Lobby Management

Visitor management built for enterprise

Advanced routing, multi-participant logic, and mass deployment reliability inside Salesforce Lightning for regulated firms managing 1,000+ advisors.

Capabilities

Deliver effortless engagement

Convert 95% of customer visits into consultations, reduce wait times by 52%, and optimize branch staffing with real-time flow management and peer benchmarking.

Turn walk-in chaos into opportunities

Turn walk-in chaos into opportunities with real-time lobby management that routes customers, balances staff, and improves the in-branch experience.

Data-driven branch optimization

Unlock actionable operational insights to staff the right people at the right branch and benchmark walk-in traffic against peers.

How it works

Engageware powers faster, smarter, and more effective walk-in appointments

01

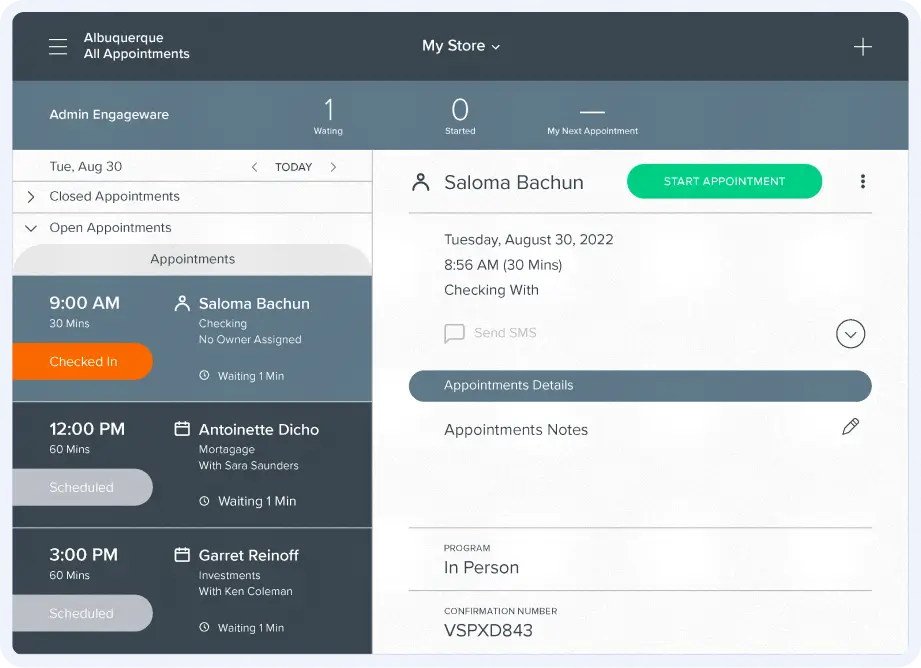

Make every arrival work for your bottom line

Monitor staff and customer walk-in engagements and optimize operations.

02

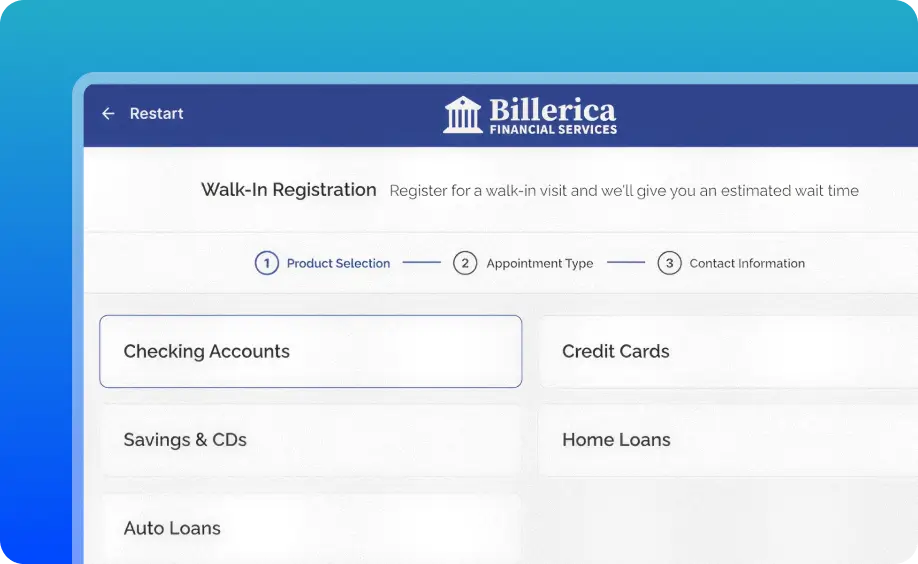

Multiply your team’s impact without adding headcount

Member-driven self-service intuitive kiosk and mobile check-in captures intent while preserving human touch for complex needs.

03

Identify engagements that generate revenue

Analytics dashboard tracks the member’s journey from lobby to loan closing. Benchmark walk-in appointments vs. peer.

Impact

$

12

M

36

%

staff utilization rate improvement

20

%

reduction in daily call volume

Turning walk-in traffic into value

Transform Service Culture While Preserving Member-First Values

21%

Increase in appointments

$600M

Increase in assets

10%

Reduction in cancellation and no-shows

50%

Increase in financial wellness appointments

70%

Increase in business appointments

79%

Increase in self-service adoption

12%

Decrease in administrative tasks

Ready to transform your branch operation and hit your revenue goals?

FAQs

Frequently asked questions

What is Engageware Lobby & Queue Management?

Engageware Lobby & Queue Management is an enterprise lobby management system designed for financial institutions. It transforms walk-in traffic into structured, advisory-driven engagements by intelligently managing queues, routing visitors, and optimizing staff utilization in real time.

How does Engageware improve branch queue management?

Engageware replaces chaotic walk-ins with a real-time branch queue management system that:

- Captures visitor intent at arrival

- Routes members to the right staff based on need and availability

- Reduces average wait times by 52%

- Converts up to 95% of walk-ins into consultations

Is Engageware designed for banks and credit unions?

Yes. Engageware is purpose-built for banks, credit unions, and regulated financial institutions. It supports complex branch environments, compliance requirements, and advisory-focused interactions—making it ideal for credit union member flow and bank visitor management.

How do customers check in to the lobby?

Customers can check in through:

- Self-service kiosks

- Mobile check-in

- Staff-assisted check-in

This member-driven approach captures intent early while preserving the human touch for complex or high-value interactions.

How does Engageware help improve staff utilization?

Engageware provides real-time visibility into lobby demand and staff capacity, enabling managers to:

- Deploy the right resources at the right branch

- Balance workloads across teams

- Improve staff utilization by up to 36%

- Reduce daily call volume by 20%

Can Engageware identify revenue-generating interactions?

Yes. Engageware analytics track the customer journey from lobby arrival to transaction or loan closing. Institutions can:

- Identify which walk-in interactions drive revenue

- Benchmark walk-in appointments against peers

- Measure conversion from consultation to outcome

This turns lobby traffic into a measurable revenue channel.

Does Engageware integrate with appointment scheduling?

Absolutely. Engageware combines lobby management with appointment management, allowing institutions to:

- Manage scheduled and walk-in traffic together

- Convert walk-ins into future appointments

- Align digital scheduling with in-branch experiences

This creates a unified, end-to-end engagement strategy.

What insights and analytics does the lobby management system provide?

Engageware delivers actionable insights including:

- Walk-in volume and peak traffic trends

- Wait times and abandonment rates

- Staff performance and utilization

- Conversion metrics and benchmarking against peer institutions

All insights are designed to support data-driven branch optimization.

What results do financial institutions see with Engageware?

Customers using Engageware Lobby & Queue Management have achieved:

- Up to $12M in net operating income improvement

- Up to 79% increase in self-service adoption

- Up to 70% increase in advisory and business appointments

- Reduced cancellations and no-shows

How is Engageware different from generic queue systems?

Unlike generic queue tools, Engageware is a financial institution lobby system built for regulated environments. It focuses on:

- Advisory outcomes, not just wait times

- Revenue and relationship growth

- Staff optimization and analytics

- Integration with enterprise appointment management

This is why 25% of top banks choose Engageware over basic queue systems.

How long does it take to deploy Engageware Lobby Management?

Engageware is designed for enterprise scalability and rapid deployment. Most institutions can roll out lobby management quickly across branches with minimal disruption, supported by Engageware’s regulated-industry expertise.

Who should use Engageware Lobby & Queue Management?

Engageware is ideal for:

- Banks and credit unions modernizing branch operations

- Institutions seeking to reduce wait times and increase consultations

- Teams focused on improving member experience and revenue per visit

- Enterprises replacing legacy or generic queue systems