasis on enhancing customer service efficiency.

Banco Comafi’s commitment to innovation and excellence in customer service continues to strengthen through its pioneering initiatives in artificial intelligence and digital financial services.

About Banco Comafi

With 76 branches in multiple provinces of Argentina, Banco Comafi remains a leading entity in financial growth. Its integration with companies such as TCC and Nubi reflect its position as a pioneer in offering financial services. Sofia’s success story represents the bank’s ongoing dedication to innovation and excellence in customer service.

ADT is a customer of Aivo, an Engageware company, leveraging solutions across Latin America.