AI AGENTS

Get customers out of loops and to a resolution

Most AI chatbots answer questions. Engageware AI Agents use automation and agentic AI with policy-aware workflows to complete transactions and solve customer issues end-to-end completely. No “please call us.”

Trusted by 450+ Banks, Telecoms, and Insurance Companies

98% resolution rate

150M+ interactions handled annually

$2M in month one

Revenue generated (Banco Banorte)

Built for regulated industries

SOC 2, ISO 27001, audit-ready

The Problem

When your AI just deflects, your customers disconnect.

When your chatbot answers FAQs but can't complete transactions, customers repeat themselves across channels.

That's not automation. That's just shifting the problem.

200

K

Monthly interactions that contact centers can’t handle

80

%

Of queries go to AI, then 80% of those transfer to humans

6

x

Customer attempts before calling when digital channels don’t resolve

The Solution

AI agents that resolve issues, not just route them

01

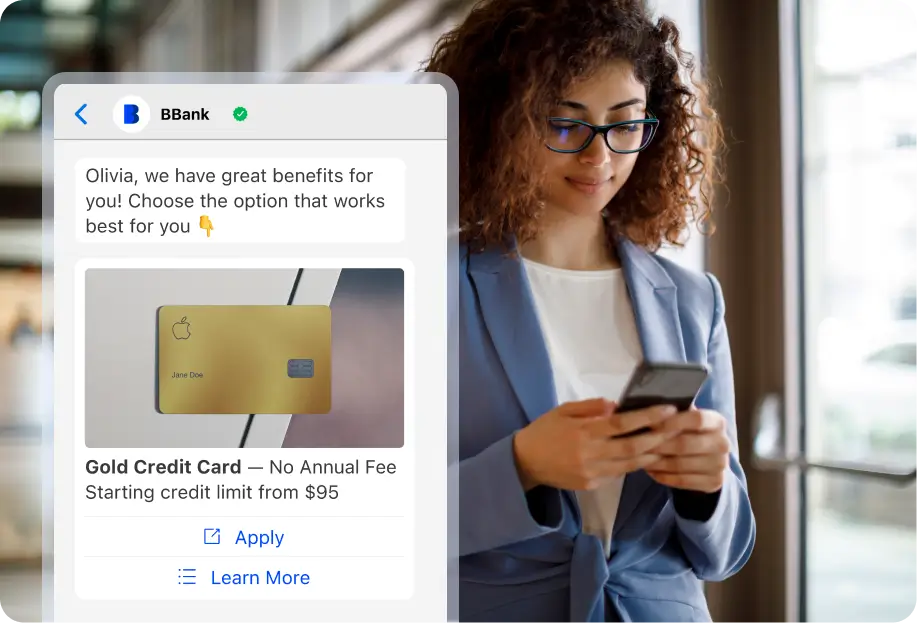

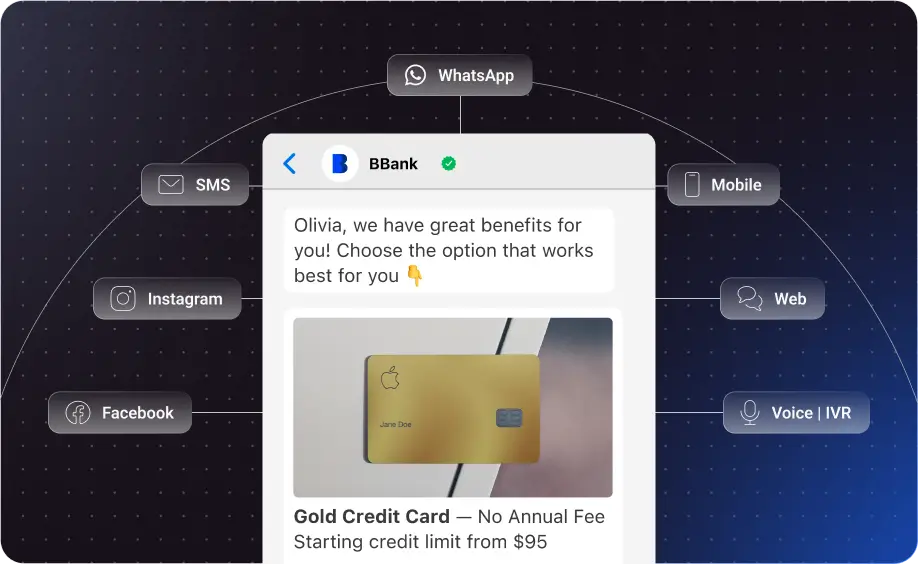

One conversation across every customer channel

Customers start on web, continue on WhatsApp, finish on mobile without repeating themselves. Build once, deploy everywhere. One conversation thread with full context across all channels.

02

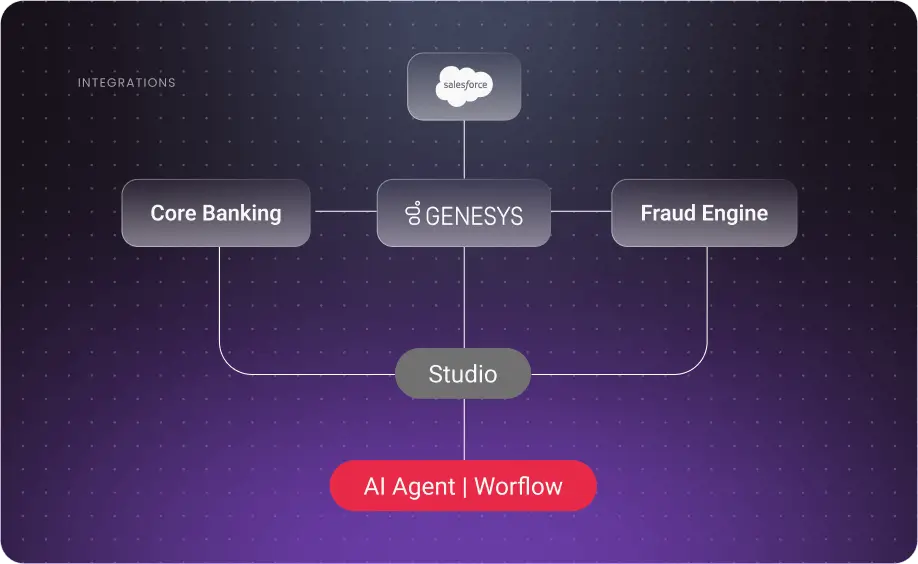

Access live data from core systems directly

Agents connect to your banking cores, CRMs, and fraud engines through Studio. They follow your actual workflows and policies, not generic scripts, using real customer data from your systems.

03

AI to human, no friction

AI handles routine inquiries automatically. Complex cases escalate to specialists with full context, so customers never repeat themselves when moving between automated and human support.

04

Turn customer insights into better AI performance

Track session data, measure feedback, and identify unanswered questions. See real-time dashboards of resolution rates, discover content gaps, and improve AI performance with customer satisfaction metrics.

98%

Resolution rate on 100K monthly conversations

50%

Call volume reduction through self-service at scale.

300%

Increase in transactional queries via WhatsApp Business.

Put Aivo to the Test

See how we can help you engage customers

Use Engage to achieve 98% open rates and 4.95% conversion rates. Launch your first campaign in days, not months.

FAQs

Frequently asked questions

How is this different from a chatbot?

Chatbots answer FAQs. Engageware AI Agents complete transactions (such as account updates, fraud blocks, loan applications) all fully automated with audit trails built in. The difference is we’re resolving, not just responding.

Can it really handle 98% of inquiries?

Yes, when you’re working with policy-aware workflows and integrated systems. We’re not doing generic AI prompts. We’re running structured processes connected to your core systems, CRM, and knowledge bases. Banco Comafi runs 100K+ conversations monthly at 98% resolution.

What happens when the AI doesn't know the answer?

It escalates to a human agent with full context preserved. The human sees everything the AI saw, every action taken, and can pick up exactly where the conversation left off. No customer repetition.

How do we control what the AI can and can't do?

Through Studio workflows and guardrails. You define what systems AI can access, what actions it can take, and when it must escalate. Every decision is logged and traceable.

Do we have to replace our current systems?

No. AI Agents connect to what you already have via APIs. Your core banking stays put. Your CRM stays put. We just make them accessible through conversational interfaces.

How long does implementation take?

Most customers go live with their first workflow in 4-6 weeks. We start with high-volume, low-complexity use cases, prove value, then expand.

What about security and compliance?

We’re SOC 2 Type II and ISO 27001 certified. GDPR and LGPD compliant. Every action is logged. Role-based access controls. Encryption everywhere. 450+ financial institutions trust us with their customer data.

Can AI Agents work in multiple languages

Yes. AI Agents communicate naturally in any language your customers use. Proven deployments across 20 countries.

What happens when an agent can't handle something?

Agents escalate intelligently to human specialists with full conversation history, customer context, and workflow state preserved. The customer doesn‘t repeat themselves. The employee sees everything that‘s already happened.

Which systems do AI Agents integrate with?

Agents connect to banking cores, CRMs (Salesforce, Zendesk, etc.), contact centers (Genesys, Five9, etc.), fraud engines, knowledge systems, and digital channels. Studio orchestrates workflows across your full tech stack.

What's the ROI?

Banco Comafi achieved 98% resolution on 100K+ monthly conversations and generated $2M in the first month. NetUno reduced call center volume by 50%. Results vary by institution, but we focus on measurable outcomes: containment rates, cost per interaction, transaction completion, and customer satisfaction.

How do AI Agents work with Live and Engage?

AI Agents handle high-volume routine interactions, seamlessly transferring complex cases to Live specialists with complete context. Engage triggers proactive campaigns based on AI Agent interactions, creating orchestrated journeys across the full Aivo Suite platform.